INP-WealthPk

Irfan Ahmed

The consumer price index (CPI), a wide-ranging measure of goods and services prices, increased by 24.9% in July 2022 compared to the corresponding month of the last year, reported WealthPK.

According to Pakistan Bureau of Statistics (PBS), inflation remained high for the month of July 2022, and headline inflation was at 24.9% on year-over-year basis (13-year high), compared to 8.4% in July 2021.

By Irfan Ahmed

ISLAMABAD, Aug 3 (INP-WealthPK): The consumer price index (CPI), a wide-ranging measure of goods and services prices, increased by 24.9% in July 2022 compared to the corresponding month of the last year, reported WealthPK.

According to Pakistan Bureau of Statistics (PBS), inflation remained high for the month of July 2022, and headline inflation was at 24.9% on year-over-year basis (13-year high), compared to 8.4% in July 2021.

On month-over-month (MoM) basis, the CPI reading increased by 4.3%. The MoM inflation remained under pressure mainly on the back of a surge in prices of transport, housing and food items. Increase in petroleum products prices is also among the main contributors to inflation.

The food index was up 3.1% on MoM basis in July 2022.

According to economic experts, Pakistan's headline inflation climbed in July as a result of higher transport and food prices, despite the fact that the nation is edging closer to receiving a bailout from the International Monetary Fund.

Meanwhile, the CPI urban inflation increased by 23.6% on YoY basis in July 2022 as compared to an increase of 8.7% in July 2021.

Similarly, on MoM basis, inflation increased by 4.5% in July 2022 as compared to 6.2% in the previous month.

The CPI rural inflation increased by 26.9% on YoY basis in July 2022 as compared to 8% in July 2021. On MOM basis, it increased by 4.2% in July 2022 as compared to 6.6% in the previous month.

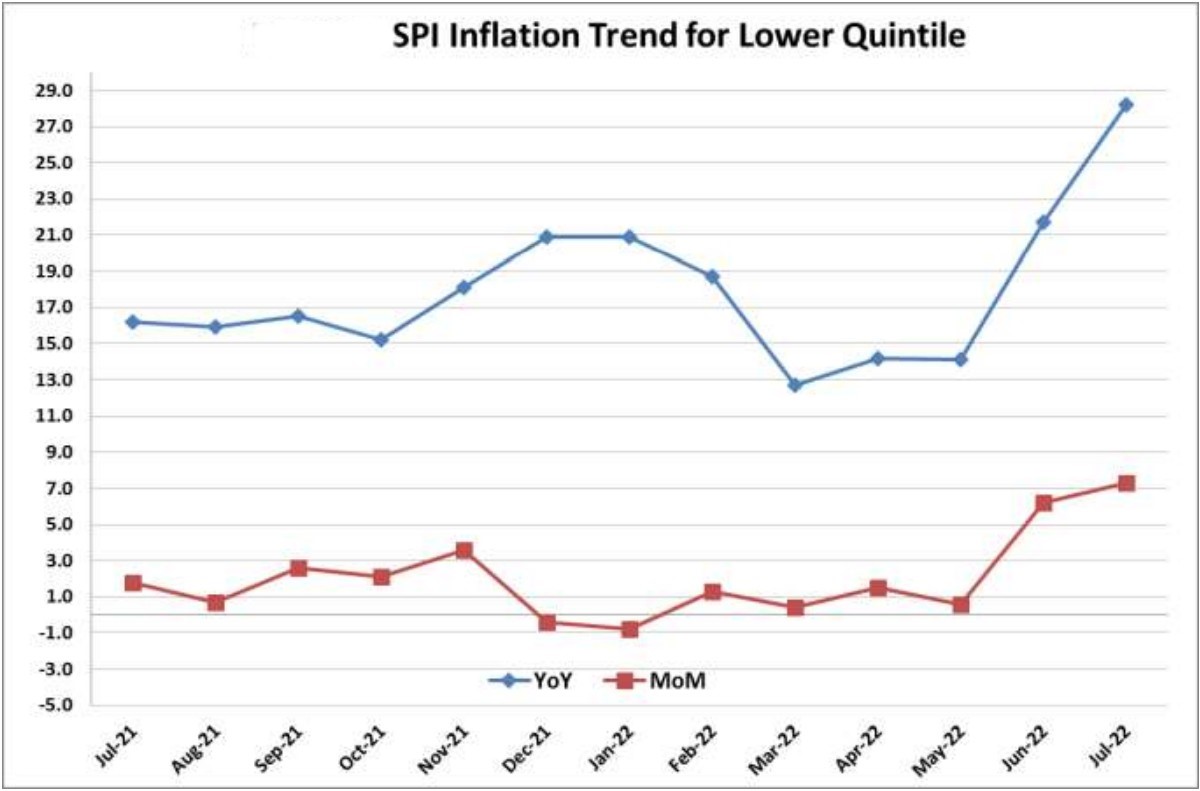

The sensitive price indicator (SPI) inflation on YoY basis increased by 28.2% in July 2022 as compared to increase of 16.2% in July 2021. On MoM basis, it increased by 7.3% in July 2022 as compared to 6.2% a month earlier.

As per the SPI data published by the PBS, an increase in average prices of potatoes, pulses, onions, and cooking oil are expected to continue the higher trend of inflation. Moreover, on the back of quarterly house rent adjustment, higher electricity charges and increase in construction cost, housing index too is likely to remain on higher side on MoM basis.

According to Finance Minister Miftah Ismail, the rise in domestic food prices and depreciation of the rupee contributed to the high inflation rate in July 22.

Source: Pakistan Bureau of Statistics

The wholesale price index (WPI) inflation on YoY basis increased by 38.5% in July 2022 as compared to 17.3% in July 2021. The WPI inflation on MoM basis increased by 2% in July 2022 as compared to 8.2% a month earlier.

Given the recent developments on the fiscal front including the rollback of the subsidy on petroleum products along with hike in electricity prices, headline inflation is expected to remain elevated in the coming months. It is likely to remain in the double-digits in August 2022 as well, averaging over 18% in FY23 along with an increase in core inflation. Moreover, in the monetary policy meeting held on July 7, 2022, the State Bank of Pakistan (SBP) increased the benchmark policy rate by 125bps to 15% (the highest since March 1999).

Moreover, rates on Export Finance Scheme (EFS) and Long-Term Financing Facility (LTFF) loans were linked to the policy rate, at a 500bps discount though (to 10%), so as to continue incentivizing exports while ensuring monetary tightening effectively.

Pakistan is hoping for controlling inflation and strengthening the PKR once the IMF program is revived.

Independent News Pakistan-Wealthpk