INP-WealthPk

Fakiha Tariq

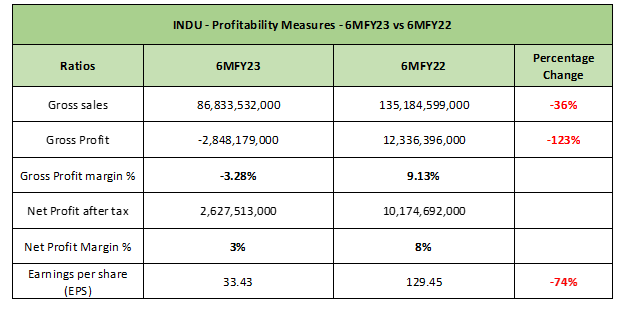

Indus Motor Company Limited (INDU) recorded a massive revenue decline of 36% to Rs86 billion in the first half of fiscal year 2022-23 compared to Rs135 billion posted in the same period of FY22, reports WealthPK. Listed on the Pakistan Stock Exchange as INDU, the company is traded under the automobile assembler sector.

INDU is the largest company listed in the automobile assembler sector with a market capitalisation of Rs67.7 billion. INDU, also known as Toyota Indus, is a joint venture between Toyota Motor Corporation (TMC), Toyota Tsushu (TTC) of Japan and House of Habib from Pakistan. Following a declining trend in financial performance, INDU underwent a gross profit decrease of 123% compared to the corresponding period of the last fiscal. INDU posted a gross loss of Rs2.8 billion compared to a gross profit of Rs12 billion earned in 1HFY22.

INDU’s net profit also plunged to Rs2.6 billion in 1HFY23 from Rs10 billion in 1HFY22. The automaker posted gross loss and net profit ratios of -3.28% and 3%, respectively, during the period. The earnings per share value dropped to Rs33.43 in 1HFY23 from Rs129.45 reported in 1HFY22.

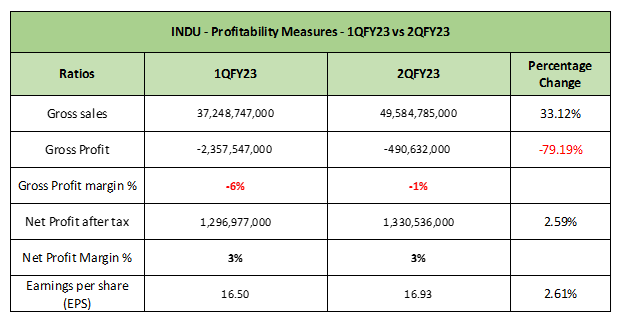

Indus Motor – Quarterly Profitability – 1HFY23

A quarterly review of INDU’s financial performance revealed that the company increased revenues, net profit and EPS values by 33%, 2.5% and 2.6%, respectively, in the second quarter (Oct-Dec) of FY23 compared to the first quarter (July-Sept) of FY23. INDU sustained a gross loss of Rs2.3 billion on the sales of Rs37 billion in the first quarter (July-Sept) of FY23. However, the company reported a net profit of Rs1.2 billion in 1QFY23. INDU’s gross loss ratio remained -6% and net profit ratio came out to be 3% in 1QFY23. The company’s EPS value was reported to be Rs16.50 in 1QFY23.

However, in the second quarter (Oct-Dec) of FY23, INDU’s sales increased by 33% to Rs49 billion in comparison to the first quarter of FY23. The company reported a gross loss of Rs490 million and net profit of Rs1.3 billion in this quarter. INDU reported a gross loss ratio of -1% and a net profit ratio of 3% in 2QFY23. The company’s EPS value was reported to be Rs16.93 in this quarter.

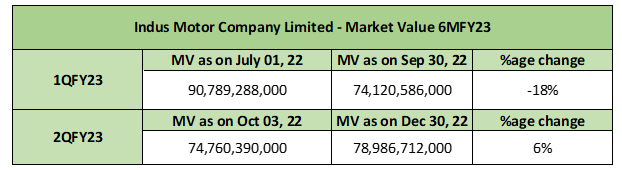

Indus Motor – Market Value Review – 1HFY23

In the first six months of FY23, Indus Motor Company lost overall 13% of its market value from Rs90 billion to Rs78 billion.

In the first quarter of FY23, INDU’s market value dropped from Rs90 billion to Rs74 billion, showing a MV loss of 18%. However, the company bounced back in the next or second quarter of FY23 and gained 6% of its market value. In 2QFY23, INDU boosted its market value from Rs74 billion to Rs78 billion.

Credit: Independent News Pakistan-WealthPk