INP-WealthPk

By Jawad Ahmed

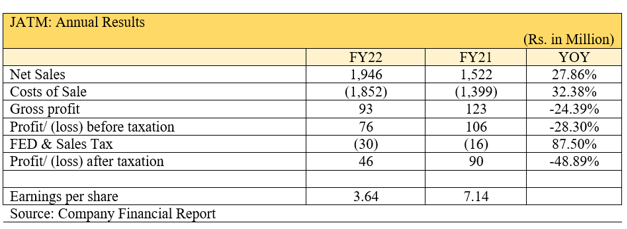

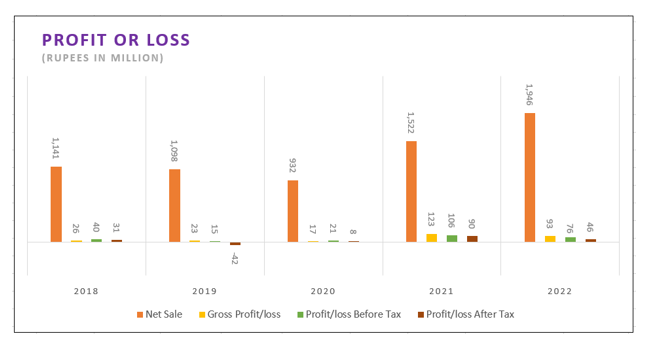

ISLAMABAD, Nov 10 (INP-WealthPK): The net sales of JA Textile Mills Limited rose from Rs1.52 billion in the fiscal year that ended on June 30, 2021 to Rs1.94 billion in the fiscal year that closed on June 30, 2022, registering a 27.8% growth year-on-year.

The sales revenues remained healthy in FY22, but the financial issues persisted for the company as a result of a rise in sales costs and tax obligations, reports WealthPK citing the company’s financial data. The company was established as a public-limited firm in Pakistan in 1987. The principal activity of the company is manufacturing and sale of yarn.

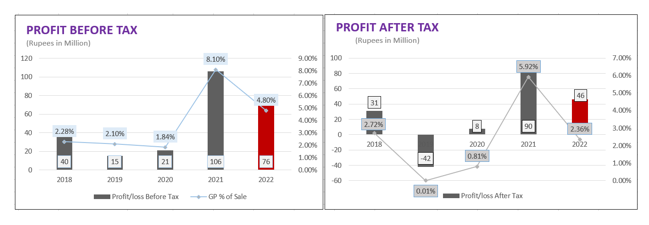

Due to an increase in production costs, the gross profit dropped 24.3% from Rs123 million in FY21 to Rs93 million in FY22. The company registered Rs106 million profit-before-tax in FY21, but the profit dragged down to Rs76 million in FY22, showing a 28.3% negative growth.

The after-tax income also decreased by 48.8% from Rs90 million in FY21 to Rs46 million in FY22. The earnings per share (EPS) fell sharply from Rs7.14 in FY21 to Rs3.64 in FY22 as a result of decline in profitability.

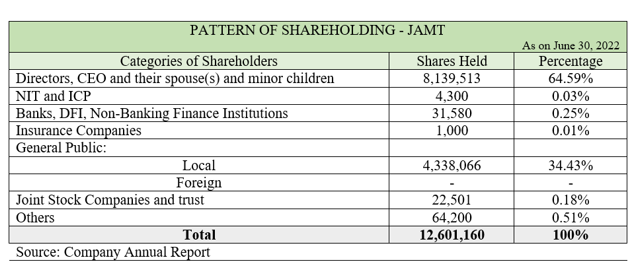

Shareholding pattern

As of June 30, 2022, the company’s directors, the chief executive officer, their spouses and minor children owned 64.59% of the shares. Local investors owned 34.43% of the shares. Banks, DFIs, NBFIs, insurance companies, modarabas and joint stock companies held a negligible number of shares.

Company’s performance over the years

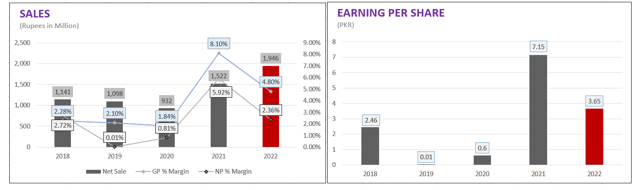

In 2019, sales revenues for the company slightly decreased to Rs1.09 billion from Rs1.14 billion in 2018. The company's gross profit also decreased 13% to Rs23 million from Rs26 million in 2018. Compared to a profit-after-tax of Rs31 million in 2018, the company saw a loss-after-tax of Rs42 million in 2019.

In 2020, the company's revenues fell further 15% to Rs932 million from Rs1.09 billion the year before. The gross profit drastically decreased, going down from Rs23 million in 2019 to Rs17 million in 2020. In contrast to a loss of Rs42 million in 2019, the company reported a net profit of Rs8 million in 2020.

The EPS grew from Rs0.01 to Rs0.6.

In 2021, due to a rise in demand, the company's top line substantially improved to Rs1.52 billion from Rs932 million in 2020.

The increase in gross profit from Rs17 million in 2020 to Rs123 million in 2021 was mostly due to rising demand and the economic recovery following the easing of the Covid-19-induced restrictions.

Additionally, the net profit also took a big stride to Rs90 million from paltry Rs8 million in 2020.As a result, the EPS rose from Rs0.6 the year before to Rs7.15 in 2021.

Credit : Independent News Pakistan-WealthPk