INP-WealthPk

Qudsia Bano

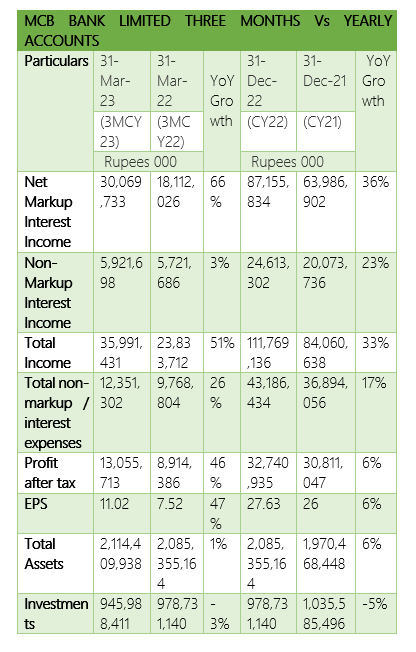

Muslim Commercial Bank (MCB) Limited has released its financial results for the three-month period ending March 31, 2023, as well as the yearly accounts for the calendar year 2022, showing an impressive performance with significant year-on-year growth in various key financial indicators, reports WealthPK. Net markup interest income – a crucial component of the bank's earnings – recorded a remarkable YoY growth of 66%, reaching Rs30,069 million compared to Rs18,112 million in the corresponding period last year. This surge can be attributed to the bank's effective management of interest rates and strong lending activities.

Non-markup interest income, which comprises various income streams, grew modestly by 3% to Rs 5,921 million, indicating the bank's ability to generate consistent income from its fee-based services. In terms of total income, the bank reported a substantial YoY growth of 51%, reaching Rs35,991 million compared to Rs23,833 million in the previous year. This remarkable increase in total income reflects the bank's successful utilization of its core banking operations and capitalization on market opportunities.

Total non-markup/interest expenses for the three-month period amounted to Rs12,351 million, indicating a 26% YoY growth compared to Rs9,768 million in the same period last year which can be attributed to operational costs associated with the bank's expansion and investments in infrastructure. The profit after tax demonstrated a strong growth, recording a YoY increase of 46% to Rs13,055 million compared to Rs8,914 million in the corresponding period last year. This substantial growth highlights the bank's effective risk management practices and sustainable profitability.

The earnings per share (EPS) also exhibited an impressive YoY growth of 47%, reaching Rs11.02 compared to Rs7.52 in the previous year, signifying the bank's commitment to delivering value to its shareholders through consistent earnings growth. In terms of balance sheet, the bank reported total assets of Rs2,114 billion as of March 31, 2023, reflecting a marginal YoY growth of 1%. However, investments decreased by 3% to Rs945 billion, indicating strategic adjustments in the bank's asset allocation.

Yearly accounts also demonstrate a remarkable performance. The net markup interest income – a key driver of the bank's earnings – witnessed a significant year-on-year growth of 36% to reach Rs87,155 million, compared to Rs63,986 million in the previous year. This growth reflects the bank's effective interest rate management and robust lending activities. Non-markup interest income, derived from fee-based services, experienced a YoY growth of 23% to Rs24,613 million, showcasing the bank's ability to generate consistent revenue from diversified sources.

Total income for the CY2022 amounted to Rs111,769 million, indicating a substantial YoY growth of 33% compared to Rs84,061 million in the previous year. This growth in total income underscores the bank's successful utilization of its core banking operations and effective capital deployment. Total non-markup/interest expenses for the year reached Rs43,186 million, reflecting a moderate YoY growth of 17% compared to Rs36,894 million in the previous year and can be attributed to operational costs associated with the bank's expansion and investments in technology and infrastructure.

Profit after tax for the fiscal year amounted to Rs32,741 million, demonstrating a modest YoY growth of 6% compared to Rs30,811 million in the previous year. This signifies the bank's consistent profitability and prudent risk management practices Earnings per share (EPS) recorded a growth of 6%, reaching Rs27.63 compared to Rs26 in the previous year which indicates the bank's commitment to delivering value to its shareholders through sustained earnings growth.

