INP-WealthPk

Hifsa Raja

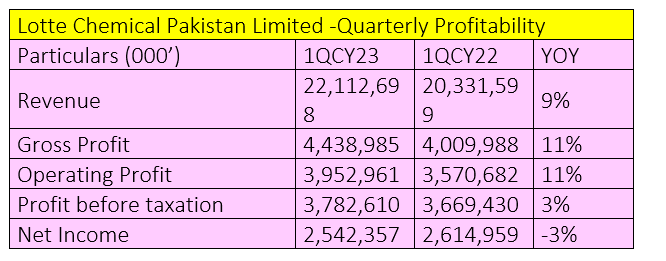

Lotte Chemical Pakistan Limited’s financial data for the first quarter of the ongoing calendar year 2023 showcases a steady performance, highlighting the company's resilience in a challenging market environment. In 1QCY23, the company reported a modest increase in revenue, which increased to Rs22 billion from Rs20 billion over the same period of the previous year, indicating a growth of 9%. Similarly, the gross profit increased to Rs4.4 billion, up 11% from the previous year's Rs4 billion.

The company’s operating profit increased by 11% to Rs3.9 billion in 1QCY23 from Rs3.5 billion in 1QCY22. Moreover, the company’s profit-before-tax inched up by 3% to Rs3.7 billion in 1QCY23 from Rs3.6 billion in 1QCY22. The company, however, saw its profit-after-tax slightly drop by 3% to Rs2.5 billion in 1QCY23 from Rs2.6 billion in 1QCY22.

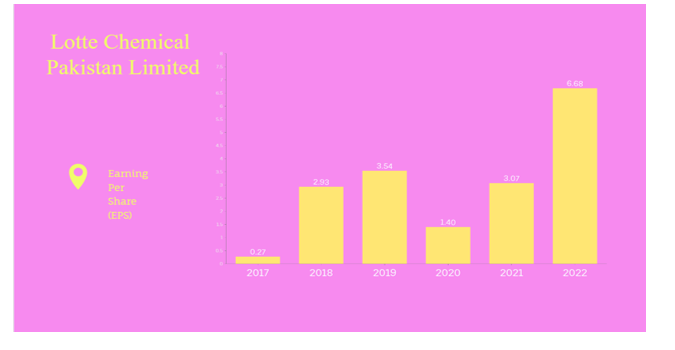

Performance over the years

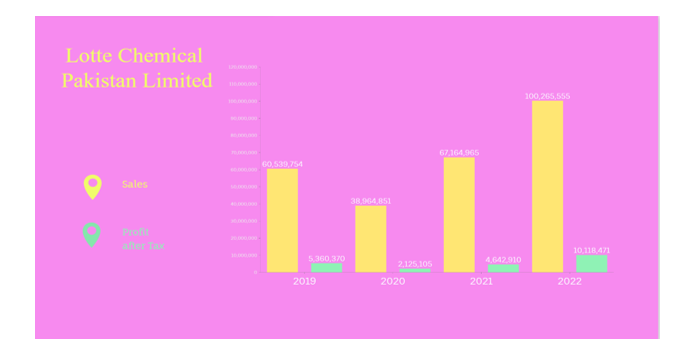

The increase in sales and profit from 2020 to 2022 signifies a favourable outlook for Lotte Chemical Pakistan as it demonstrates the company's strong market presence, customer loyalty, and the ability to adapt to changing market dynamics. Stakeholders and investors can look forward to the company's continued success and its efforts to capitalise on emerging opportunities in the consumer goods industry.

Performance in CY22

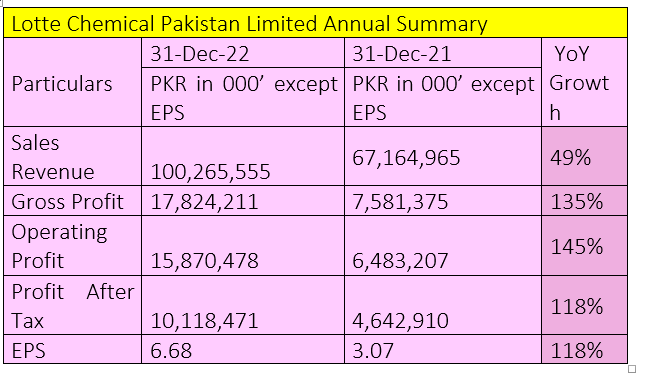

In the calendar year 2022, the company reported an increase in net sales revenue, which jumped to Rs100 billion from Rs67 billion in CY21, indicating a growth of 49%. The gross profit rocketed to Rs17 billion, up 135% from the previous year's figure of Rs7 billion.

