INP-WealthPk

Hifsa Raja

The market is bearish these days and will remain so even in the next year though the equity investors look on the bright side. The market is down due to devaluation of the Pakistani rupee. If we talk about the current week’s trading activity, it is lackluster, said Asad Mustafa Securities Manager Muhammad Imran in an interview with WealthPK.

WealthPK: What is the current market situation for trading?

Muhammad Imran: The market got off to a good start. It started out well but ended up spending the entire day in a range-bound session. Similar events occurred with the KSE-100; although it started the day on a positive note, the index was dragged and it began trading in a narrow range.

WealthPK: What do you suggest according to the current situation of the market, should an investor make an investment?

Muhammad Imran: The investor ought to buy a variety of equities. He shouldn't invest all of his resources in one thing but diversify his portfolio by investing in several asset groups. Diversifying an investor's asset allocation should include commercial banks (+17.0 points), technology and communication (+97.0 points), and other assets.

WealthPK: What are the stocks that are contributing more to the volumes than others?

Muhammad Imran: The stocks that are contributing more to the volumes are WorldCall Telecom Limited, TRG Pakistan Limited, Unity Food Limited, Ghani Chemical Industry Limited, and Ghani Global Holdings Limited.

WealthPK: What is the current volume of the market at which the stocks are being traded?

Muhammad Imran: The number of shares traded dropped from 189.3 million to 132.9 million (-29.8 percent DoD). Additionally, the average transaction value dropped from USD22.6 million to USD20.5 million – a 9.7% decline. Although there is a decent volume of third-tier stocks, the main board volumes remain dry.

WealthPK: How does your company help the investor in trading?

Muhammad Imran: Our company offers the investor the aid of a seasoned trader. We ask the investor to sell the item if it is collapsing and is in an alarming condition, and we then negotiate over his stake. We square up on the investor’s position.

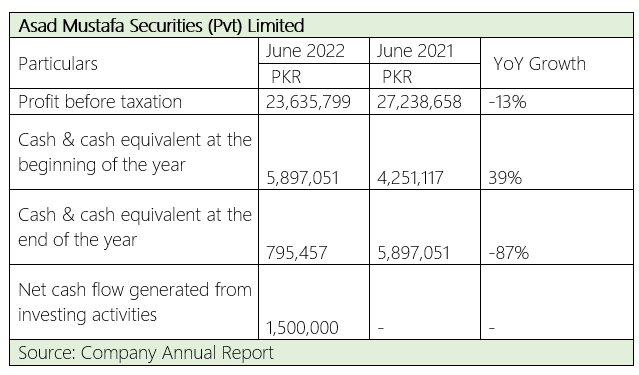

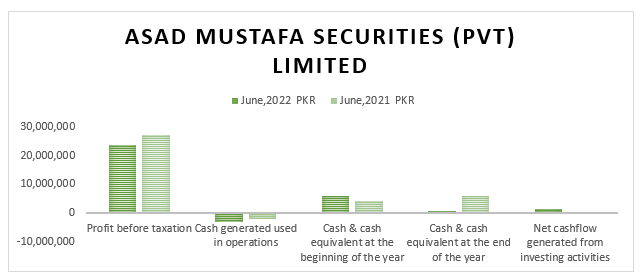

The profit before taxation, showing a decline of 13%, stood at Rs23 million in FY22 compared to Rs27 million over the same period of FY21. The cash and cash equivalent at the beginning of the year showed an increase of 39% and reached Rs5.89 million in FY22 from Rs4.25 million profit in FY21.

The cash and cash equivalent at the end of the year showed a decrease of 87% and reached Rs795,457 in FY22 from Rs5.89 million in FY21. The net cash flow generated from investing activities was Rs1.5 million, reports WealthPK.

Financial Performance

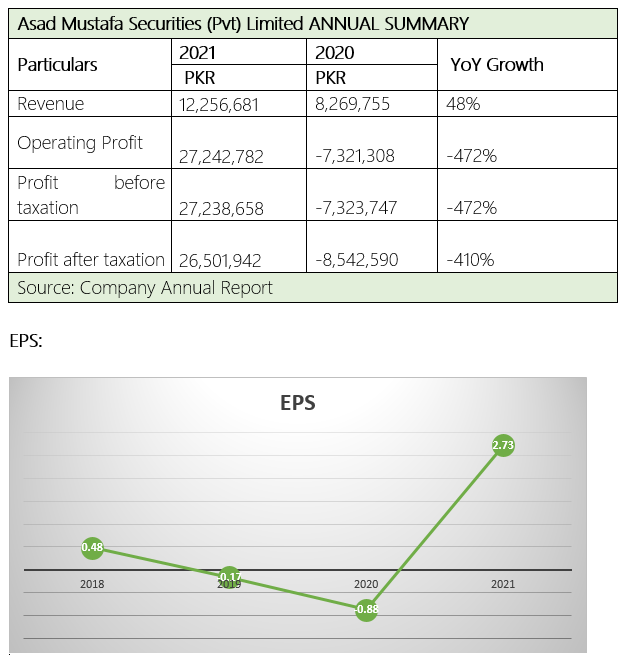

During the Fiscal Year 2020-21, the company generated a revenue of Rs12.25 million over Rs8.26 million in 2019-20, registering an increase of 48%. The operating profit for FY21 was Rs27.24 million, registering a decrease in the loss by 472% from Rs7.32 loss in FY20.

Profit-before-tax for FY21 was Rs27.23 million compared to Rs7.32 million in FY20, showing a decrease in the loss by 472%. Similarly, profit after tax for FY21 was Rs26 million compared to Rs8 million in FY21, showing a decrease in the loss by 410%.

In 2018, the earnings per share (EPS) was Rs0.48. It was minus Rs0.17 in 2019 and minus Rs0.88 in 2020 and then increased to Rs2.73 in 2021.

Credit : Independent News Pakistan-WealthPk