INP-WealthPk

Hifsa Raja

Industries with low share prices such as cement and steel are likely to offer investors capital gains of 30-40% once the economic conditions improve. Besides, the export-oriented textile sector also offers healthy investment opportunities, said Muhammad Waheed, the equity manager at Networth Securities Private Limited, during an interview with WealthPK.

WealthPK: What particular sector should the investor pick for investment?

Muhammad Waheed: Investment in the textile sector can fetch handy profits. The reason is that the high exchange rates have squeezed the local demand, but the foreign demand for goods remains robust, thus attracting investment to this industry. The domestic political unrest is less of an issue for the textile businesses with global contracts.

WealthPK: Why is the textile industry keener to meet overseas demand than local demand?

Muhammad Waheed: The increase in the exchange rate has driven up the cost of raw materials for the textile businesses. Therefore, the companies will suffer if they satisfy the local demand for goods made out of pricey raw material. The textile industry looks for international contracts that pay top prices for their goods in order to make up for the costly raw material.

WealthPK: Which companies one has to pick from the textile sector for investment?

Muhammad Waheed: An investor has to consider Nishat Mills, which is reporting earnings of Rs29.33 per share. With a high earning return of Rs31.10, Nishat Chunian Limited is also a terrific alternative in the textile sector. Interloop Limited is also a good investment opportunity.

WealthPK: Will the early elections bring any stability to the country’s economic situation?

Muhammad Waheed: The prevailing uncertainty will definitely go away if early elections are called as a new government with clear mandate will preside over the economy well. The current political unrest is to blame for the extremely low share values. Share prices are anticipated to increase by 30-40% after the elections are held.

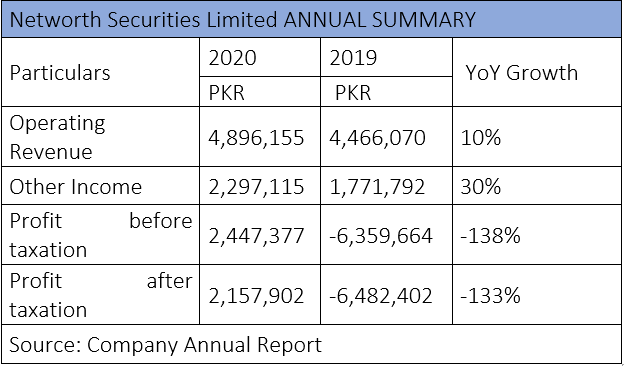

Annual performance

During the fiscal year 2020-21, the company generated revenue of Rs4.89 million, up 10% from Rs4.46 million in fiscal 2019-20. The company’s other income stood at Rs2.2 million in FY21, up 30% from Rs1.7 million in FY20. The before-tax profit stood at Rs2.4 million in FY21 as the company recovered from a before-tax loss of Rs6.3 million in FY20, showing a 138% decline in loss. Similarly, the company posted the after-tax profit of Rs2.1 million in FY21, again recovering from the after-tax loss of Rs6.4 million in FY20, showing a 133% decrease in loss.

Company profile

Networth Securities Private Limited is a successful brokerage firm providing services to institutional and individual clients. Muhammad Waheed, the equity manager, said, “we aim to achieve our goal through personalised service, efficiency and integrity. Interests of our clients always come first and we place the client’s concerns ahead of our own in each and every transaction as we are dedicated to the development of long-term client relationships. Our team-approach philosophy ensures a client’s needs are important to each and every member of our organisation.”

Credit : Independent News Pakistan-WealthPk