INP-WealthPk

Jawad Ahmed

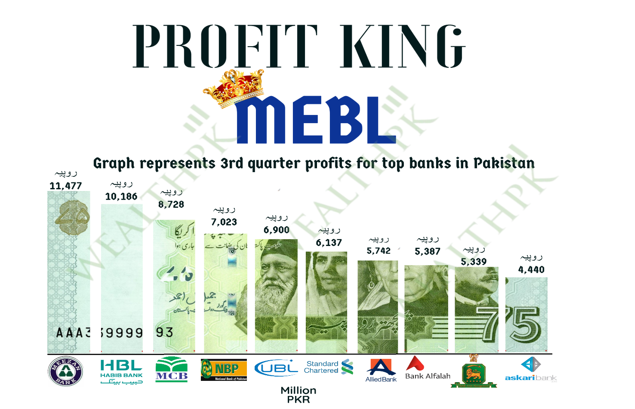

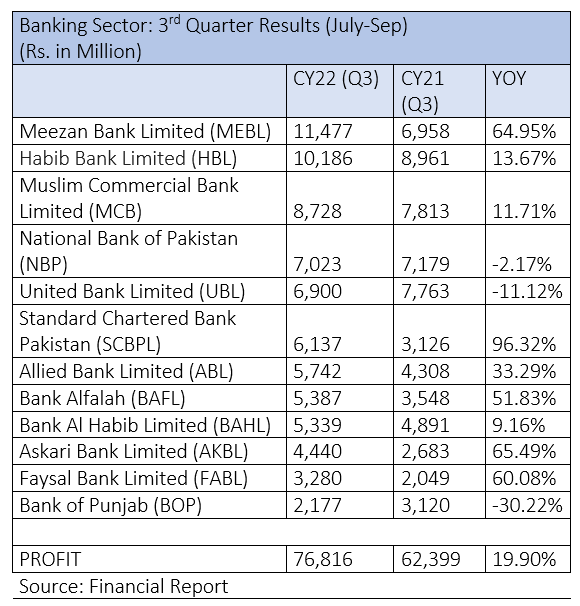

The Meezan Bank Limited topped the banking sector in terms of earnings in the third quarter (July-September) of 2022 as its profits jumped to Rs11.47 billion from Rs6.95 billion, posting a 65% increase year-on-year.

The top 12 banks in Pakistan declared net profits of Rs76.81 billion during the quarter under review, up 19.90% from Rs62.399 billion during the same time last year, according to WealthPK.

Muhammad Safdar Kazi, Chief Executive Officer of Fair Edge Securities (Pvt) Ltd, said that people were increasingly parking their investments in banks to earn healthy profits keeping in view the elevated interest rates. “Banks serve as havens for their savings nowadays as people prefer keeping their money in savings accounts to investing in businesses.”

He also noted how several banks had manipulated the rupee-dollar exchange rate, pocketing exorbitant fees. "Higher interest rates, hefty fees, and foreign exchange income have increased the profits of the banking sector in Pakistan," he said.

During the July-September quarter of this year, Habib Bank Ltd earned Rs10.18 billion profit, Muslim Commercial Bank Ltd Rs8.72 billion, Standard Chartered Bank Ltd Rs6.13 billion, Allied Bank Ltd Rs5.74 billion, Bank Alfalah Ltd Rs5.38 billion, Bank Al Habib Ltd Rs5.33 billion, Askari Bank Ltd Rs4.44 billion, Faysal Bank Ltd Rs3.28 billion, National Bank of Pakistan Rs7 billion, United Bank Ltd Rs6.9 billion and Bank of Punjab Ltd Rs2.17 billion.

Compared to the same quarter of the previous year, top performers during this calendar year’s third quarter included Habib Bank Ltd with a year-on-year growth of 13.6%, Muslim Commercial Bank Ltd 11.7%, Standard Chartered Bank Ltd 96.3%, Allied Bank Ltd 33.2%, Bank Alfalah Ltd 51.8%, Bank Al Habib Ltd 9.1%, Askari Bank Ltd 65.4% and Faysal Bank Ltd 60%, while underperformers included the National Bank of Pakistan -2.1%, United Bank Ltd -11.1% and Bank of Punjab Ltd -30.2%.

“The objective of the government in raising the policy rate was to reduce aggregate demand in the overheated economy. However, the banking industry has seen an increase in profits as a result of the higher interest rate. This practice will hinder economic expansion and widen the gap between the rich and the poor,” noted Safdar Kazi, the CEO of Fair Edge Securities (Pvt) Ltd.

Credit : Independent News Pakistan-WealthPk