INP-WealthPk

Qudsia Bano

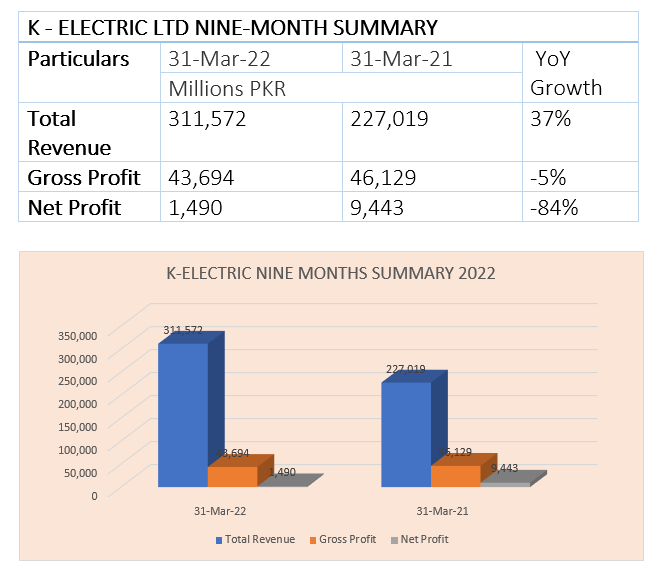

Karachi Electric (K-Electric) revenue climbed 37% to R311.6 billion in the first nine months of financial year 2021-22 compared to Rs227 billion in the corresponding period of fiscal 2020-21. The gross profit, however, registered a negative growth of 5% during the first three quarters of FY22 and stood at Rs43.7 billion compared to Rs46 billion in the corresponding period of FY21. Net profit likewise saw a drastic drop of 84%, plunging from Rs9.44 billion in the nine-month period of FY21 to Rs1.49 billion in the same period of FY22, due to severe devaluation of the Pakistani rupee against the US dollar and an increase in financing and effective borrowing rates, reports WealthPK.

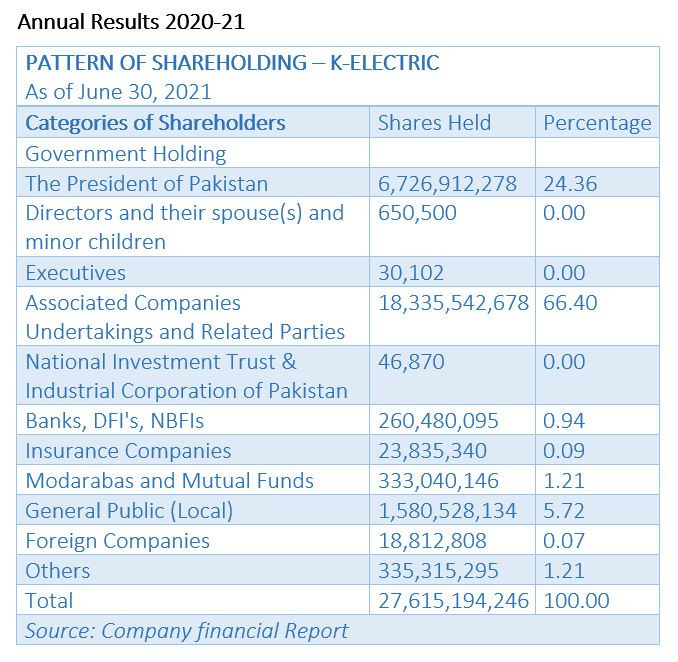

As of June 30, 2021, the President of Pakistan owned 24.36% shares of the K-Electric. Associated companies, undertakings and related parties owned 66.40% shares, banks, development financial institutions, and non-banking financial institutions owned 0.94% shares, insurance companies 0.09%, modarabas and mutual funds 1.21%, general public (local) 5.72% and ‘others’ owned 1.21% shares of the company, respectively.

Financial Performance in 2020-21

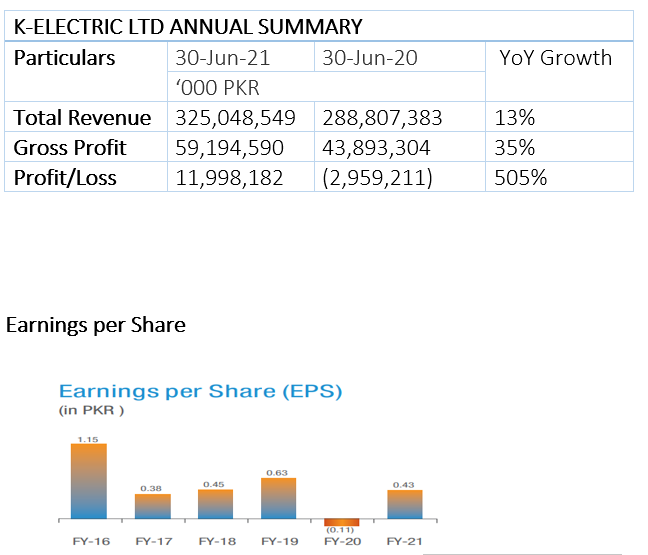

During the fiscal year 2020-21, the company generated net sales revenue of Rs325 billion, showing an increase of 13% over Rs288.8 billion in 2019-20. The gross profit for FY21 stood at Rs59.2 billion, 35% up from Rs43.9 billion in FY20. Profit-after-tax for FY21 was Rs12 billion, 505% up from a loss of Rs2.96 billion in FY20.

The earnings per share (EPS) in 2016 stood at Rs1.15, but fell to Rs0.38 in 2017. It slightly improved to Rs0.45 in 2018 and went up further to Rs0.63 in 2019. The EPS then steeply dropped to minus Rs0.11 in 2020. However, it recuperated and climbed to Rs0.43 in 2021.The company's primary business is the generation, transmission, and distribution of electric energy to industrial and other consumers in its permitted territories.

Credit: Independent News Pakistan-WealthPak