INP-WealthPk

Qudsia Bano

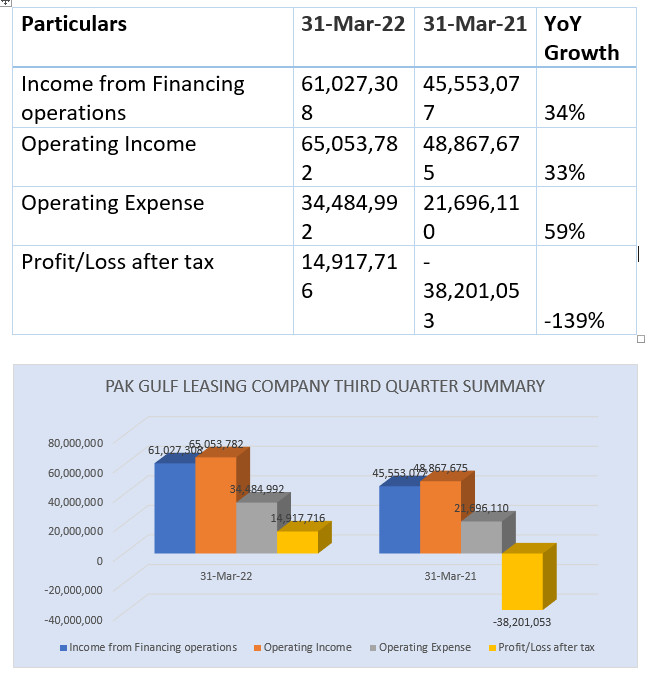

Pak Gulf Leasing Company’s income from financing operations climbed 34% to Rs61 million in the third quarter of fiscal year 2021-22 compared to Rs45.5 million during the corresponding period of fiscal 2020-21.

Similarly, the operating income registered a growth of 33% to Rs65 million during the third quarter of FY22, up from Rs48.9 million in the corresponding period of FY21.

The company's net income increased to Rs14.9 million, registering a growth of 139% from the previous year’s loss of Rs38.2 million. The net income reflects an increase in demand for the company's products and services due to favourable market conditions, reports WealthPK.

Annual Results 2020-21

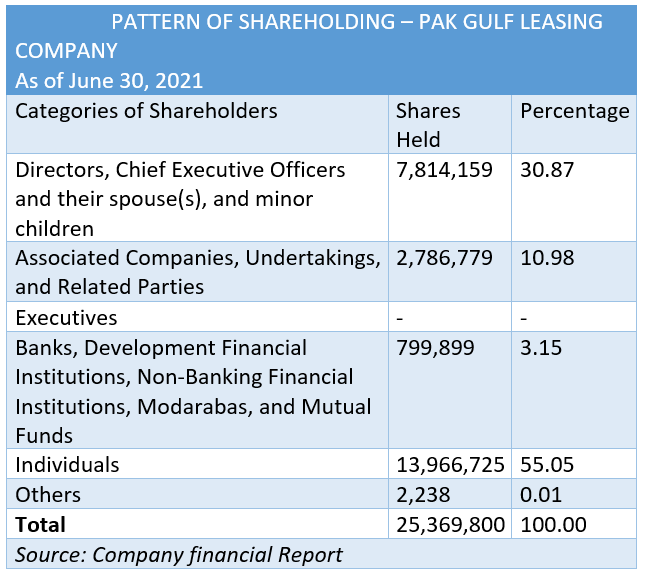

As of June 30, 2021, directors, the chief executive officer, their spouse(s) and minor children owned 30.87% of the company’s shares. Associated companies, undertakings and related parties had 10.98% of the shares. Banks, development financial institutions, and non-banking financial institutions, modarabas and mutual funds owned 3.15% of the total shares. ‘Individuals’ category had 55.05% of the shares, while ‘others’ category came with 0.01%.

Financial Performance

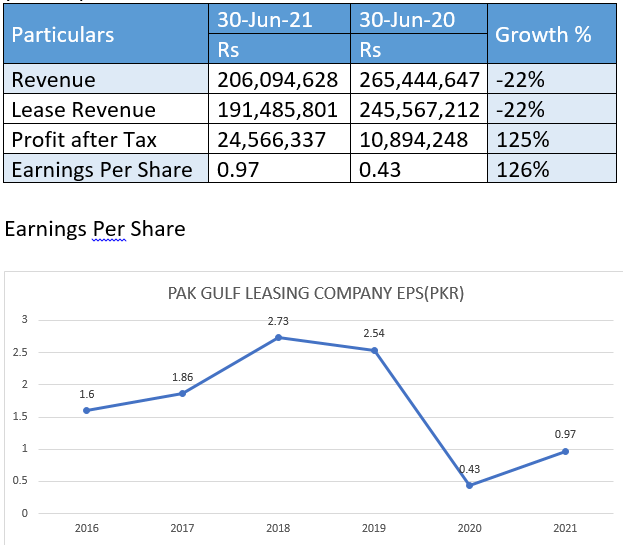

During the fiscal year 2020-21, the company’s sales declined 22% to Rs206 million, from Rs265.44 million in 2019-20. The lease revenue for the year 2020-21 stood at Rs191.48 million, down 22% from Rs245.6 million the previous year.

Profit-after-taxation in FY21 stood at Rs24.66 million, showing an increase of 125% compared to Rs10.9 million the previous year, reports WealthPK.

Earnings per share (EPS) of the company kept on increasing from 2016 to 2018, before going down in 2019, when it stood at Rs2.54. EPS then nosedived to Rs0.43 in 2020 before slightly improving to Rs0.97 in 2021.

Leasing and Ijarah operations are the two business segments of Pak-Gulf Leasing Company.

The company provides lease loans in both the conventional mode and on Shariah-Compliant (Ijarah) basis. The company's certificates of investments act as lucrative investment vehicles for savings both for public and private sector entities.

Credit: Independent News Pakistan-WealthPak