INP-WealthPk

Qudsia Bano

Nishat Mills Limited, one of Pakistan's leading textile manufacturers, has released its financial results for the three and nine-month periods of the outgoing fiscal year 2022-23. According to the results, the company demonstrated robust growth in 9MFY23, but the first- quarter figures revealed a more nuanced picture.

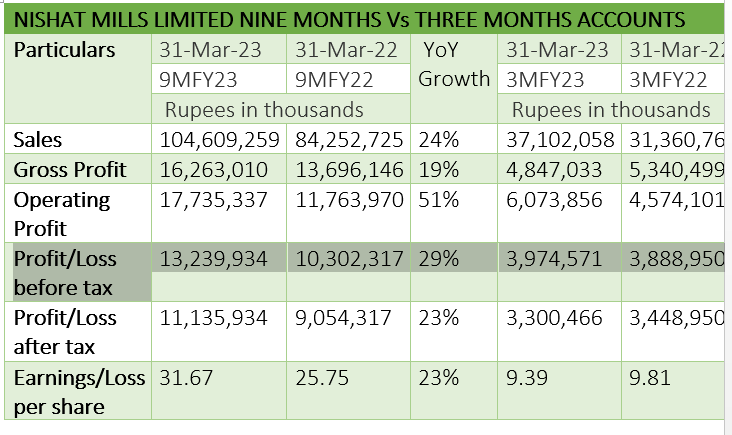

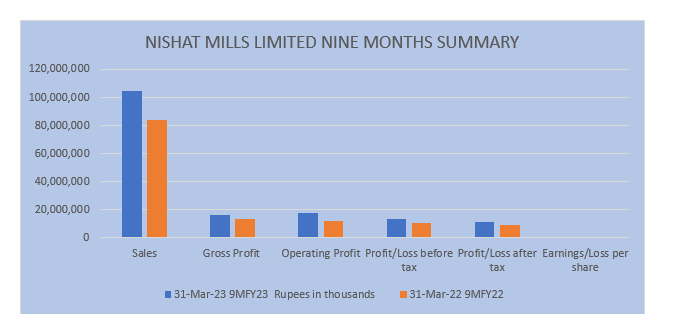

Nine-month accounts analysis

Nishat Mills Limited witnessed a remarkable year-on-year growth in sales, with revenue reaching Rs104.61 billion during the nine months of FY23. This represents a substantial 24% increase compared to Rs84.25 billion in the same period of last year. The company's ability to generate higher sales can be attributed to its strong market position and effective business strategies. The gross profit for the nine-month period amounted to Rs16.26 billion, exhibiting a growth rate of 19% compared to Rs13.70 billion in the corresponding period of the previous year. This indicates that Nishat Mills managed to maintain healthy profit margins despite cost pressures in the industry. The operating profit surged 51% from Rs11.76 billion in 9MFY22 to Rs17.74 billion in 9MFY23.

This notable growth is a result of increased operational efficiency and cost optimisation measures implemented by the company. The profit-before-tax for the nine-month period reached Rs13.24 billion, reflecting a solid 29% YoY growth. Nishat Mills' consistent profitability showcases its strong financial performance, driven by effective management of operating expenses and improved productivity. The after-tax profit stood at Rs11.14 billion, indicating a YoY growth of 23%. The company's ability to maintain steady profitability highlights its resilience and adaptability in the face of evolving market dynamics. The earnings per share (EPS) for the nine months amounted to Rs31.67, up by 23% from Rs25.75 in the same period last year. This growth in EPS reflects Nishat Mills' commitment to creating value for its shareholders.

