INP-WealthPk

Fakiha Tariq

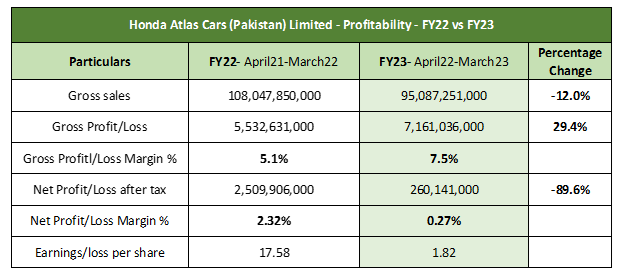

The net profit of Honda Altas Cars Limited (HCAR) plunged by 89.6% to Rs260 million in the April 2022-March 2023 period from Rs2.50 billion posted over the same period a year ago, WealthPK reports. HCAR’s fiscal year runs from April to March. HCAR ended the FY23 with gross sales of Rs95 billion. The company posted a gross profit of Rs7.16 billion on it, thus achieving a yearly gross profit ratio of 7.5%. The company posted a net profit of mere Rs260 million and a net profit ratio of 0.27% in FY23. HCAR ended FY23 with earnings per share of Rs1.82 for its shareholders.

In comparison to fiscal 2022, the automobile assembler’s revenues dropped by 12% from Rs108 billion to Rs95 billion in FY23. The company posted an increase of 29.4% in gross profit. HCAR’s earnings per share dropped steeply to Rs1.82 from Rs17.58 by the end of FY22. Listed on Pakistan Stock Exchange (PSX) with the symbol of ‘HCAR’, the company is the fifth-largest firm in the automobile assembler sector with a market capitalisation of Rs13.4 billion.

Financial Analysis – FY13-FY23

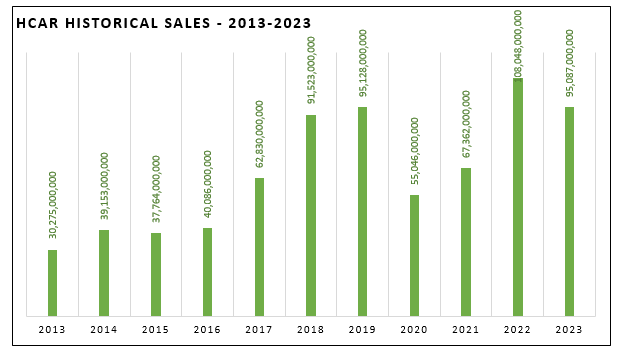

In the last 10 fiscal years (2013-2023), HCAR underwent two dips in revenue collection with the second drop occurring in FY23. Continuously increasing its sales from Rs30.2 billion in FY13, HCAR achieved the second-highest 10-year sales in FY19 at Rs95.1 billion. The company experienced the first dip in sales in FY20 at Rs55 billion. From then onwards, HCAR kept raising its sales, peaking in FY22 when its sales stood at Rs108 billion. The company then exhibited its second revenue dip of 12% from 2022 to 2023.

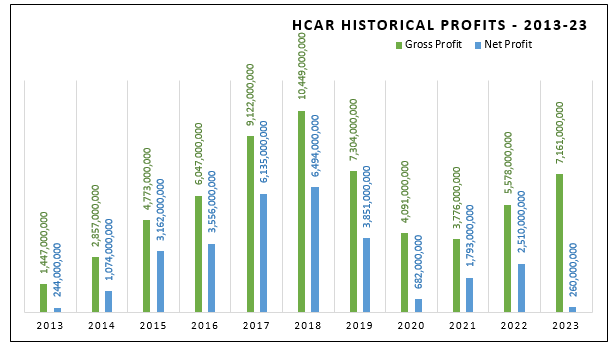

In terms of gross profitability, the auto assembler hit peak gross profit of Rs10.44 billion in FY18. From 2013 to 2018, HCAR kept increasing its gross profit. From 2018 onwards, the company’s gross profit saw gradual decline and reached the low of Rs3.77 billion in FY21.

However, the firm started recouping the decline and earned a gross profit of Rs7.16 billion in FY23. In terms of net profits, the company followed uneven trends with two prominent dips. From 2013 to 2018, HCAR’s net profit kept increasing from Rs244 million to the highest 10-year amount of Rs6.49 billion in FY18. In the next two years (2019 and 2020), the company’s net profit kept dropping, reaching Rs682 million in 2020. The company’s net profits got boosted in 2021 and 2022. However, in FY23, HCAR experienced another drastic depression in net profitability.

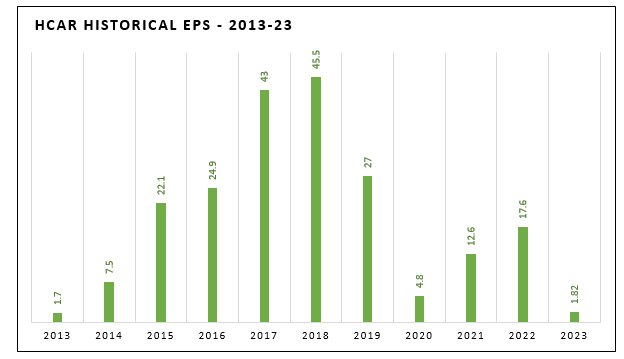

In the last 10 years, the company posted the highest earnings per share of Rs45.5 in FY18. HCAR’s EPS value also showed two depressions from 2013 to 2023. The first EPS dip was seen from 2018 to 2019, where EPS value declined from Rs45.5 to Rs27. The second EPS dip was observed from 2022 to 2023, when EPS dropped from Rs17.6 to Rs1.82.

Credit: Independent News Pakistan-INP