INP-WealthPk

Jawad Ahmed

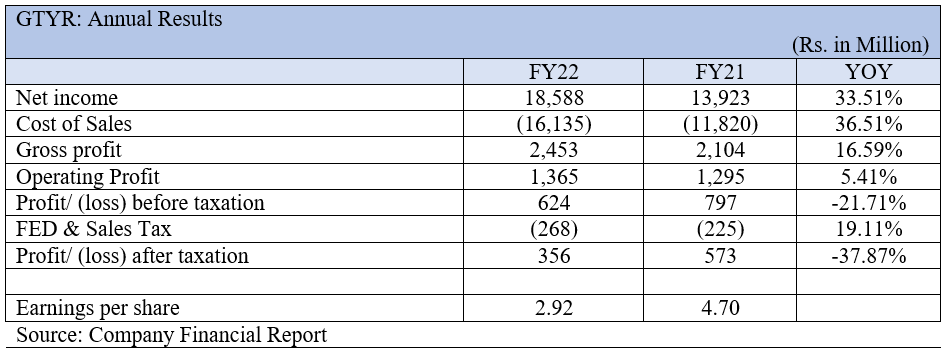

Ghandhara Tyre & Rubber Company Limited reported net sales of Rs18.5 billion in the previous financial year 2021-22, up 33.51% from Rs13.9 billion during the fiscal 2020-21, according to WealthPK. The company produces tyres and tubes for cars and motorcycles. It was registered as a private limited company on March 7, 1963, but later changed its status to a public limited entity.

The company's top line increased during the period under review, but profitability fell due to rising costs of sales and higher prices. Profit-before-tax fell by 21.7% to Rs624 million in FY22 from Rs797 billion in FY21.

After statutory tax adjustments, the net profit for the year was Rs356 million, down from Rs573 million in FY21, showing a decrease of 37.87% year-on-year. As a result, EPS also declined from Rs4.70 in FY21 to Rs2.92 in FY22.

