INP-WealthPk

Amir Khan

Pakistan's struggling economy faces a new challenge as remittances continue to plunge, with the majority of inflows coming from Saudi Arabia, the United Arab Emirates (UAE), and the United Kingdom, according to WealthPK. As the official interbank exchange rate and the grey market rate diverge by more than Rs20 per dollar, many expatriates are choosing illegal channels to send money back home for family support and investments. Talking to WealthPK, Dr. Eatzaz, Memorial Chairperson of the State Bank of Pakistan, said Karachi is among the four cities worldwide, along with Dubai, that is closely connected to the global grey market (Hundi/Hawala) trade networks.

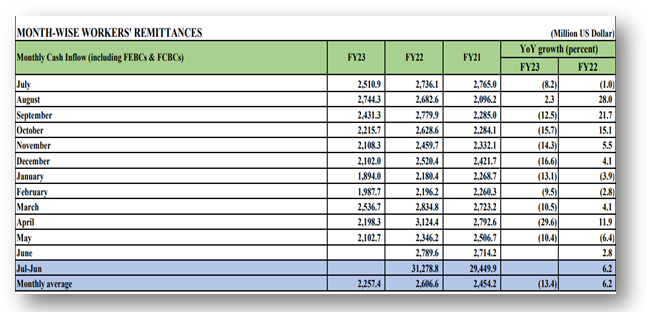

A growing number of people are resorting to the grey market to send their remittances, enticed by the higher exchange rates compared to the open market and interbank rates, he added. ''Remittances experienced a significant rise of over 35 percent, reaching $31.3 billion in FY22 from $23.1 billion in FY20. However, the ongoing fiscal year has seen a substantial decline. In the first 11 months until May, the country has witnessed a loss of $3.7 billion in remittances, with inflows decreasing by almost 13 percent to $24.8 billion compared to $28.5 billion the previous year,’’ he explained.

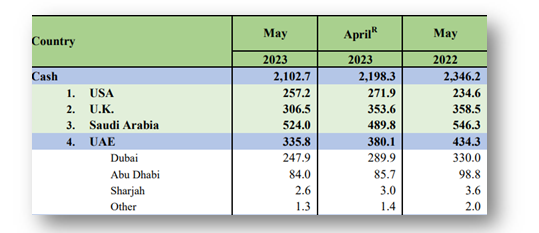

As per the SBP report, the largest amount of money coming in was from Saudi Arabia, but it decreased by 16.3 percent to $5.924 billion. The second highest amount came from the UAE, which was approximately $4.321 billion, but it also experienced a decline of 19.2 percent. The third largest sum of remittances came from the UK, amounting to $3.718 billion, indicating an 8 percent decrease compared to the previous year, he added.

Expressing concern, Dr. Eatzaz said, ‘’As an import-oriented economy, scarcity of dollars in Pakistan's current account has severe consequences, leading to increased unemployment and record-high levels of inflation. The decline in remittances poses significant challenges to Pakistan's management of its external account, particularly considering its meager foreign exchange reserves, which are less than $4 billion. ‘’Remittances have been a lifeline for Pakistan, contributing to significant economic growth in recent years.

However, the decline in remittances is a cause for concern, as the lost amount surpasses the much-needed IMF tranche of $1.1 billion that Pakistan has been struggling to secure for a year,’’ he explained. The SBP memorial chairperson suggested that the government ban illegal channels like hawala and hundi, which will increase the remittance inflow through official channels by up to $50 billion.“Pakistan can launch awareness campaigns and incentive programs to discourage the use of illicit routes, thereby benefiting both migrant workers and the country,” he suggested.

Credit : Independent News Pakistan-WealthPk