INP-WealthPk

Muhammad Mudassar

The sales of petroleum products reduced by 26% in July 2002 as compared to the previous month. Total sales in July were 1.44 million tons, according to the Oil Companies Advisory Council (OCAC).

The POL products are major contributor to Pakistan’s imports. According to the State Bank of Pakistan (SBP), around 41% of imports are associated with petroleum products.

The value of Pakistan’s imports in July 2022 declined to $5 billion from $7.7 billion last month, reflecting the government’s efforts to stem the country’s current account gap, Finance Minister Miftah Ismail said.

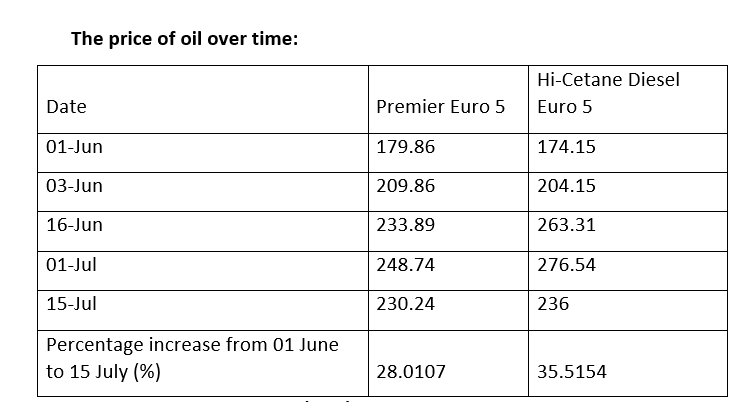

The main factors that have contributed to this reduction in oil consumption is an increase in prices and slowing down of the economy. During the period from June 1 to July 15, the prices of gasoline and diesel increased by 28% and 35.5%, respectively.

Source: Pakistan State Oil (PSO)

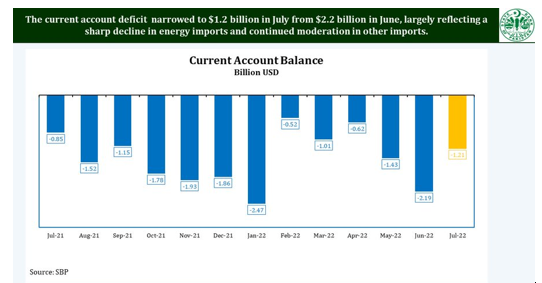

On the other hand, the current account deficit also reduced sharply. The SBP stated that the current account deficit shrank to $1.2 billion in July from $2.2 billion in June, largely reflecting a sharp decline in energy imports and a continued moderation in other imports.

Another reason for reduction in the import bill was the government's announcement that import of luxury items would be banned. Now that the ban on these imported goods has been lifted, it is no longer in effect.

It is important for Pakistan to increase its exports in order to reduce its current account deficit. Ban on imports slows down the country’s economy.

Oil consumption was reduced mainly due to a significant decline in sales of all three petroleum products. High-speed diesel (HSD) sales reduced by 38% on a month-over-month (MoM) basis to 444,000 tons, motor gasoline (MOGAS) sales declined by 15% to 594,000 tons and furnace oil (FO) sales dipped by 23% to 350,000 tons.

As compared to last year, Pakistan’s oil sales recorded a decline of 26% on a year-over-year (YoY) basis in July 2022, which is because of a drop in MOGAS and HSD sales by 27% and 38%, respectively. Excluding the FO, oil sales were down 31% on a YoY basis, and 26% on a MoM basis in July 2022, to 1.1 million tons.

According to Saad Ziker, analyst at Topline Securities, it is expected that oil sales will drop by 15-20% on a YoY basis in FY23, mainly due to low growth estimated in agriculture sector, likely decline in auto sales because of higher prices, and increase in petroleum prices.

Credit : Independent News Pakistan-WealthPk