INP-WealthPk

Saba Javed

The output of the Large-Scale Manufacturing Industry (LSMI) is contracting persistently and the industry needs crucial reforms for long-term growth, said Muhammad Naeem, Standing Member of All Pakistan Textile Mills Association, while talking to WealthPK. “Monetary and fiscal policy tightening, import controls, high fuel costs, lower global and domestic demand, and increase in the cost of doing business have caused a decline in the LSMI output, as we can see in the decrease in production of textile, paper, machinery, automobiles, and petroleum,’’ said Naeem. He said the manufacturing sector had been struggling for months to continue operations, as the raw material supplies had dried up because of import restrictions. The problem has exacerbated due to sharp currency devaluation and the overall slowdown of the country’s economy, he added.

The contraction is broad-based, with 18 out of 22 sectors recording lower production. Only apparel, leather products, furniture, and other manufacturing sectors (football) saw an increase in production, while a decrease was witnessed in food, beverages, tobacco, textiles, wood products, paper & board, coke & petroleum products, pharmaceuticals, rubber products, nonmetallic mineral products, fabricated metal, chemicals, iron & steel products, electrical equipment, machinery and equipment, automobiles and other transport equipment.

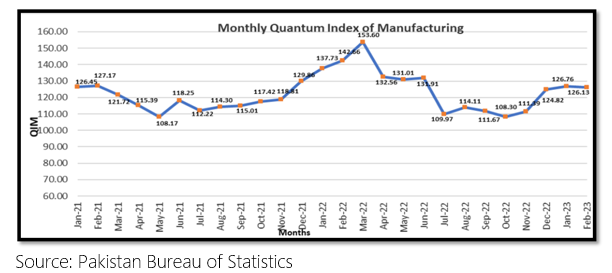

According to the Pakistan Bureau of Statistics (PBS), the overall output of the LSMI decreased by 5.56% to 116.64 points during July-February 2022-23, compared to 123.50 points in the corresponding period of 2021-22, with the base year 2015-16. On a year-on-year basis (YoY), the output declined by 11.59% to 126.13 points in February 2023 from 142.66 points in February 2022. On a monthly basis, LSMI output decreased 0.50% to 126.13 points in February 2023 against 126.75 points in January 2023.

The sectors showing growth during July-February include wearing apparel (35.53%), leather products (3.85%), furniture (58.45%) and other manufacturing (football) (35.81%). The sectors showing decline during the July-February period include food (1.95%), beverages (6.14%), tobacco (20.42%), textile (14.03%), wood products (68.65%), paper and board (3.37%), coke and petroleum products (9.43%), chemicals (4.84%), chemicals products (0.53%), fertilizers (7.77%), pharmaceuticals (22.41%), rubber products (7.32%), non-metallic mineral products (9.08%), iron and steel products (3.89%), fabricated metal (12.79%), computer, electronics and optical products (25.07%), machinery and equipment (48.98%), automobiles (38.59%), and other transport equipment (37.73%).

Nadeem said the growth of a nation's manufacturing sector was a key indicator of its economic strength. Industries aid in the eradication of poverty and unemployment by creating jobs, he added. ‘’Pakistan’s growth prospects are expected to remain constrained, as there is a persistent drop in business and consumer confidence for a long time period due to which the industry’s output is expected to shrink more in the upcoming months with supply chain disruptions, weakened confidence, higher borrowing costs and fuel prices,’’ he said. He suggested structural reforms to improve investment, competitiveness and productivity, including trade and business regulatory reforms to remove distortionary protections.

Credit: Independent News Pakistan-WealthPk