INP-WealthPk

Fakiha Tariq

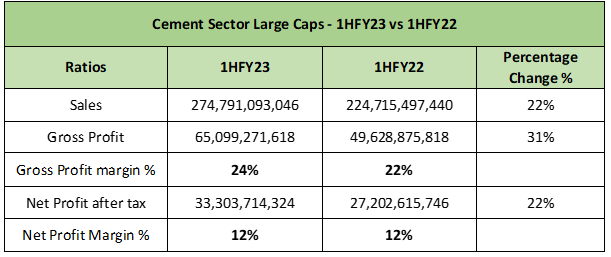

Large cap cement companies collectively posted a hefty increase of 22% and 31% in revenue and profits, respectively, in the first half (July-Dec) of the ongoing fiscal year 2022-23 compared to the same period of the last fiscal, reports WealthPK.

Large cap cement firms posted revenue of Rs274 billion in the 1HFY23 compared to Rs224 billion posted in the same period of FY22. Large caps’ gross profit increased to Rs65 billion in 1HFY23 compared to Rs49 billion reported in 1HFY22. In 1HFY23, the large cap cement companies declared Rs33 billion net profit, registering a growth of 22% over Rs27 billion in 1HFY22.

The cement sector on Pakistan Stock Exchange comprises 23 public limited companies, whereas the top eight firms represent the “large cap school”.Lucky Cement Limited (LUCK), with a market cap of Rs135.5 billion, is the largest company, followed by Bestway Cement Limited (BWCL), which has a market cap of Rs82.7 billion.

Fauji Cement Company Limited (FCCL), Kohat Cement Company Limited (KOHC) and Maple Leaf Cement Factory Limited (MLCF), with market caps of Rs28 billion, Rs27.3 billion and Rs26.6 billion, ranked third, fourth and fifth, respectively.

Cherat Cement Company Limited (CHCC), DG Khan Cement Company Limited (DGKC) and Pioneer Cement Limited (PIOC) ranked sixth, seventh and eighth with market caps of Rs20.7 billion, Rs17.9 billion and Rs13.2 billion, respectively.

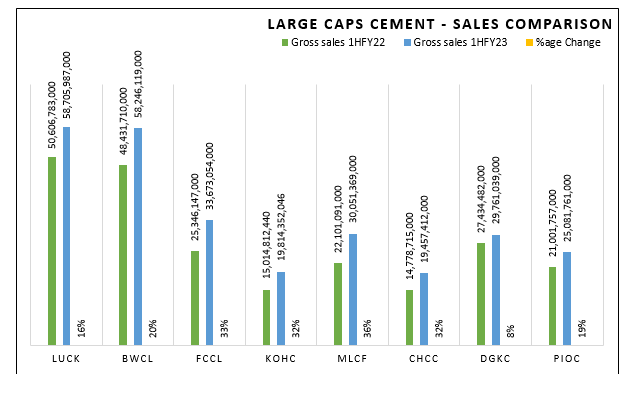

Large cap cement firms – 1HFY22 sales vs 1HFY23 sales

In terms of semi-annual revenues, MLCF posted the highest revenue growth of 36% as its sales value increased from Rs22 billion in 1HFY22 to Rs30 billion in 1HFY23. FCCL posted the second-highest revenue growth of 33%. KOHC (Rs15 to Rs19 billion) and CHCC (Rs14 to Rs19 billion) ranked third, increasing their sales by 32% each year-on-year.

BWCL’s revenue increased from Rs48 to Rs58 billion in the two comparable periods at a growth rate of 20%; PIOC posted 19% growth with its sales increasing from Rs21 to Rs25 billion; LUCK posted a 16% growth with its sales revenue reaching Rs58 billion from Rs50 billion.

Out of eight large caps, the lowest increase in sales was reported by DGKC at 8%, as its revenue increased from Rs27 billion in 1HFY22 to Rs29 billion in 1HFY23.

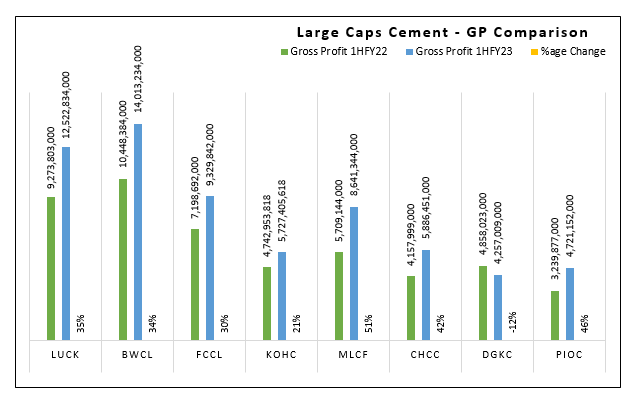

Large cap cement firms – 1HFY22 GP vs 1HFY23 GP

MLCF led the large cap cement school by posting a 51% increase in its gross profit (GP), which increased to Rs8.6 billion in 1HFY23 from Rs5.7 billion in 1HFY22. PIOC posted the second-highest GP increase of 46% and CHCC ranked third by reporting GP growth of 42%.

LUCK posted growth of 35% as its GP increased from Rs9.2 billion to Rs12 billion during the two comparable periods; BWCL’s GP cranked up to Rs14 billion from Rs10 billion at a 34% growth rate and FCCL’s GP posting 30% growth jumped to Rs9.3 billion in 1HFY23 from Rs7.1 billion in 1HFY22.

KOHC posted the lowest increase of 21% in GP as its profit increased to Rs5.7 billion in 1HFY23 from Rs4.7 billion in 1HFY22. Only DGKC suffered a decrease in GP of 12% as its profit was pushed down to Rs4.2 billion in 1HFY23 from Rs4.8 billion in 1HFY22.

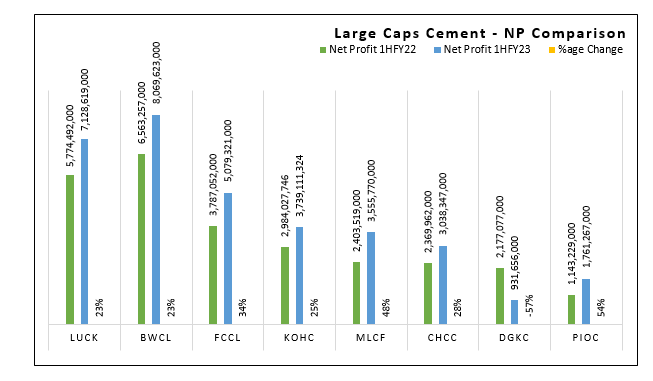

Large cap cement firms – 1HFY22 NP vs 1HFY23 NP

PIOC posted the highest growth in net profit (NP) of 54%, pushing its profit from Rs1.1 billion in 1HFY22 to Rs1.7 billion in 1HFY23. MLCF posted a 48% growth in NP and FCCL 34%.

CHCC posted a 28% NP increment, KOHC 25% and LUCK and BWCL 23% each. DGKC net profit decreased by 57% to Rs931 million in 1HFY23 from Rs2.1 billion in 1HFY22.

Credit: Independent News Pakistan-WealthPk