INP-WealthPk

Hifsa Raja

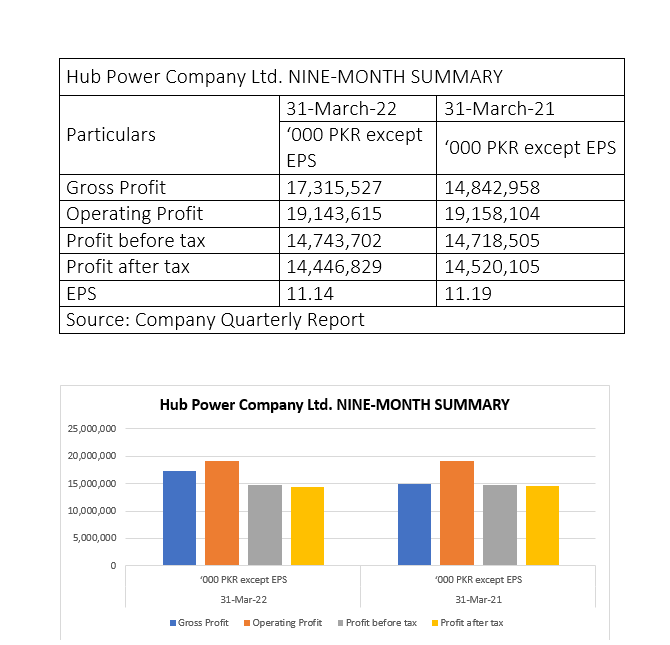

The gross profit of Hub Power Company Limited (HUBC) climbed 17% to Rs17.31 billion in the first nine months of the previous financial year 2021-22 (9MFY22) compared with Rs14.84 billion over the corresponding period of the fiscal 2020-21.The operating profit nominally decreased to Rs19.14 billion from Rs19.15 billion in 9MFY21.

Similarly, profit-before-taxation in 9MFY22 also inched up to Rs14.74 billion from Rs14.71 billion over the same period of FY21.

The profit-after-taxation during the 9MFY22 slightly dropped to Rs14.44 billion from Rs14.52 billion over the corresponding period of FY21.

The earnings per share (EPS) settled at Rs11.14 in 9MFY22, slightly down from Rs11.19 in 9MFY21, reports WealthPK.

Shareholdin

PATTOLDING – Hub Power Company Ltd. As oune 30, 2021

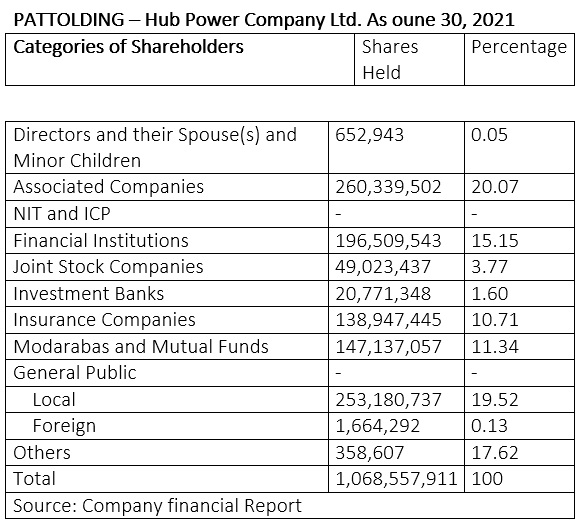

As of June 30, 2021, directors, their spouse(s) and minor children owned 0.05% of the shares of the company, associated companies 20.07%, financial institutions 15.15%, joint stock companies 3.77%, investment banks 1.60%, insurance companies 10.71%, modarabas and mutual funds 11.34%, general public (local) 19.52% and ‘others’ 17.62%, respectively.

