INP-WealthPk

Jawad Ahmed

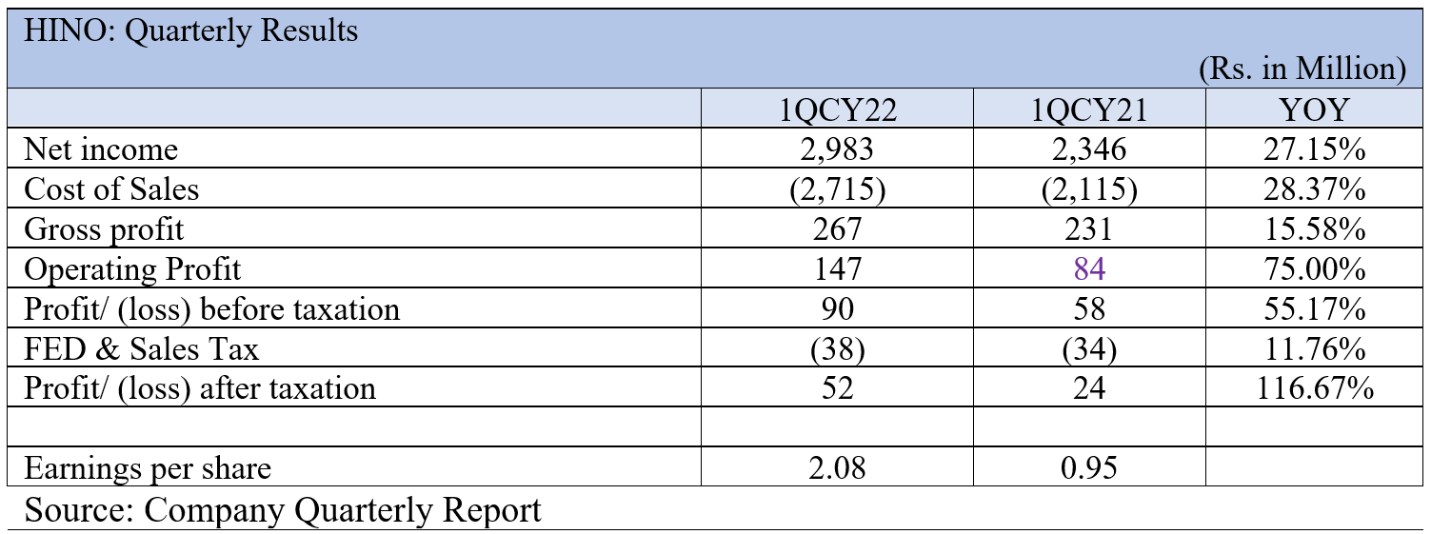

The sales of Hinopak Motors Limited increased by 26.8% to Rs2.98 billion in the first quarter (April-June) of financial year 2022-23 compared to Rs2.35 billion in the same period of 2021-22, reports WealthPK. It is to mention here that the Hinopak Motors financial year starts on April 1 and ends on March 31.

The company, which is listed on the Pakistan Stock Exchange as a limited liability, reported a gross profit of Rs267 million during the first quarter of its financial year as opposed to a gross profit of Rs231 million during the same period last year.

The company’s profit-after-tax increased by whopping 116.7% to Rs52 million in April-June period from Rs24 million in the same period of last year. This healthy profit took the company’s earnings per share to Rs2.08 from Rs0.95 previously.

