INP-WealthPk

Hifsa Raja

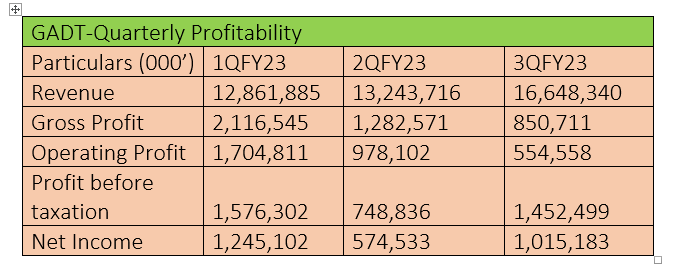

Gadoon Textile Mills Limited kept increasing its gross revenue in the first nine months of the ongoing financial year 2022-23. The company made the highest sales of Rs16.6 billion in the third quarter (January-March), and the highest net profit of Rs1.2 billion in the first quarter (July-September). The company also achieved the highest gross profit of Rs2.1 billion in the July-September quarter of FY23.

The company posted the lowest net profit of Rs574 million in the second quarter (October-December).

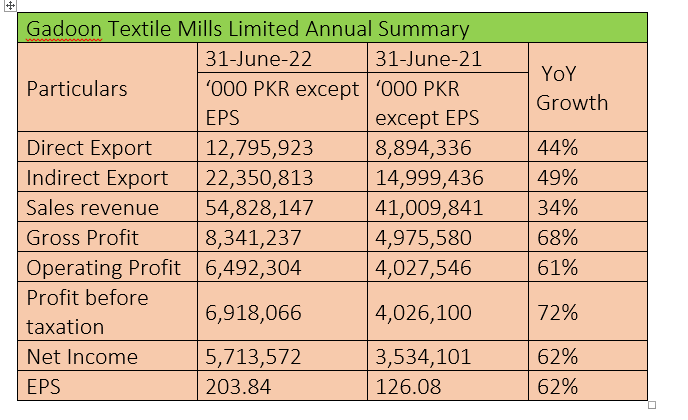

FY22 compared with FY21

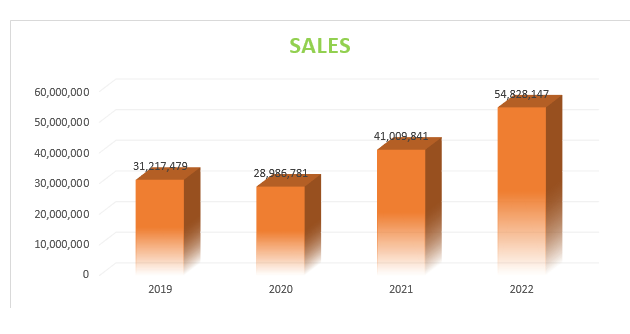

Gadoon Textile Mills produced the highest sales of Rs54 billion in 2022, showing a rising trajectory since 2020.

The company earned Rs12 billion in revenue through direct exports in FY22 compared to Rs8 billion in FY21, showing a growth of 44%. The direct exports allow companies to establish direct relationships with foreign customers and have more control over the sales process. Through indirect exports the company generated Rs22 billion in revenue in FY22 compared to Rs14 billion in FY21 with a growth rate of 49%. Through indirect exports, the company provides access to foreign markets through established distribution channels and intermediaries. In FY22, the company reported a healthy increase in net sales revenue, which reached Rs54 billion compared to Rs41 billion the previous year, indicating a growth of 34%.

The gross profit also increased to Rs8.3 billion, up 68% from the previous year's figure of Rs4.9 billion.

The company managed to achieve a 61% growth in operating profit, which jumped to Rs6.4 billion in FY22 from the previous year's Rs4 billion. Moreover, the company managed to achieve a 72% growth in profit-before-tax, which climbed to Rs6.9 billion in FY22 from the previous year's Rs4 billion.

The profit-after-tax also increased to Rs5.7 billion in FY22 from Rs3.5 billion in FY21, reflecting an increase of 62%. Sales revenue for the business increased significantly, demonstrating excellent market penetration and customer demand. These robust financial results reinforce Gadoon Textile Mills’ position as a leading player in the industry and highlight its ability to deliver value to its shareholders. With its positive performance, Gadoon Textile Mills is well-positioned for continued success and future growth.

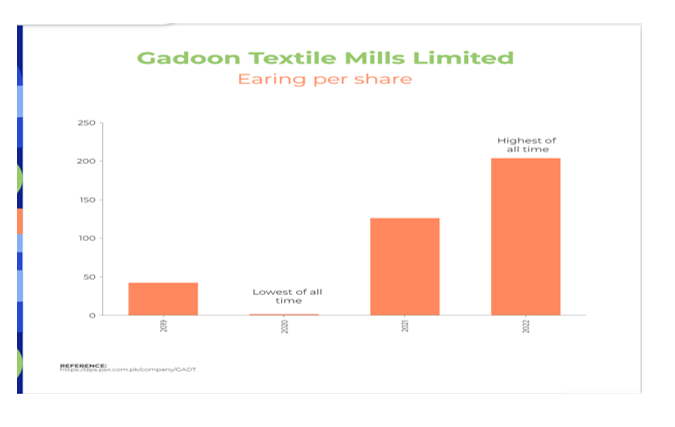

Earnings Per Share (EPS)

Over the past few years, the earnings per share (EPS) of the company have shown varying trends. Notably, in 2020, the EPS experienced a huge fall, reaching Rs1.62, primarily due to the impact of the Covid-19 pandemic. However, subsequent years witnessed a rebound, with EPS flying high to Rs203.84 in 2022. In a span of just three years, the company experienced contrasting extremes in its EPS, reaching both an all-time low and an all-time high

The company's resilience and capacity to adjust to difficult situations and seize growth opportunities are reflected in these swings in EPS. These changes will be actively watched by stakeholders and investors since they offer important information about the profitability and prospects of the company.

