INP-WealthPk

Hifsa Raja

Mughal Iron & Steel Industries Limited, a prominent player in the iron and steel sector of Pakistan, has released its financial report, revealing that while sales remained robust in the second and third quarters, profits surged in the first and third quarters of the just-ended financial year 2022-23.

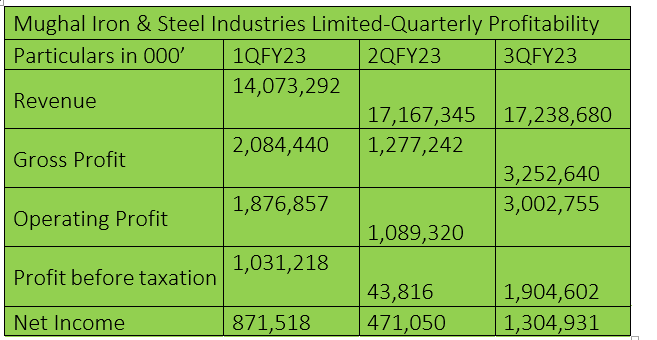

In the first quarter (July-September) of FY23, the company posted gross revenues of Rs14 billion and a gross profit of Rs2 billion. The company posted a net profit of Rs871 million.

In the second quarter (October-December), the company posted a gross revenue of Rs17.1 billion, gross profit of Rs1.2 billion and net income of Rs471 million. In the third quarter (January-March), the company posted a gross revenue of Rs17.2 billion, gross profit of Rs3.2 billion and net income of Rs1.3 billion.

The company's financial figures demonstrate fluctuations in revenue and profitability across the three quarters of FY23. While the first quarter showed some decline in revenue, the sales surged in the second and third quarters. Similarly, the gross and operating profits varied throughout the quarters. The company's net income also displayed a significant increase from the second to the third quarter.

FY22 compared with FY21 Top of Form

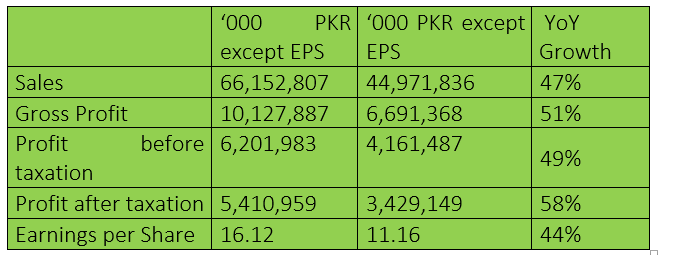

The company's sales surged 47% to Rs66 billion in FY22 from Rs44 billion in FY21. This impressive performance was accompanied by a robust increase in gross profit, which surged 51% to Rs10 billion in FY22 from the previous year's Rs6.6 billion. The company's ability to effectively manage costs, optimise production processes, and capture market opportunities contributed to this notable achievement.

Furthermore, Mughal Iron & Steel Industries demonstrated strong profitability as is evident from the significant growth in both profit before and after taxation. The profit-before-tax for FY22 surged 49% to Rs6.2 billion from Rs4.1 billion in FY21. The profit-after-taxation also surged 58% to Rs5.4 billion from Rs3.4 billion in FY21 Overall, the steelmaker’s annual summary is characterised by substantial growth in sales, gross profit, and profitability year-on-year. The company's strategic initiatives, market positioning, and operational excellence have positioned it for continued success and reinforced its standing as a leading player in the iron and steel industry.

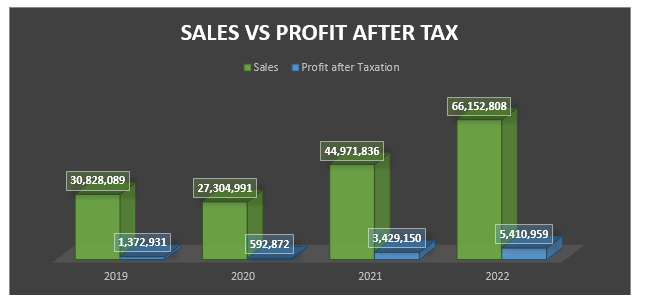

Mughal Iron & Steel Industries has demonstrated consistent growth in both sales and profitability since 2020, indicating the company's ability to capitalise on market opportunities, control costs, and drive operational efficiency.

