INP-WealthPk

Qudsia Bano

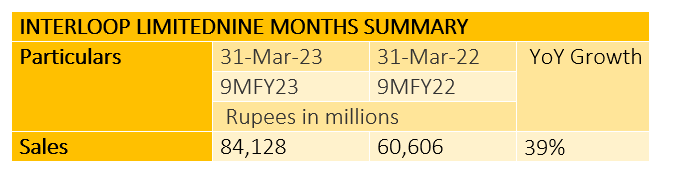

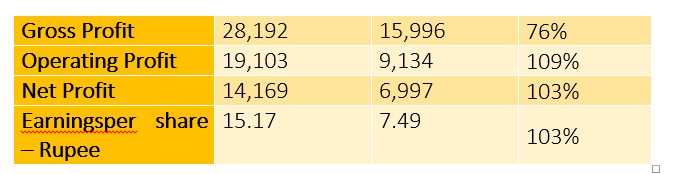

Interloop Limited, a leading textile manufacturing company, has delivered exceptional performance and maintained steady operations, surpassing expectations in the first nine months of the just-ended fiscal year 2022-23 (FY23). Overcoming various obstacles such as rising raw cotton prices, increased RLNG rates, gas supply shutdowns, disruptions in the global supply chain, higher interest rates, and economic inflation, the company has demonstrated effective strategic planning and efficient resource management. During the nine months period, Interloop Limited experienced a significant increase in revenue and profits, reflecting the company's commitment to innovation, customer satisfaction, and operational effectiveness. Sales witnessed a remarkable surge of 39%, reaching Rs84 billion compared to Rs60 billion in the corresponding period of FY22.

Despite a 25% rise in the cost of sales, from Rs44 billion to Rs55 billion, Interloop achieved an impressive 76% growth in gross profit, amounting to Rs28 billion. This substantial increase highlights the company's ability to efficiently manage costs and optimise profitability. Operating profits also witnessed robust growth, rising from Rs9 billion to Rs19 billion, showcasing the effectiveness of the company’s business strategy. Moreover, the company achieved a remarkable 103% increase in net profit, with a total of Rs14 billion compared to Rs6 billion in the corresponding period of FY22. This notable performance translated into a 103% increase in earnings per share (EPS), reaching Rs15.17 compared to Rs7.49 in the same period of FY22. As an export-oriented entity, Interloop Limited benefited from the depreciation of the Pakistani rupee against the US dollar, resulting in a gain of Rs8 billion during the first nine months of FY23 compared to Rs2.6 billion in the corresponding period of FY22.

This currency advantage further contributed to the company's overall financial success. Interloop Limited's remarkable financial results demonstrate its commitment to generating value for shareholders and its confidence in the long-term sustainability of the business. By focusing on innovation, customer satisfaction, and operational efficiency, the company has achieved significant growth amidst challenging market conditions. Interloop Limited's ability to navigate obstacles and deliver exceptional financial performance underscores its position as a leader in the textile manufacturing industry. With its continued strategic approach, the company is well-positioned to seize future opportunities and maintain its upward trajectory in the market.

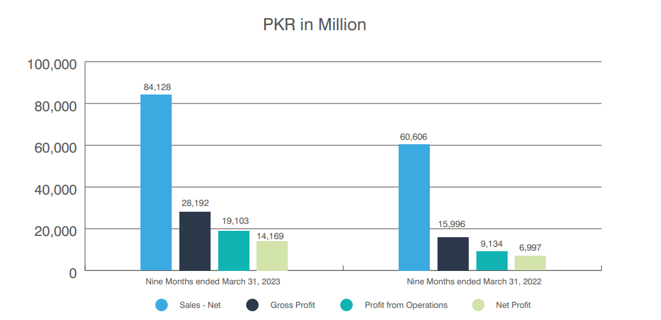

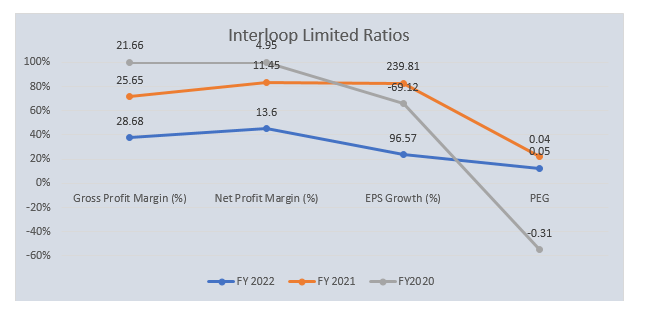

The historical ratios of Interloop Limited provide valuable insights into the company's financial performance and growth trends over the past three fiscal years (FY20, FY21 and FY22).

The gross profit margin indicates the percentage of revenue that a company retains after deducting the cost of goods sold (COGS). A higher gross profit margin suggests that the company is efficiently managing its production costs. Over the three years, Interloop Limited has shown a consistent improvement in its gross profit margin, rising from 21.66% in FY20 to 28.68% in FY22. This upward trend indicates that the company has been able to control its production expenses and generate more revenue from each sale, which is a positive sign for its financial health and operational efficiency.

The net profit margin measures the percentage of revenue that remains as profit after deducting all expenses, including COGS, operating expenses, interest and taxes. A higher net profit margin indicates better profitability and effective cost management. Interloop Limited has displayed a consistent growth in its net profit margin over the three-year period, increasing from 4.95% in FY20 to 13.60% in FY22. This significant improvement reflects the company's ability to control costs, boost operational efficiency, and generate higher profits from its business activities.

EPS growth represents the percentage increase or decrease in the company's earnings per outstanding share of common stock. It is a key indicator of a company's profitability and the value it delivers to its shareholders. Interloop Limited achieved astounding EPS growth of 239.81% in FY21, but it slowed down to 96.57% in FY22. The decline may be attributed to a higher base effect from the extraordinary growth in the previous year. Nonetheless, the company has maintained a positive growth trajectory in its earnings, which is a positive sign for investors.

The PEG ratio assesses the relationship between a company's price/earnings (P/E) ratio and its earnings growth rate. A PEG ratio below 1 suggests that the stock may be undervalued relative to its earnings growth potential. Interloop Limited's PEG ratios have been consistently low over the three-year period. The PEG ratios of 0.05, 0.04 and (0.31) in FY22, FY21 and FY20, respectively, indicate that the company's earnings growth has outpaced its valuation, making it an attractive investment option in the eyes of investors.

About the company

Interloop Limited was incorporated in Pakistan on 25th April, 1992, and publicly listed on the Pakistan Stock Exchange on 5th April, 2019. Interloop is a vertically integrated multi-category full family clothing company, manufacturing hosiery, denim, knitted apparel, and seamless active-wear for top international brands and retailers, besides producing yarn for a range of textile customers. Interloop’s commitment to environmental, social responsibility and governance is deeply rooted in its mission and has gained it global recognition as a pioneer in responsible manufacturing. Interloop’s diverse and engaged workforce and operational excellence have made it a partner of choice for its customers.

Credit: INP-WealthPk