The company’s operating profit also soared by 145% to Rs15.8 billion in CY22 from Rs6.48 billion in CY21. Moreover, the company’s profit-after-tax leapt by 118% to Rs10 billion in CY22 from the previous year's Rs4.6 billion.

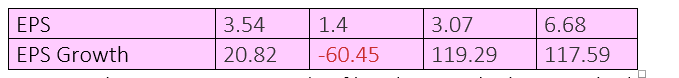

Earnings Per Share (EPS)

The company has maintained positive EPS and profitability for four years, but its EPS in 2020 was low, reflecting a decline in its earnings.

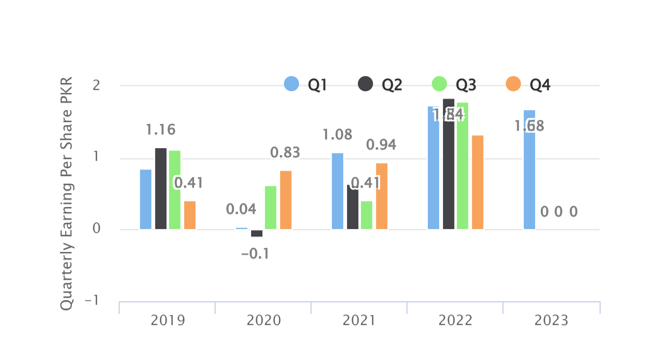

EPS growth in 2019 was around 20%, indicating the business had an increase in profits during that year. In 2020, the growth turned negative due to a dip in EPS. However, EPS growth took a leap and reached 119% in 2021, showing a considerable increase in the company's EPS. The EPS growth in 2022 was also healthy at around 117%.

The company’s EPS hit an all-time low in 2017, and all-time high in 2022. In the latest financial update for the first quarter of CY23, the company's EPS stood at Rs1.68.

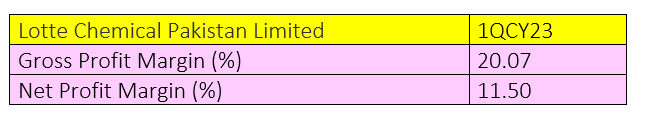

Ratio analysis

In the first quarter of CY23, the gross profit margin stood at 20.07% and the net profit margin at 11.50%, respectively.

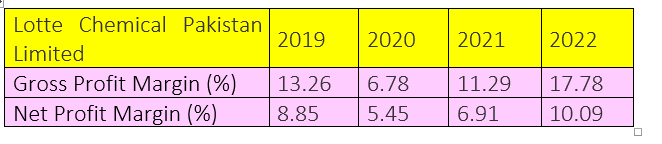

In 2019, the company’s gross profit margin was 13.26%, which decreased to 6.78% in 2020, but rose again to 11.29% in 2021 and further to 17.78% in 2022. The net profit margin in 2019 stood at 8.85%, but dropped to 5.45% in 2020. Nevertheless, it increased to 6.91% in 2021 and to 10.09% in 2022.

The financial data highlights the dynamic nature of Lotte Chemical's profitability over the years. While the company faced challenges in certain periods, it managed to demonstrate resilience and implement measures to enhance profitability. Lotte Chemical's ability to rebound and achieve higher profit margins in subsequent years suggests effective management strategies, cost controls, and potentially favourable market conditions. Moving forward, Lotte Chemical will likely continue to focus on sustaining and improving its profitability by leveraging its strengths, addressing weaknesses, and capitalising on growth opportunities in the chemical industry.

Industry comparison

Lotte Chemical Pakistan Limited’s competitors include Engro Polymer and Chemicals Limited, Archroma Pakistan Limited, Nimir Industrial Chemicals Limited and Sitara Chemical Industries Limited.

Lotte Chemical Pakistan Limited has the largest market capitalisation of ₨38.1 billion followed by Engro Polymer and Chemicals Limited’s market value of ₨36.3 billion. Sitara Chemical Industries Limited has the lowest market value of Rs5 billion.

Company profile

Lotte Chemical Pakistan Limited is engaged in the manufacturing and sale of purified terephthalic acid (PTA). PTA is the primary raw material for producing polyester fiber, polyester filament yarn, polyester film, and polyethylene terephthalate (PET). The company is the local producer and supplier for the domestic polyester and PET industries with short delivery. For producing PTA, it imports its feedstock (paraxylene) from suppliers based in Asia and Middle East. It has also enabled infrastructure development in Port Qasim, Karachi, including a chemical jetty, raw water pipeline, and production of industrial gases through third party contracts. The company has the capacity to produce approximately 500,000 tonnes of PTA per year through its plant located at Port Qasim.

The company is a subsidiary of Lotte Chemical Corporation.

Credit: INP-WealthPk