INP-WealthPk

By Hifsa Raja

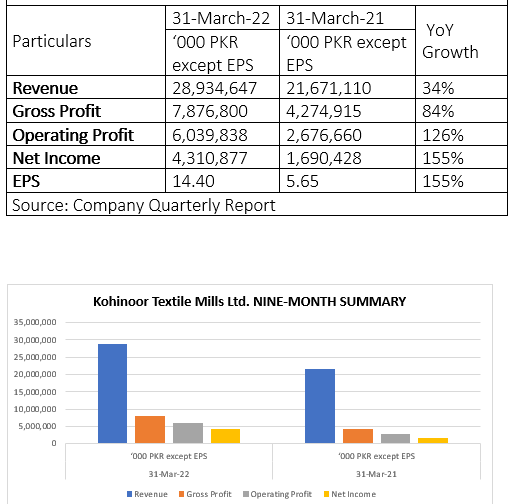

ISLAMABAD, Aug 26 (INP-WealthPK): The net income of Kohinoor Textile Mills Limited (KTML) increased by 155% to Rs4.31 billion in the first nine months of the previous financial year 2021-22 (9MFY22) compared to Rs1.69 billion during the same period of fiscal 2020-21, reports WealthPK.

According to figures, the revenue generated by KTML increased by 34% to Rs28.93 billion till March 31, 2022, compared to Rs21.67 billion in the corresponding period of FY21.

Similarly, the gross profit of the mills registered a growth of 84% during the first nine months of FY22 and stood at Rs7.87 billion from Rs4.27 billion in the corresponding period of FY21.

Its operating profit showed a hike of 126%, touching Rs6.03 billion on March 31, 2022, compared to Rs2.67 billion on March 31, 2021. Its net income increased by 155% and reached Rs4.31 billion in 9MFY22 against Rs1.69 billion in the corresponding period of FY21.

The earnings per share (EPS) of the mills increased to Rs14.40 from Rs5.65 previously.

Financial Performance

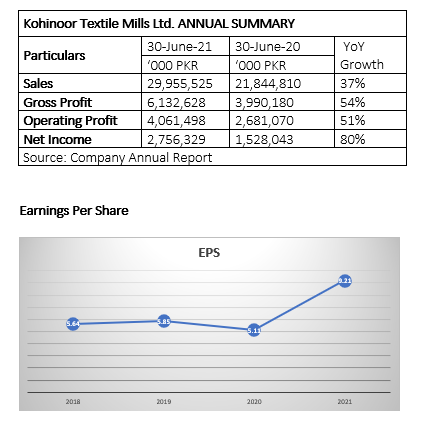

During the fiscal year 2020-21, the company generated net sales revenue of Rs29.95 billion against Rs21.84 billion in 2019-20, registering an increase of 37%.

The gross profit for FY21 was Rs6.13 billion, up 54%, from Rs3.99 billion in FY20. Its operating profit for FY21 was Rs4.06 billion compared to Rs2.68 billion in FY20, showing an increase of 51%.

The net income of the mills in FY21 was Rs2.75 billion as compared to Rs1.52 billion in FY20, witnessing an increase of 80%.

The EPS were Rs5.64 in 2018 and Rs5.85 in 2019. However, it decreased to Rs5.11 in 2020 before jumping to Rs9.21 in 2021.

Ratio Analysis:

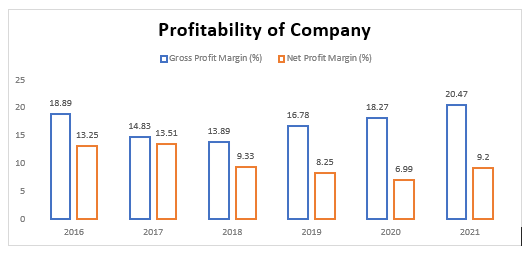

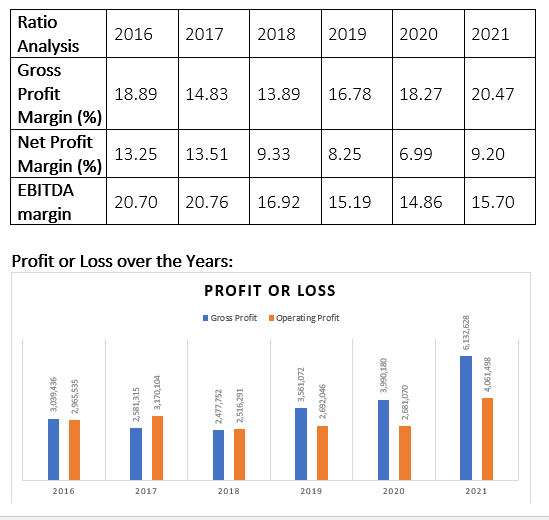

In 2016, the gross profit margin of the mills reached 18.89%. The net profit margin demonstrated net profitability of 13.25%.

In the years 2017 and 2018, the profitability of the mills was comparatively low. In 2019, the gross profit margin and net profit margin were 16.78% and 8.25%, respectively. In 2020, the gross profit margin reached 18.27%, whereas the net profit margin fell to 6.99%. The profitability increased in 2021 to 20.47% of gross profit margin, and net profit margin reached 9.2%.

The earnings before interest, taxes, depreciation and amortization (EBITDA), which show the operational efficiency of the company, remained high in 2016 and 2017. The EBITDA increased in 2021.

The profitability of the mills remained high in 2019 as compared to 2018 when gross and operating profits were low. In 2019 and 2020, the profitability increased.

The profitability of Kohinoor Textile Mills Limited, a public limited company manufacturing yarn and cloth, also remained high in 2021, according to the research conducted by WealthPK.

Credit: Independent News Pakistan-WealthPak