INP-WealthPk

Hifsa Raja

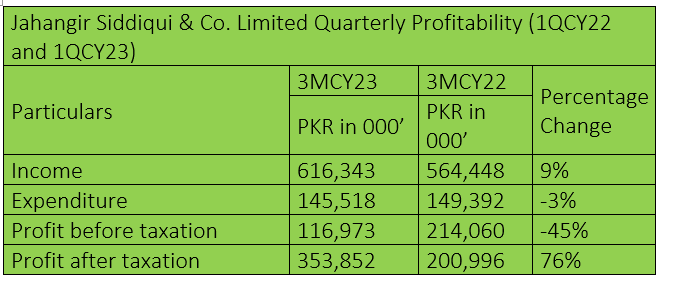

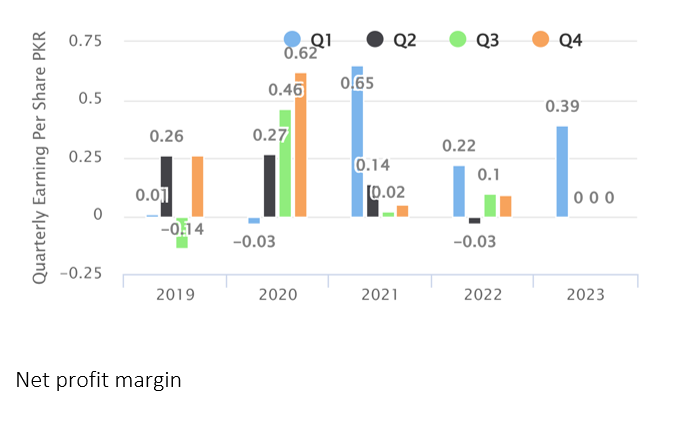

Jahangir Siddiqui & Co. Limited (JSCL) sales increased 9% to Rs616 million in the first three months of the ongoing calendar year 2023 (3MCY23) from Rs564 million over the corresponding period of the previous year. The company managed to decrease its expenditure by 3% to Rs145 million in 3MCY23 from Rs149 million in 3MCY22, indicating potential cost-saving measures implemented by it.

The most notable change can be observed in the profit-before-taxation, which declined 45% to Rs116 million from Rs214 million in 3MCY22. This shows reduction in profitability before accounting for taxes. On a positive note, the profit-after-taxation jumped 76% to Rs353 million in 3MCY23 from Rs200 million in 3MCY22, reports WealthPK.

![]()

Furthermore, the earnings per share (EPS) saw a significant improvement of 77% in 3MCY23 compared to 3MCY22. This indicates that the company's profitability per outstanding share has increased, which can be seen as a positive indicator for its shareholders.

Overall, the quarterly profitability analysis suggests a mixed performance. While the company experienced growth in income and significant improvement in net profit, the decline in pre-tax profit highlights challenges impacting the company's overall profitability.

CY22 compared with CY21 Top of Form

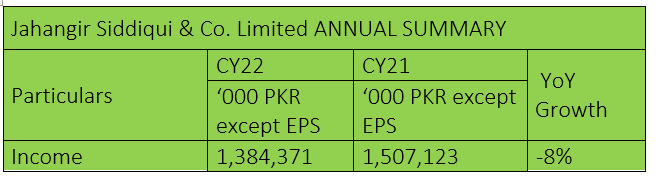

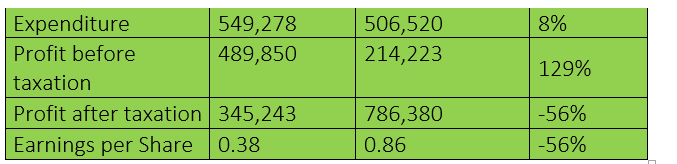

JSCL experienced an 8% decline in income, which stood at Rs1.3 billion in CY22 compared to Rs1.5 billion in FY21. One notable aspect was an increase in the expenditure during CY22. Despite this, the company managed to achieve a 129% growth in profit-before-tax, which stood at Rs489 million in CY22, as compared to the previous year's pre-tax profit of Rs214 million.

The profit-after-tax for CY22 witnessed a decline, with a recorded figure of Rs345 million compared to Rs786 million in CY21, reflecting a decrease of 56%. These financial results highlight the mixed performance of the company, with a decrease in income but an increase in profit-before-taxation.

In conclusion, JSCL's annual summary depicts a mixed performance. While the company achieved significant growth in before-tax profit, the decline in after-tax profit raises concerns regarding the company's overall financial health. It will be crucial for the company's management to assess and address the factors contributing to the decline in profitability, implement appropriate strategies, and focus on sustainable growth in future.