It needs to be seen as to how the business can maintain its strong performance, strategise and build on its advantages while resolving issues that affected the company in the past.

In the latest financial update for FY23, the company's EPS showed a mixed performance across the quarters.

During the first quarter, the company reported an EPS of Rs44.42, indicating a promising start to the year. The second quarter also witnessed a surge in EPS, which increased to Rs64.92.

The company's EPS leapt to Rs101.14 in the third quarter.

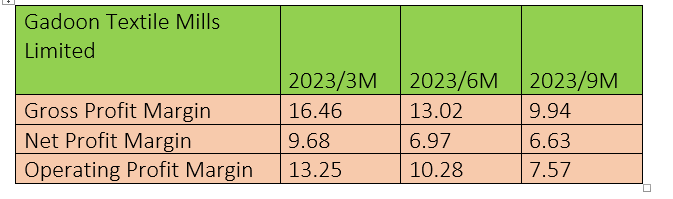

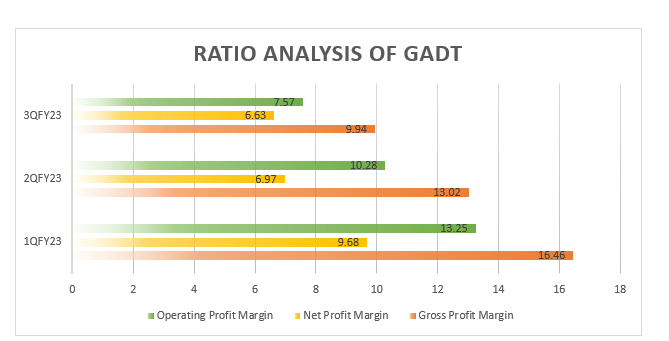

Ratio analysis

In the first quarter of FY23, the gross profit margin stood at 16.46%, demonstrating senior management was effective at increasing revenue while considering the expense of delivering the company's goods and services. The net profit margin stood at 9.68%, suggesting sound money management and spending restraint. The operating profit margin was 13.25% in 1QFY23, highlighting good business strategy and operational efficiency capacity to make money from primary activities.

In the second quarter, operating, net, and gross profit margin numbers all decreased. The gross profit margin dropped to 13.02%, net profit margin to 6.97% and operating profit margin to 10.28%.

These numbers show the company struggled to be profitable and effective during the second quarter.

In the third quarter, the gross profit margin further dipped to 9.94%, net profit margin to 6.63 and operating profit margin to 7.57.

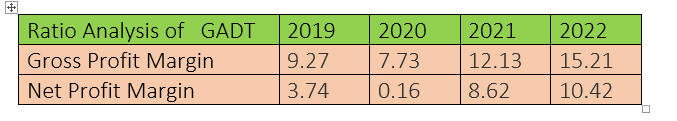

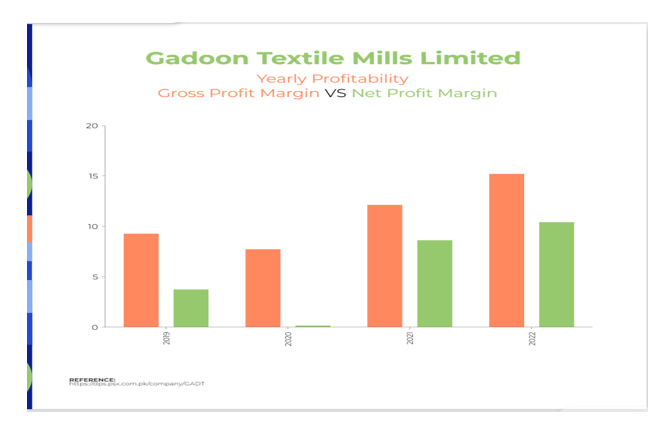

The company had robust gross and net profit margins in 2019, indicating its financial performance was solid. However, both the margins slid in 2020 with gross profit margin falling to 7.73% and net profit margin to 0.16%.

Profitability rebounded considerably in 2021 and 2022.

Gadoon Textile Mills’ ability to bounce back from a difficult time in 2020 to a profitable situation in later years is a testament to its resilience and strategic judgement. Positive outcomes have come from the company's efforts to reduce expenses, optimise operations, and adjust to changing market conditions.

The future goals of Gadoon Textile will center on maintaining this rising trend and building on its advantages in order to maintain development and profitability. Investors, stakeholders, and business experts alike will be intently watching the company's capacity to overcome obstacles and produce consistent results.

Business Excellence Award 2021

The company received the "Business Excellence Award 2020-2021" from the Sarhad Chamber of Commerce and Industry (SCCI). It also received the Best Corporate Report Award with second position in the textile category at the "Best Corporate and Sustainability Report Awards 2020" held by the Joint Committee of the Institute of Chartered Accountants of Pakistan (ICAP) and the Institute of Cost and Management Accountants of Pakistan (ICMAP).

Company profile

Gadoon Textile manufactures and processes all types of cotton and man-made fibers. It is primarily engaged in the textile industry operating in business-to-business segments. The company offers a diverse product portfolio, including yarn and knitted bedding products.

Credit : Independent News Pakistan-WealthPk