INP-WealthPk

Uzair bin Farid

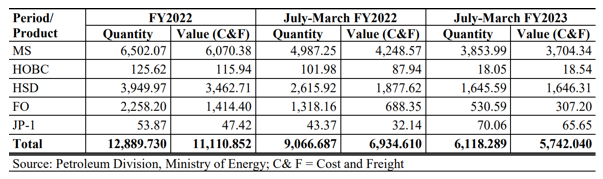

The oil demand decreased from 16.7 million tonnes during the 10-month period (July-March) of FY2022 to 13.1 million tonnes in the corresponding period of the current fiscal year, data available with WealthPK says. According to the Pakistan Economic Survey (PES) 2022-23, the decrease in the demand for furnace oil (FO), high-speed diesel (HSD), motor spirit (MS), and high-octane blended component (HOBC) is mainly due to the increase in their prices, especially of MS and HSD.

The decrease in the demand for furnace oil is because of the shift from furnace oil and HSD to re-liquefied natural gas (RLNG), coal and other alternative sources for the production of electricity. The total market value of the imported fuel and oil products in July-March FY23 is estimated to be USD5.7 billion, with total tonnage standing at 6.1 million tons. Similarly, the total imported quantities of MS, HSD, and FO are 3853.9 thousand tonnes, 1645.6 thousand tonnes, and 530.6 thousand tonnes, respectively.

Furnace oil imports declined from a high of 1318.2 thousand tonnes in July-March 2022 to 530.6 thousand tonnes in July-March 2023 precisely because the government wants to shift from this source for production of electricity. Jet fuel (JP-1 and JP-8) is the only oil whose demand has registered an increase of 18% during the period under consideration.

Import of petroleum products

(Quantity in thousand MT; Value in million US$)

A decrease in fuel demand is not a good sign for economy as it shows that the economic activity centring around communication and production has dropped in pace. All developed and developing economies of the world are huge consumers of petroleum products. This is due to the fact that their industries churn out products round the clock. In order to carry out their tasks, their industrial units need a constant supply of energy. Energy consumption is a huge indicator that a country or an economy is growing.

If the consumption of oil and petroleum products decreases in a country, it slows down economic activity, which is all the worse as industrial shutdowns, economic disruptions and slower growth cause job losses, falling incomes and supply-side disruptions. The result is that the market shortage of goods causes prices to rise and consequently, economic instability sets in.If, however, the petroleum products consumption decreases because of the shift to renewable sources of energy, it is all the better as the world desperately needs sustainable models of growth and development.

Credit: Independent News Pakistan-WealthPk