Though the corporation saw significant sales growth in 2021, it had trouble sustaining profitability in the following year. In order to develop effective plans for long-term growth and increased profitability, the management must evaluate the elements causing these changes, such as market circumstances, operational effectiveness, and cost management.

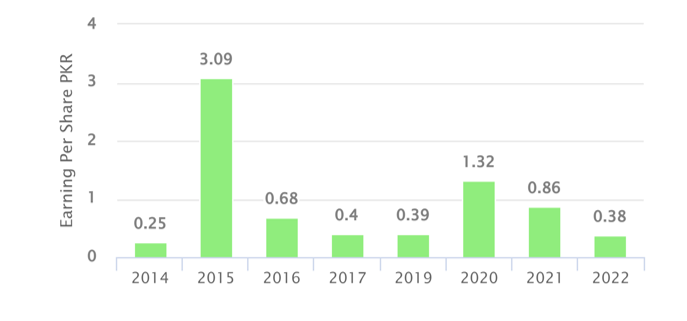

Earnings Per Share

Over the past few years, the earnings per share (EPS) of the company have shown varying trends. In 2015, the EPS surged to Rs3.09, which has been the highest till date. The EPS in 2019 stood at Rs0.39, but it had a considerable increase in EPS in 2020 at Rs1.32. This increase showed higher profitability and more earnings produced for each outstanding share.

But in 2021, the trend changed, and EPS dropped to Rs0.86, signifying a drop in per-share profitability. In 2022, the company earned an EPS of Rs0.38, suggesting a continued decline in profitability per share. The company's management should closely examine the factors contributing to fluctuations in EPS, including revenue growth, cost management, and overall financial performance, to devise strategies for improving profitability and enhancing shareholder value in the future.

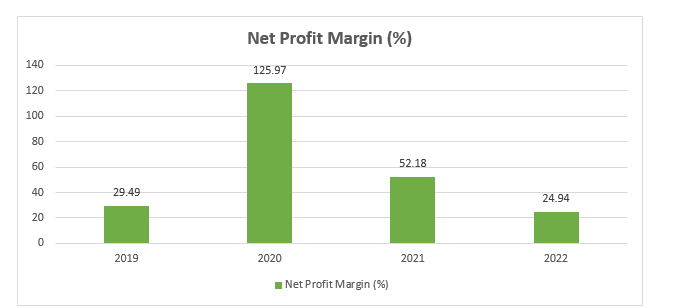

The company's net profit margin was strong in 2020 at 125.97%, which plunged to 52.18% in 2021, and further to 24.94% in 2022.

The fluctuating net profit margin suggests the presence of both positive and negative factors impacting the company's profitability over the analysed period. It is essential for the company to closely monitor its financial performance, identify any challenges or inefficiencies, and implement appropriate measures to improve profitability.

Efforts to streamline operations, optimise costs and explore new business opportunities will be crucial for JSCL to enhance its financial performance and ensure sustained profitability in the competitive market. By addressing the underlying factors affecting the net profit margin, the company can strengthen its position, attract investors and maintain long-term growth.

Industry comparison

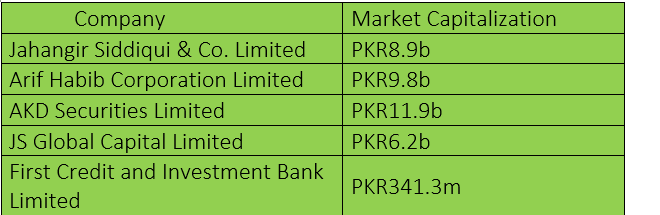

Arif Habib Corporation Limited, AKD Securities Limited, JS Global Capital Limited and First Credit and Investment Bank Limited are regarded as rivals of JSCL in terms of market capitalisation. AKD Securities Limited has the largest market capitalisation of Rs11.9 billion, followed by Arif Habib Corporation Limited’s Rs9.8 billion. First Credit and Investment Bank Limited has the lowest market cap of Rs341 million.

The market value of JSCL is Rs8.9 billion.

Company profile

JSCL is an investment holding company. Its segments include capital market and brokerage, banking, investment adviser/assets manager, energy infrastructure and petroleum, and others. The capital market and brokerage segment deals in trading of equity securities, maintaining and trading portfolios and earning share brokerage and money market, forex and commodity brokerage, advisory, underwriting, book-running and consultancy services.

The banking segment is to provide investment and commercial banking. The investment adviser/assets manager segment provides investment advisory and asset management services to different mutual funds and unit trusts. The energy infrastructure and petroleum segment is to invest in the oil marketing sector and storage of petroleum, LPG and allied products. The other segment includes telecommunication, media and information technology, underwriting, and consultancy services.

Credit : Independent News Pakistan-WealthPk