INP-WealthPk

Jawad Ahmed

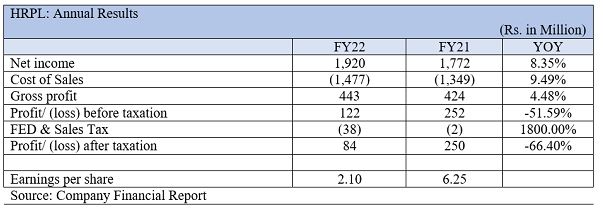

The revenues of Habib Rice Product Limited, a producer of rice-based starch sugar and proteins, increased 8.35% in the financial year ending June 30, 2022 to Rs1.92 billion from Rs1.77 billion the year earlier, according to the company’s latest financials filed with the stock exchange. Despite strong topline growth, the company’s profit margins were squeezed by high sales expenses and federal taxes.

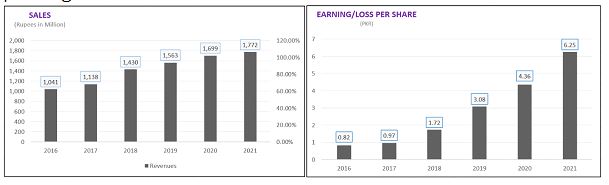

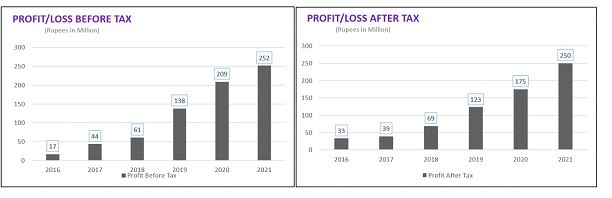

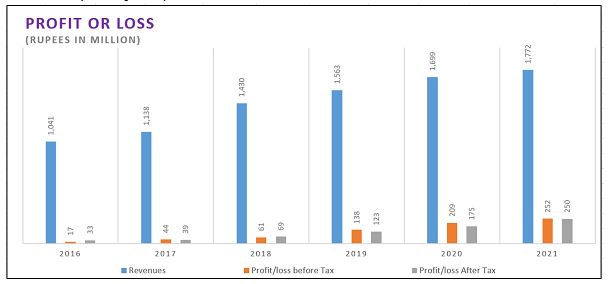

The company, which is listed on the Pakistan Stock Exchange as a limited liability, reported a gross profit of Rs443 million in FY22 as against Rs423 million in FY21, showing a modest growth of 4.48%. The company's net profitability, however, decreased on growing sales costs and taxes, dragging the net profit down 51.6% to Rs122 million in FY22 from Rs252 million in FY21. The earnings per share (EPS) thus dropped to Rs2.10 from Rs6.25 during the two comparable periods. Historical financial performanceThe company's net sales revenue climbed in 2019 to Rs1.56 billion from the previous year's Rs1.43 billion. The company's net profit for the year was Rs123 million, up from Rs69 million the prior year, showing a respectable increase of 78.3%.

The EPS for the year increased from Rs1.72 to Rs3.08 on profit growth.

When compared to 2019, the company's sales rose 8.7% to Rs1.69 billion in 2020. The profit before taxes increased from Rs138 million in 2019 to Rs209 million in 2020. After deducting taxes, the company's net profit in 2020 increased to Rs175 million from Rs123 million in 2019. This resulted in an increase in earnings per share from Rs3.08 to Rs4.36.

In 2021, the company’s sales edged up to Rs1.77 billion from Rs1.69 billion in 2020, showing a 4.3% rise. During the year, the profit before tax increased to Rs252 million from Rs209 the previous year. In contrast to the previous year's net profit of Rs175 million, the profit after tax this year jumped to Rs250 million.

The earnings per share thus increased to Rs6.25 from Rs4.36 in 2020.

Credit: Independent News Pakistan-WealthPk