Financial Performance

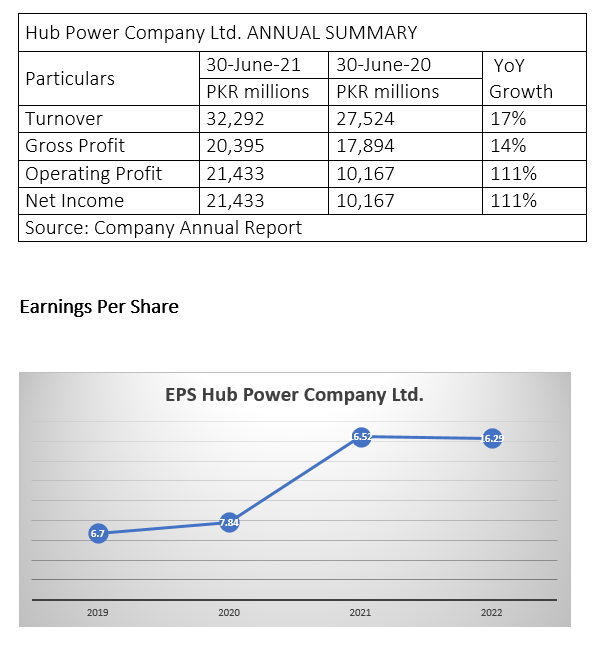

During the fiscal year 2020-21, the company generated turnover of Rs32.29 billion over Rs27.52 billion in 2019-20, registering an increase of 17%. The gross profit for FY21 was Rs20.39 billion, up 14% from Rs17.89 billion, in FY20. Operating profit for FY21 was Rs21.43 billion compared to Rs10.16 billion in FY20, posting an increase of 111%. Net income for FY21 was Rs21.43 billion, as compared to Rs10.16 billion in FY20, posting an increase of 111%.

The EPS in 2019 stood at Rs6.7, which inched up to Rs7.84 in 2020 before taking a big flight to Rs16.52 in 2021 and staying almost flat at Rs16.29 in 2022.

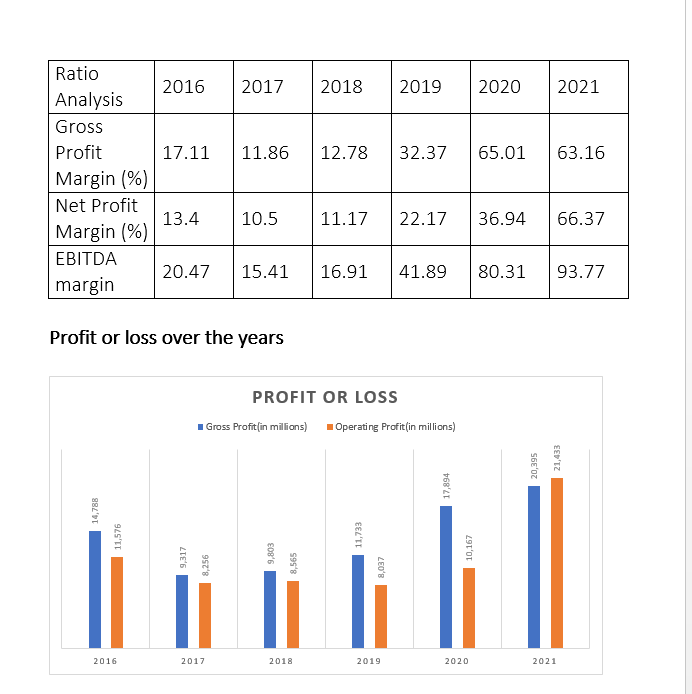

Ratio Analysis

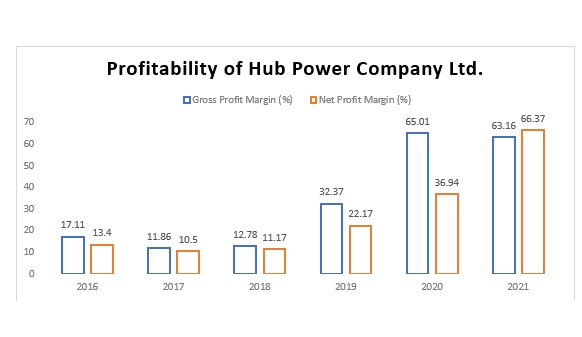

In 2016, the company’s gross profit margin reached 17.11% with a net profit standing at 13.4%. Both the gross and net profits remained low in 2017 and 2018. Then in 2019, the gross and net profit margins rose up to 32.37% and 22.17%, respectively. In 2020, the gross profit margin ballooned to 65.01%, whereas the net profit margin shot up to 36.94%. The gross profit margin in 2021 slightly dropped to 63.16%, but the net profit margin further shot up to 66.37% during the year.

The EBITDA (earnings before interest, taxes, depreciation and amortisation) showed higher margins in 2019 and 2020. EBITDA further increased in 2021.

Profitability – gross and operating – remained high in 2020 compared to 2019. The profitability increased further in 2021. The Hub Power Company Limited was incorporated in Pakistan on August 1, 1991 as a public limited company. The company owns an oil-fired power station of 1,200MW in Balochistan.

Credit : Independent News Pakistan-WealthPk