Company’s performance over the years

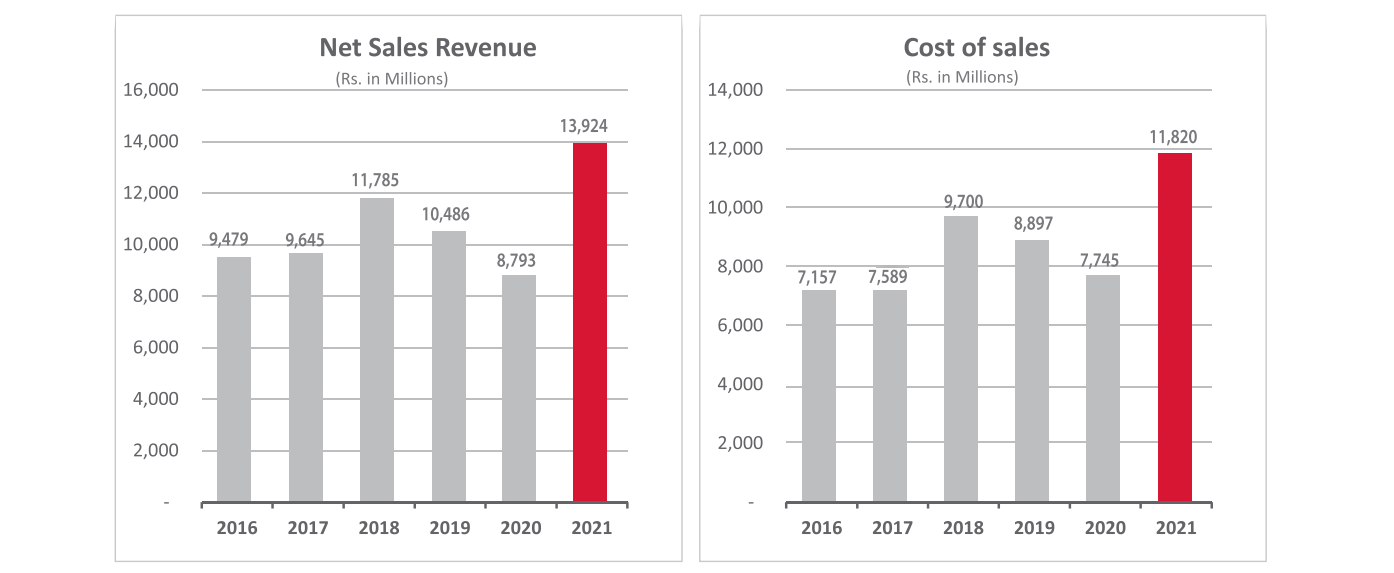

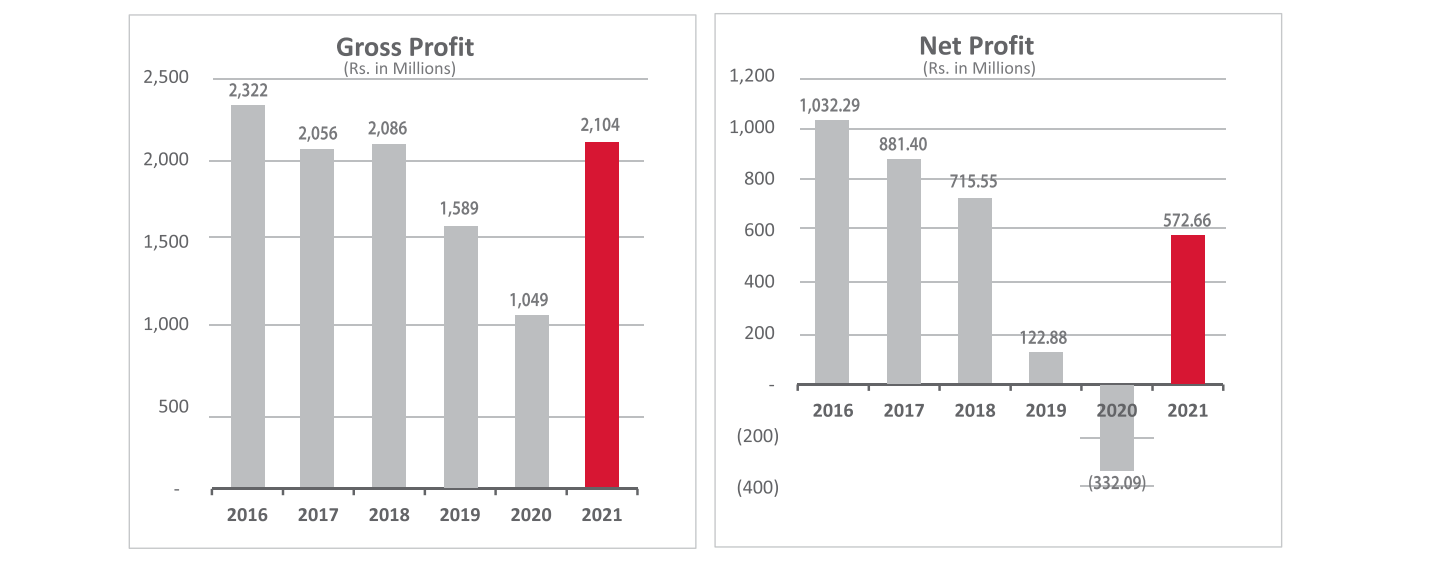

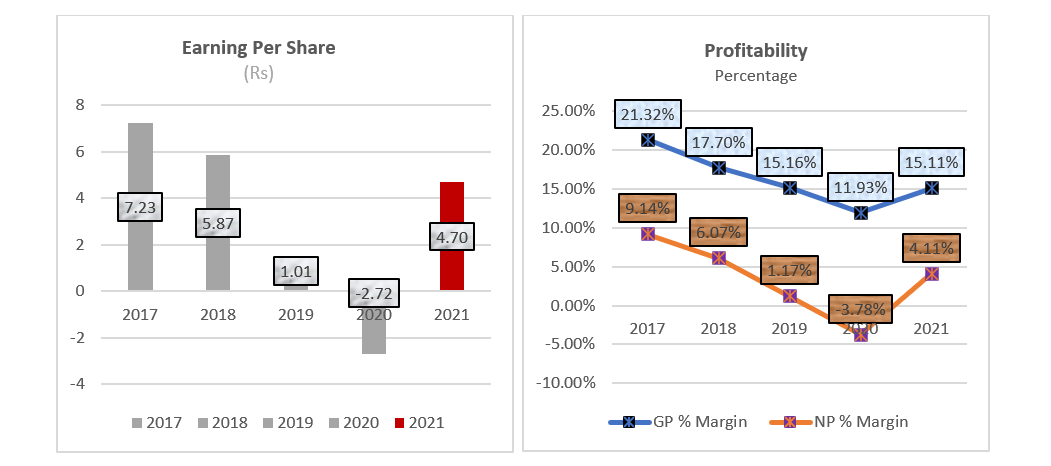

In 2019, the net sales of the company decreased to Rs10.4 billion compared to Rs11.7 billion in the preceding year, showing a decline of 11%. The gross profit also declined 24% to Rs1.5 billion from Rs2 billion in 2018. The net profitability also decreased to Rs122 million from Rs715 million in FY18, which dragged the EPS down to Rs1.01 from the earlier Rs5.87.

In 2020, sales of the company further declined 16.15% to Rs8.7 billion as opposed to Rs10.4 billion in 2019. This was mostly caused by the Covid-19 epidemic, which had a negative impact on replacement market sales.

Furthermore, the company reported a 34% decline in gross profit during the year, which stood at Rs1 billion, down from Rs1.5 billion the previous year.

The company sustained a loss-before-tax of Rs446 million in 2020. It had pocketed Rs253 million profit-before-tax in 2019.

After tax deductions, the company registered a net loss of Rs332 million in 2020 compared to a net profit of Rs122.88 million the year before, showing a negative growth of 370%.

This also translated into loss per share of Rs2.72 in 2020. The company had an EPS of Rs1.01 in 2019.

However, in 2021, the company experienced a spectacular increase in its turnover, which rose by 58.34% to Rs13.9 billion from Rs8.7 billion the year before.

The gross margins stood at Rs2.1 billion, up 100.6% from Rs1 billion the year before.

The profit-after-tax recovered from a loss of Rs332 million the previous year to stand at Rs572 million during the year under review. Due to gains in profit, the EPS also shed the negativity of the previous year and edged up to Rs4.70.

Credit : Independent News Pakistan-WealthPk