INP-WealthPk

Qudsia Bano

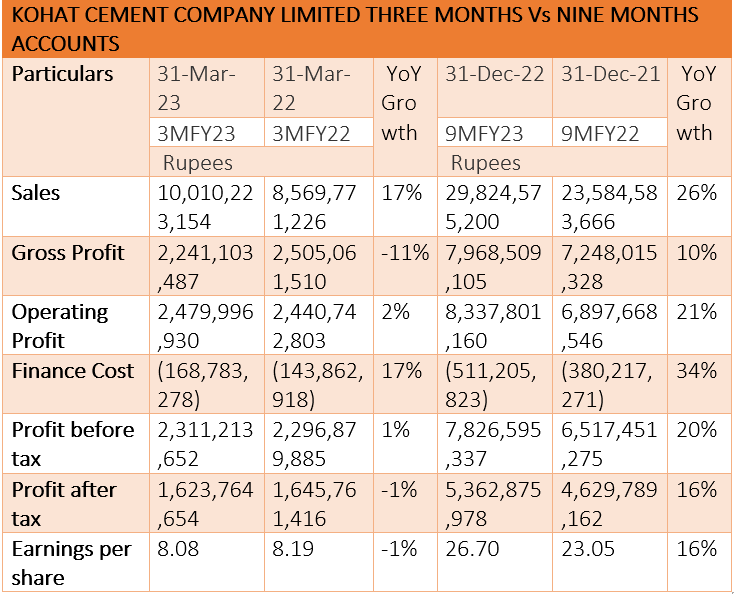

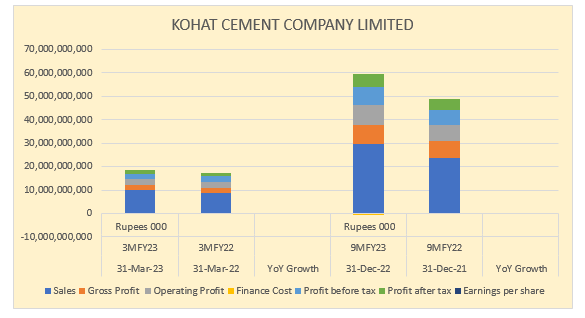

Kohat Cement Company Limited (KOHC) announced its financial results for the three-month period ending March 31, 2023, reporting a substantial sales growth of 17%, but an 11% decline in gross profit year-on-year. The total sales reached Rs10.01 billion in 3MFY23 from Rs8.57 billion over the corresponding period last year, reports WealthPK. The gross profit declined to Rs2.24 billion from the previous year's Rs2.51 billion. However, the company managed to maintain an operating profit of Rs2.48 billion, reflecting a modest 2% increase over the previous year's Rs2.44 billion.

During the three-month period, Kohat Cement also witnessed a rise in finance costs, which amounted to Rs168.78 million, signifying a 17% increase from Rs143.86 million in the same period last year. KOHC’s profit-before-tax of Rs2.31 billion reflected a marginal growth of 1% over Rs2.30 billion the previous year. Kohat Cement reported a profit-after-tax of Rs1.62 billion, showing a slight decline of 1% from Rs1.65 billion in the corresponding period of 2022.

The earnings per share for the three-month period stood at Rs8.08, exhibiting a marginal decrease of 1% compared to the previous year's Rs8.19. Despite the decline in gross and net profits, Kohat Cement Company remains optimistic about its sales growth, which indicates a positive market reception for its products. The company continues to focus on enhancing its operational efficiency to improve profitability in the coming quarters.

In the nine months from July 2022 to March 2023, KOHC also showed impressive growth, achieving a substantial year-on-year sales growth of 26%. The total sales for the period amounted to Rs29.82 billion compared to Rs23.58 billion in the same period last year. The company also reported a gross profit of Rs7.97 billion, reflecting a solid 10% increase from the previous year's Rs7.25 billion. The operating profit for the nine months stood at Rs8.34 billion, indicating a notable growth of 21% compared to Rs6.89 billion in the same period last year.

Finance costs experienced a significant rise to Rs511.21 million, representing a growth of 34% from the previous year's cost of Rs380.22 million. However, despite this increase, the company achieved a profit-before-tax of Rs7.83 billion, demonstrating a healthy 20% growth from Rs6.52 billion in the corresponding period last year.

After-tax adjustments, KOHC reported a profit-after-tax of Rs5.36 billion, showing a solid 16% increase from Rs4.63 billion in the same period last year. The earnings per share for the nine-month period stood at Rs26.7, marking a growth of 16% compared to Rs23.05 the previous year. KOHC’s strong performance in sales and profitability highlights its successful operations and market position. The company remains focused on capitalising on growth opportunities and maintaining its commitment to delivering value to its stakeholders.