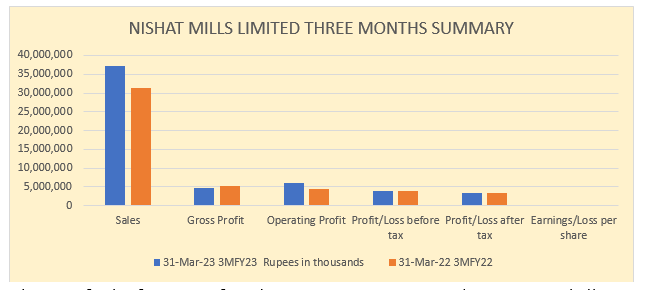

Three-month analysis

In contrast to the robust performance witnessed during the nine-month period, Nishat Mills' quarterly results displayed a more mixed performance. During the three months ended March 31, 2023, the company recorded sales of Rs37.10 billion, reflecting an 18% YoY growth. Although the growth rate remained positive, it was lower compared to the previous quarter, indicating a potential slowdown in demand or market conditions during this period.

The gross profit for the quarter amounted to Rs4.85 billion, representing a decline of 9% compared to Rs5.34 billion in 3MFY22. This decrease may be attributed to factors such as increased input costs or pricing pressures. The operating profit, however, exhibited a positive trend, growing by 33% from Rs4.57 billion in 3MFY22 to Rs6.07 billion in 3MFY23. This improvement can be attributed to the company's operational efficiency and cost management efforts.

The profit-before-tax for the quarter amounted to Rs3.97 billion, reflecting a modest growth of 2%. Although the increase is relatively small, it demonstrates Nishat Mills' ability to maintain profitability despite potential challenges in the operating environment. The after-tax-profit for the three months reached Rs3.30 billion, showing a slight decline of 4% compared to Rs3.45 billion in 3MFY22.

This dip in profitability suggests the company faced some headwinds during this particular period. The EPS for the quarter amounted to Rs9.39, representing a marginal decrease of 4% compared to Rs9.81 in 3MFY22. This decline indicates the company's profitability per share was slightly lower during this quarter.

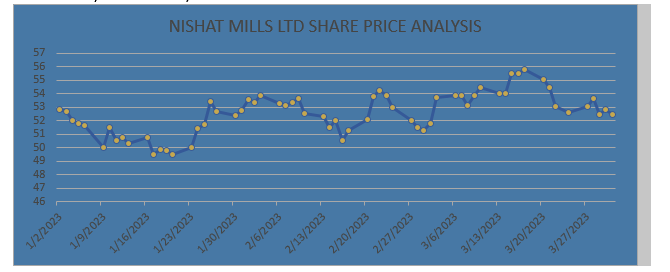

Share price analysis

During the first quarter of 2023, the share prices of the company exhibited fluctuations and varied movements. At the beginning of the quarter, on January 2, 2023, the share price stood at Rs52.82. It experienced a slight decline in the following days, reaching Rs51.62 on January 6. The share price continued to decline further, reaching its lowest point of Rs49.5 on January 17.

However, from January 24 onwards, the share price started to recover and witnessed a generally upward trend. It reached Rs53.46 on January 26, marking a significant increase. Despite some minor fluctuations, the share price remained relatively stable around the Rs52-53 range for the remainder of January and early February.

On February 15, the share price briefly dropped to Rs50.56 but quickly rebounded to Rs54.26 on February 22, reflecting a substantial increase. The upward trajectory continued, and by the end of February, the share price reached Rs53. March started on a relatively stable note, with the share price fluctuating between Rs51 and Rs53. However, a significant jump occurred on March 15 when the share price surged to Rs55.48, indicating a notable increase in value. The share price remained relatively steady for the remainder of March, with minor fluctuations between Rs52 and Rs55.

About the company

Nishat Mills is a public limited company incorporated in Pakistan under the Companies Act, 1913 (Now Companies Act, 2017) and listed on Pakistan Stock Exchange. The company is engaged in textile manufacturing, spinning, combing, weaving, bleaching, dyeing, printing, stitching, apparel, buying, selling and otherwise dealing in yarn, linen, cloth, and other goods and fabrics made from raw cotton, synthetic fibre and cloth. It also generates, accumulates, distributes, supplies and sells electricity.

Credit: INP-WealthPk