Performance over the years

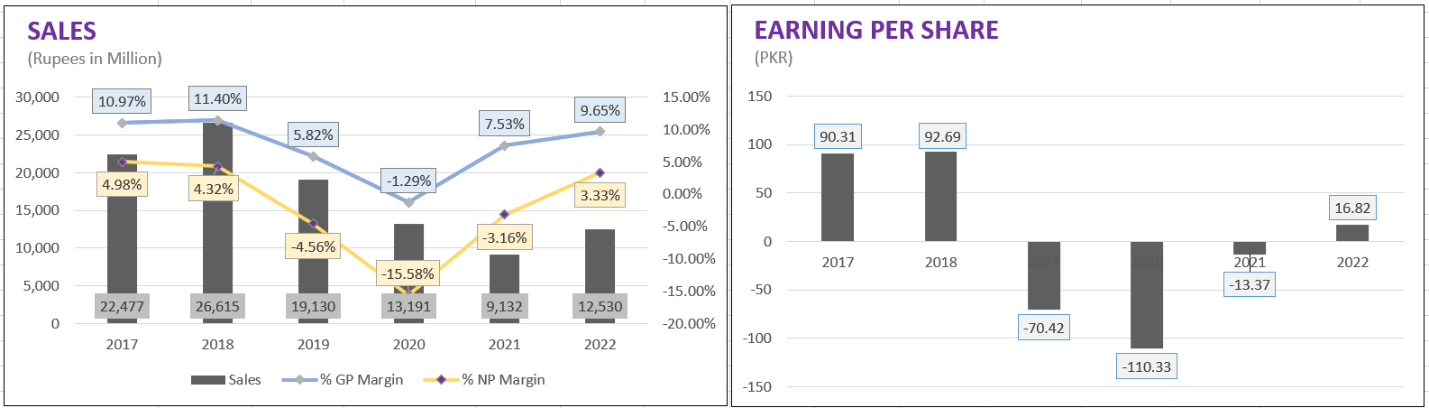

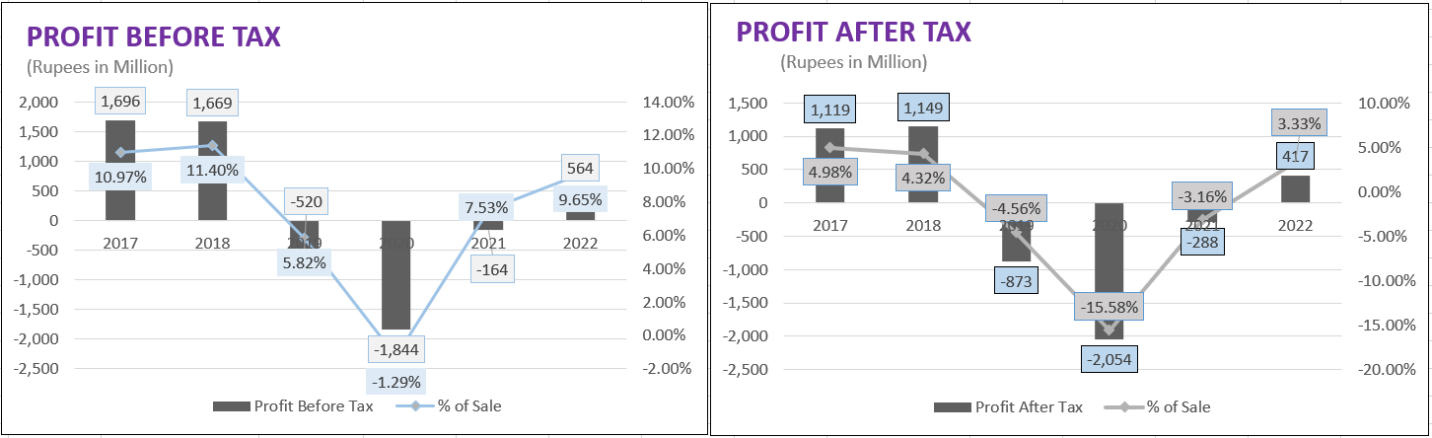

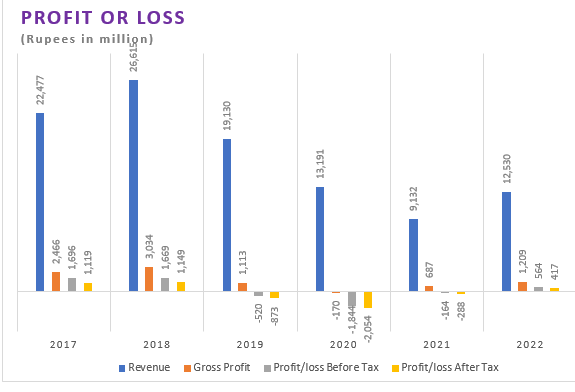

In 2019, the company’s sales decreased by 39.1% to Rs19.1 billion, down from Rs26.6 billion in 2018, mainly due to adverse foreign exchange parities.

During the year, the gross profit fell by 63.3% to Rs1.1 billion, down from slightly over Rs3 billion the previous year, and after-tax income went down by 27.15% to Rs873 million against net profit of Rs1.15 billion the previous year. The gross margin was recorded at 5.82% and the net profit margin at -4.56% in 2019.

In 2020, sales decreased by another 45% to Rs13.2 billion from Rs19.1 billion in 2019. Thus, the company recorded gross loss of Rs170 million from gross profit of Rs1.1 billion a year before. As a percentage of net sales, gross profit margins decreased from -4.56% to -15.58%.

In comparison to last year’s net loss of Rs873 million, the company’s net loss increased to Rs1.8 billion in 2020. This translated into loss per share of Rs110.33 from a loss per share of Rs70.42 last year.

In 2021, revenues fell by 44.5% to Rs9.1 billion from Rs13.2 billion in 2020. Gross profit, on the other hand, climbed to Rs687 million from loss of Rs170 million. Gross profit margins thus increased from -1.29% to 7.53% of total sales.

The company reduced its loss-after-tax by 86%, which stood at Rs288 million, compared to the previous year’s after-tax loss of Rs2.05 billion. Loss per share stood at Rs13.37 compared to Rs110.33 of last year.

During the company’s financial year 2022 that ended on March 31, sales volume for cars and light commercial vehicles rebounded strongly. Net sales jumped from Rs9.1 billion in 2021 to Rs12.5 billion in 2022 at a growth rate of 37.4%.

Gross profit increased 76% from Rs687 million in 2021 to Rs1.2 billion in 2022. Gross profit margins as a percentage of net sales improved from 7.53% to 9.65%. Increase in sales volume contributed to improved margins in 2022.

The automaker earned a net profit of Rs417 million as compared to a net loss Rs288 million last year. The major reason for the turnaround was recovery in sales volume.

Independent News Pakistan-Wealthpk