INP-WealthPk

By Hifsa Raja

Pakistan’s cement sector, which is currently witnessing rather slow growth, offers much attraction to the investors believing in the notion that investments will likely fetch notable profits if made at a time when the market is low.

This was pointed out by Muhammad Faraz, Manager of General Investment & Securities (GIS).

“When the market is actively trading there is no point entering it as it has already reacted, making it difficult for an investor to get a foothold,” said Muhammad Faraz, during an interview with WealthPK.

He said investors need to buy shares of DG Khan Cement Company (DGKCC) as the company intends to invest Rs900 million in Hyundai Nishat Pakistan in exchange for shares.

Q: Should an investor invest in dividend-only shares or participate in short-term trading keeping in view the market’s current situation?

A: The market has witnessed a decline of 14% over the previous year due to elevated interest rates, burgeoning inflation and political noise. Due to the current volatile climate, short-term trading in the market is not advisable at this time.

An investor ought to buy shares that pay dividends at the end of year and refrain from engaging in frequent short-term trading. Even if the share price doesn't rise, the dividend gives you a profit of Rs4-5 a share every three months.

Q: What is your advice to a new investor?

A: The investors should shun the tendency of getting rich overnight. As a new investor, you should come up with a long-term investment strategy, and should preferably invest in shares giving regular dividends. Selection of a good company is also necessary. The investors should look for trending industries for investment like oil and gas and renewable energy.

The consumer staples sector is also attractive as its projected annual earnings growth is 42% over the next five years.

Q: How has market reacted to the news of Pakistan’s exit from the Financial Action Task Force’s grey list?

A: The development did not have that much impact on the market as the political divisions have cast a gloom on the performance of the market. The market did not see any major upsurge in its points after the development.

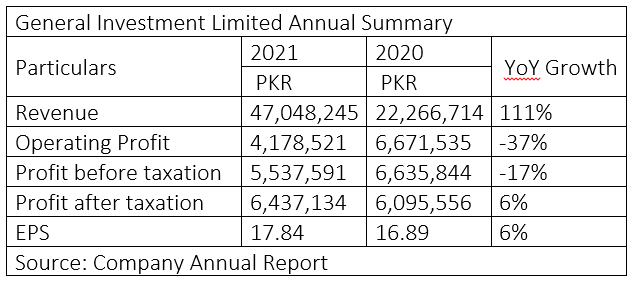

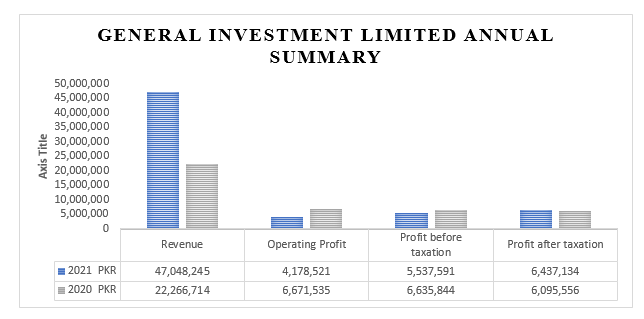

Financial Performance in 2020-21

During the fiscal year 2020-21, the company’s revenue was Rs47 million over Rs22 million in 2019-20, registering an increase of 111%.

The company’s operating profit declined 37% to Rs4 million in FY21 from Rs6 million in FY20.

The before-tax profit also dropped 17% to Rs5.5 million in FY21 from Rs6.6 million in FY20.

The after-tax profit, however, inched up to Rs6.4 million in FY21 from Rs6 million in FY20, registering an increase of 6%.

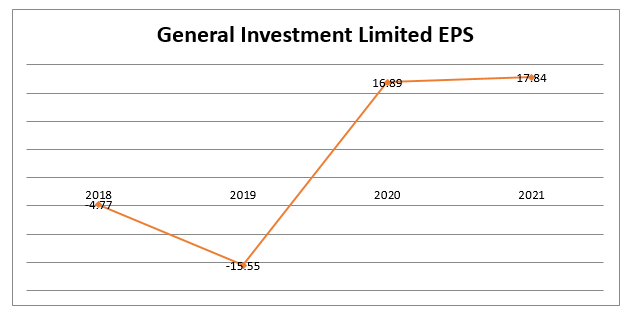

Earnings per Share

The earnings per share witnessed a negative trend during 2018 and 2019. However, the EPS made hefty gains and surged to Rs16.89 in 2020 and to Rs17.84 in 2021.

General Investment & Securities has been engaged in providing brokerage and corporate finance services to a large number of institutional, corporate, and high-net-worth individuals and retail clients since 2002.

Credit : Independent News Pakistan-WealthPk