INP-WealthPk

Jawad Ahmed

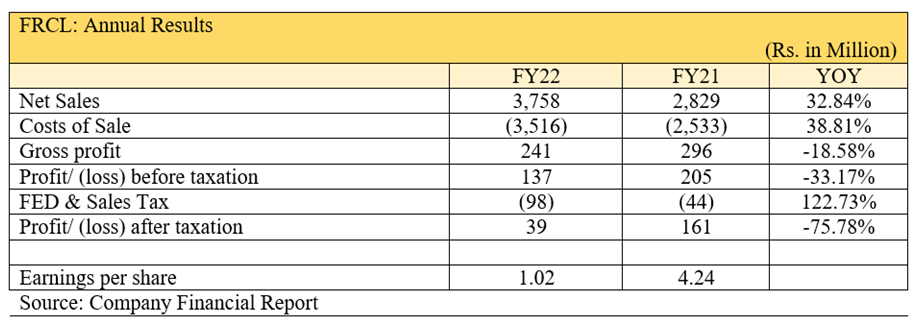

Frontier Ceramics Limited’s net sales increased 32.84% to Rs3.75 billion in the financial year that ended on June 30, 2022 compared with Rs2.82 billion in fiscal 2020-21.

However, the year proved to be challenging for the company as it suffered a sharp fall in its profitability, reports WealthPK quoting the company’s financial stats.

Frontier Ceramics Limited was incorporated in July 1982 as a public limited company. The principal activities of the company are manufacturing of ceramic tiles, sanitary wares and related products.

The rise in sales costs caused the gross profit to decline by 18.58% to Rs241 million in FY22 from Rs296 million in FY21. Compared to Rs205 million in FY21, the company generated a before-tax profit of Rs137 million in FY22. The after-tax earnings fell by 75.7%, from Rs161 million in FY21 to Rs39 million in FY22. The earnings per share (EPS) decreased from Rs4.24 in FY21 to Rs1.02 in FY22 as a result of the sharp decline in earnings.

Company’s performance over the years

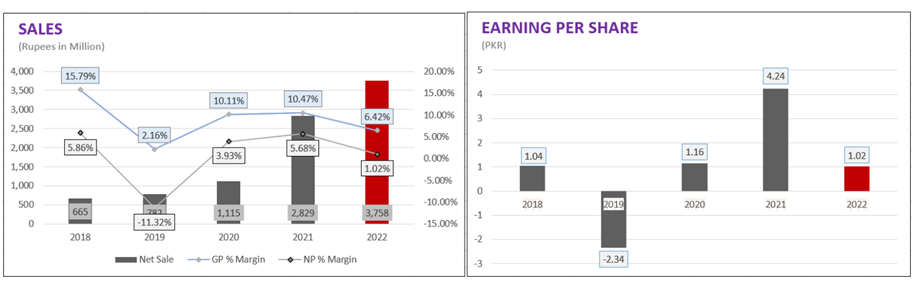

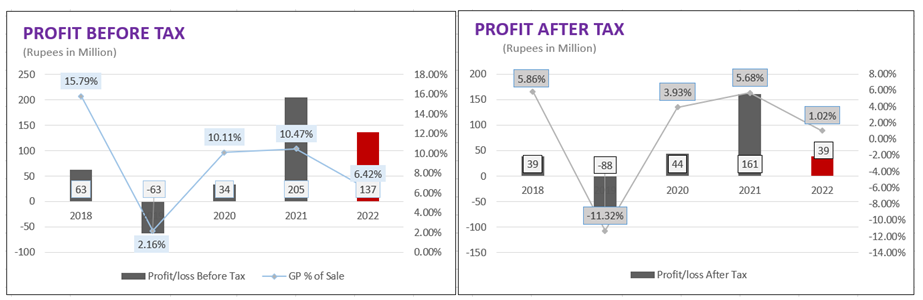

The company's sales revenue climbed from Rs665 million in 2018 to Rs782 million in 2019. The business's gross profit, however, fell from Rs106 million in 2018 to Rs17 million in 2019.

A net loss of Rs88 million was reported by the company in 2019, compared to a profit of Rs39 million in 2018. The loss per share plunged to minus Rs2.34 in 2019 from Rs1.04 the previous year.

Despite the Covid-19 epidemic and the challenging economic environment, the firm managed to increase revenues in 2020 by 43% to Rs1.11 billion from Rs782 million the previous year. The company's gross profit also improved, going up from Rs17 million in 2019 to Rs113 million in 2020.

In comparison to a loss of Rs88 million in 2019, the company declared a net profit of Rs44 million in 2020. From a loss per share of Rs2.34 the year before, the EPS for 2020 rose to Rs1.16.

In 2021, the company's top line climbed to Rs2.82 billion from Rs1.11 billion in 2020 due to an increase in product demand.

The economy recovered after the Covid-19-induced restrictions were relaxed, and the surge in demand led to an increase in gross profit, which rose from Rs113 million in 2020 to Rs296 million in 2021.

The net profit also increased dramatically from Rs44 million to Rs161 million. The company’s EPS also improved from the previous year's Rs1.16 to Rs4.24 in 2021.

Current results and future outlook

The company's sales rose in the fiscal year 2021-22; yet the year was difficult for the business because of a steep decline in profitability.

To maximise profitability, minimise market risks, face upcoming difficulties, and continue business growth, the company’s management are making efforts to reduce costs wherever possible and develop a price-efficient sales mix.

Credit: Independent News Pakistan-WealthPk