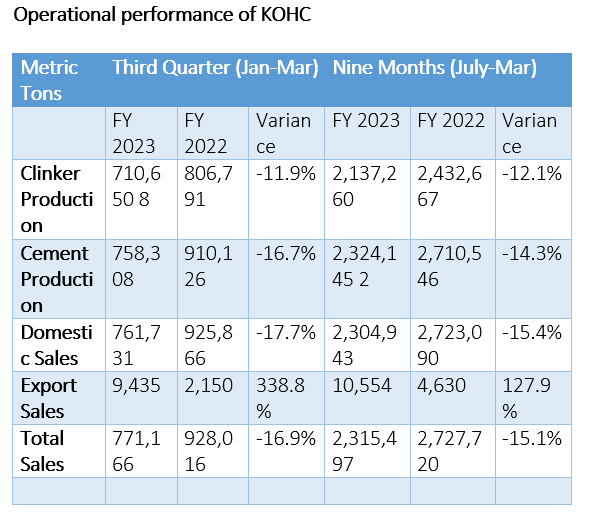

KOHC has also released its operational performance metrics for the third quarter (January-March) and the nine-month period (July-March) of fiscal year 2022-23 compared to the corresponding periods of FY22. In terms of clinker production, the company recorded 710,650 metric tonnes in the third quarter of FY23, showing a decrease of 11.9% compared to 806,791 metric tonnes in the same period last year. Similarly, for the nine-month period, clinker production amounted to 2,137,260 metric tonnes, reflecting a decline of 12.1% from 2,432,667 metric tonnes the previous year.

Cement production also experienced a decrease, with 758,308 metric tonnes produced in the third quarter, representing a decline of 16.7% from 910,126 metric tonnes in the previous year. For the nine-month period, cement production amounted to 2,324,145 metric tonnes, showing a decline of 14.3% compared to 2,710,546 metric tonnes the previous year.

In terms of sales, Kohat Cement reported a decrease in both domestic and export sales. Domestic sales for the third quarter of this fiscal amounted to 761,731 metric tonnes, showing a decline of 17.7% compared to 925,866 metric tonnes in the same period last year. For the nine-month period, domestic sales reached 2,304,943 metric tonnes, reflecting a decrease of 15.4% from 2,723,090 metric tonnes the previous year.

Export sales, on the other hand, showed a significant increase. In the third quarter, export sales amounted to 9,435 metric tonnes, showing a substantial growth of 338.8% compared to 2,150 metric tonnes the previous year. For the nine-month period, export sales reached 10,554 metric tonnes, representing a significant increase of 127.9% from 4,630 metric tonnes the previous year.

Overall, KOHC’s total sales for the third quarter and nine months of FY23 experienced a decline. Total sales in the third quarter amounted to 771,166 metric tonnes, showing a decrease of 16.9% compared to 928,016 metric tonnes the previous year. For the nine-month period, total sales reached 2,315,497 metric tonnes, reflecting a decline of 15.1% from 2,727,720 metric tonnes the previous year.

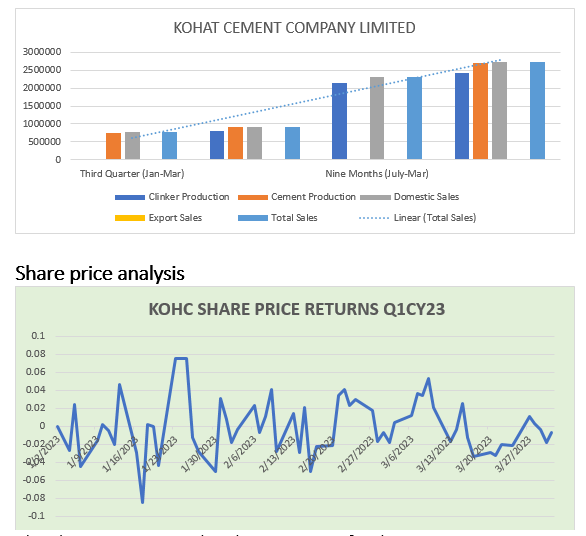

The data represents the share prices of Kohat Cement Company during the third quarter of FY23. The quarter started on a positive note, with the share price at 144. However, it dipped slightly in the following days, reaching a low of 135.12 on January 6, 2023. The share price continued to fluctuate throughout the quarter, with occasional rises and falls. On January 17, there was a significant drop in the share price, reaching a low of 120.77. However, the price recovered slightly over the next few days, hovering around the 120-125 range. Towards the end of January, there was an upward trend in the share price, reaching a peak of 143.81 on January 25.

However, the price dropped again, and by the end of the month, it stood at 135. In February, the share price remained relatively stable, fluctuating between 130 and 140. The highest point during this period was on February 24, when it reached 143. The month ended with a share price of 133. March witnessed increased volatility in the share price. On March 8, there was a significant surge, reaching 152. However, this surge was short-lived, and the price fluctuated between 140 and 160 for the rest of the month. By the end of March, the share price stood at 139. Overall, the share prices of Kohat Cement during the third quarter of FY23 experienced moderate volatility.

Credit: Independent News Pakistan-WealthPk