The bank's total assets stood at Rs2,085 billion as of December 31, 2022, reflecting a solid YoY growth of 6%. This growth indicates the bank's effective balance sheet management and continuous focus on expanding its asset base. However, investments decreased by 5% to Rs979 billion, reflecting strategic adjustments in the bank's investment portfolio to optimize returns.

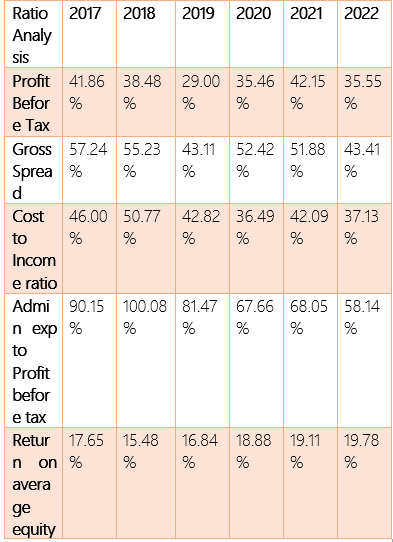

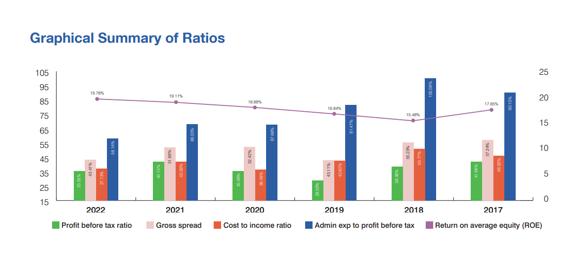

The bank has showcased consistent and impressive financial performance over the years, as reflected in its ratio analysis. With a strong profit before tax ratio ranging from 29.00% to 42.15%, the bank has demonstrated its ability to generate earnings from core operations. Effective interest rate management is evident through the steady gross spread ratio of 43.11% to 57.24%. The bank's focus on cost efficiency is evident in the favorable cost to income ratio ranging from 36.49% to 50.77%.

The bank has also successfully controlled administrative expenses, as seen in the declining admin expense to profit before tax ratio. With a solid return on average equity ranging from 15.48% to 19.78%, the bank consistently delivers profitable returns to its shareholders. The ratio analysis highlights the bank’s robust financial performance, efficient operations, and prudent management practices, positioning it as a stable and valuable institution in the banking sector.

Share price analysis

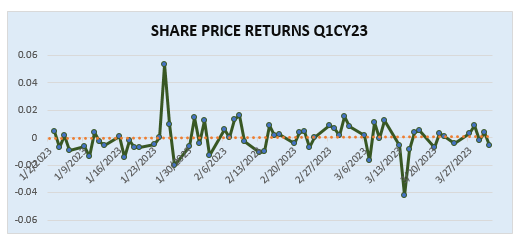

During the first quarter of CY23, the bank’s share prices exhibited fluctuations but maintained a relatively stable trend overall. The prices opened at 115.51 and experienced minor variations, reaching a high of 120.77 and a low of 107.7. The stock demonstrated resilience, with prices mostly hovering around the 114-116 range, indicating a relatively steady market performance and investor confidence in the bank. It is worth noting that the share prices showed some volatility towards the end of the quarter, with a dip observed on March 14 when the prices dropped to 115. However, they rebounded shortly after, closing the quarter at 114.99.

About the bank

MCB is a Pakistan-based banking company. The bank's segments include retail banking, which includes retail lending and deposits, banking services, cards, and branchless banking; corporate banking, which offers loans, deposits, project financing, trade financing, investment banking, and other banking activities; consumer banking, which includes consumer financing activities and offers credit cards, auto loans, housing finance, and personal loans to individual customers; treasury, which offers fixed income, equity, foreign exchange, credit, funding, own position securities, lending and borrowings and derivatives for hedging and market making; and international banking, which offers loans, deposits, project financing, trade financing, investment banking, and other banking activities by its overseas operations. The bank operates approximately 1,426 branches within Pakistan and 11 branches outside Pakistan. It operates in Pakistan, South Asia, and the Middle East.

Credit: Independent News Pakistan-WealthPk