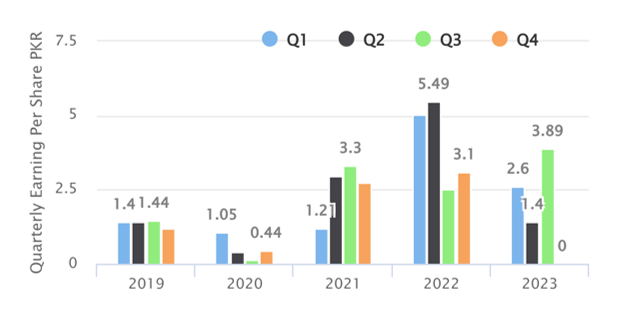

Earnings Per Share (EPS)

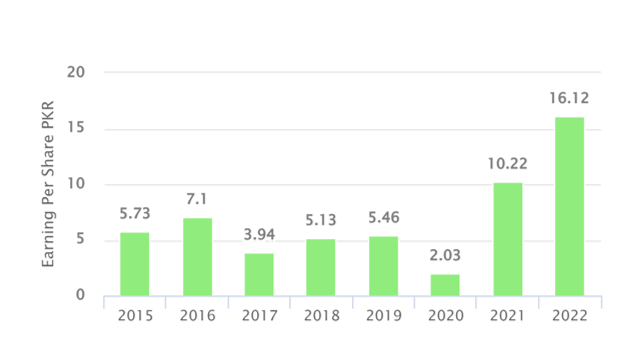

The company’s EPS fluctuated over the years, suggesting variations in its profitability on a per-share basis. In 2015, the EPS was Rs5.73, which increased to Rs7.1 in 2016. This increase shows higher profitability and more earnings produced. But in 2017, the trend changed, and the EPS dropped to Rs3.94, signifying a drop in profitability. In 2020, Mughal Iron & Steel Industries experienced a further decrease in EPS, which dropped to Rs2.03, suggesting a continued decline in profitability per share, posing a challenge for the company's shareholders. The company saw significant growth in its EPS in 2021 when it stood at Rs10.22 before jumping to Rs16.12 in 2022, the highest growth achieved since 2015.

In the latest financial update for fiscal 2022-23, the company's EPS stood at Rs2.6 in the first quarter before dipping to Rs1.4 in the second quarter. The EPS jumped back to Rs3.89 in the third quarter.

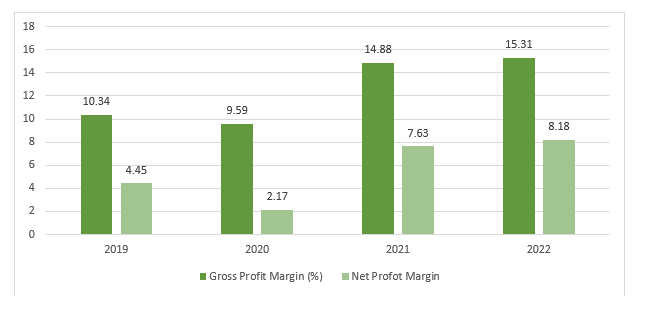

Net profit margin

The company's gross and net profit margins remained high in 2021 and 2022 compared to the previous two years.

These positive developments highlight the company's operational efficiency, effective cost management, and improved financial performance. A rising gross profit margin indicates better control over production costs, while an increasing net profit margin suggests the company's ability to generate higher profits relative to its revenue. These ratios provide insights into Mughal Iron & Steel Industries Limited's financial strength.

Industry comparison

International Steels Limited, International Industries Limited, Agha Steel Industries Limited and Cherat Cement Company Limited are regarded as rivals of Mughal Iron & Steel Industries in terms of market capitalisation. Cherat Cement Company Limited has the largest market capitalisation of Rs22.6 billion. The market value of Mughal Iron & Steel Industries is Rs15.9 billion.

Company profile

Mughal Iron & Steel Industries was incorporated in Pakistan as a public limited company on February 16, 2010 under the repealed Companies Ordinance, 1984 (now the Companies Act, 2017). The company’s operations comprise of ferrous and nonferrous business segments. However, the principal activity of the company is manufacturing and sale of mild steel products relating to ferrous segment.

Credit: INP-WealthPk