INP-WealthPk

Hifsa Raja

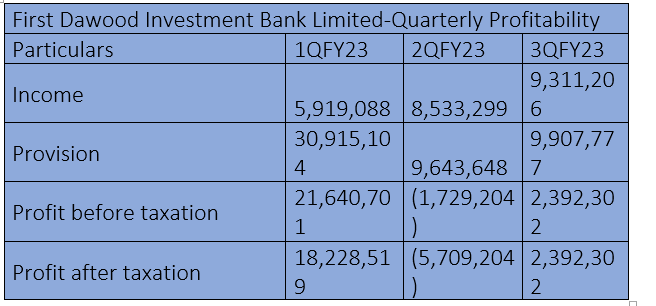

First Dawood Investment Bank Limited has released its quarterly profitability figures, highlighting a challenging period for the company. The financial report highlights fluctuating performance and significant provisions made during the first nine months of the last fiscal year 2022-23. In the first quarter (July-September) of FY23, the bank posted income of Rs5.9 million and provision of Rs30.9 million. The company posted a net profit of Rs18.2 million during this quarter.

In the second quarter (October-December), the company posted income of Rs8.5 million and provision of Rs9.6 million. However, it suffered a net loss of Rs5.7 million. In the third (January-March) quarter, the company posted income of Rs9.3 million and provision of Rs9.9 million. It recorded a net profit of Rs2.3 million in this quarter.

These figures highlight the volatile nature of First Dawood Investment Bank Limited's quarterly profitability, driven by the varying levels of provisions made and their impact on the overall financial performance. The bank faces challenges in maintaining stable profitability in the current market conditions. As the company moves forward, it will need to carefully manage provisions and implement effective strategies to ensure sustainable growth and improved financial performance in the future.

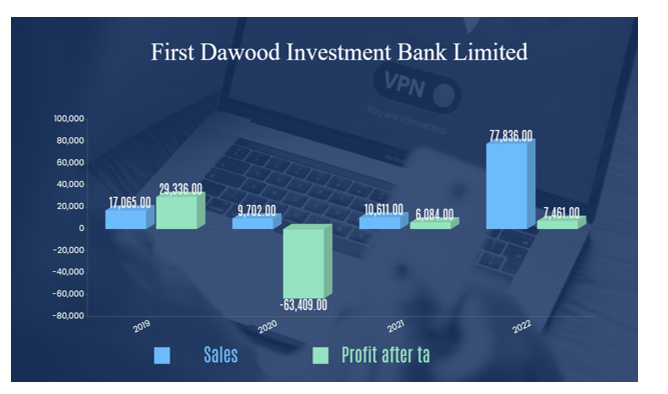

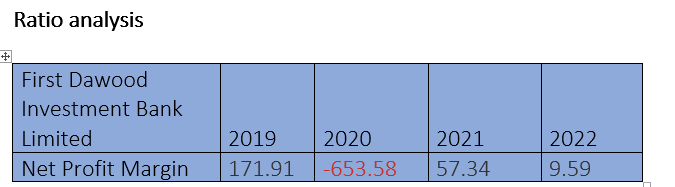

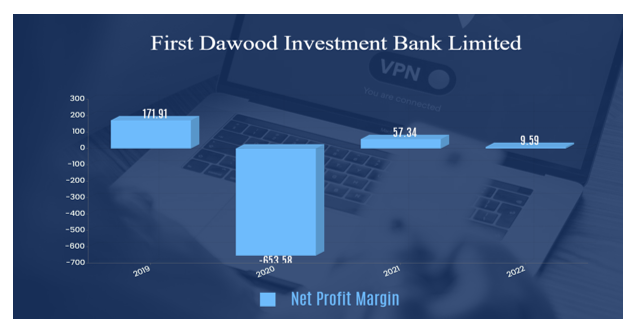

The bank's financial performance has seen substantial fluctuations over the years. In 2019, the bank’s net profit was pretty good, but in 2020, it turned negative. The next two years (2021-2022), however, saw an improvement in net profitability. The bank must identify and rectify the issues that led to the 2020 net losses and the comparatively poor profitability in the years that followed.

Performance in FY22

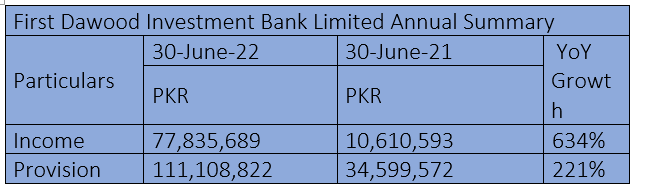

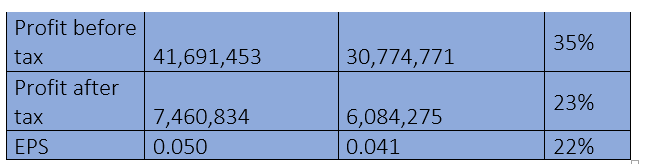

In the fiscal year 2021-22, the company reported a gigantic increase of 634% in net sales revenue, which ballooned to Rs77 million from Rs10 million the previous year. The provision also soared 221% to Rs111 million in FY22 from the previous year's Rs34 million.

The company’s profit-before-tax increased by 35% to Rs41.6 million in FY22, surpassing the previous year's Rs30.7 million. Moreover, the company had 23% increase in profit-after-tax, which swelled to Rs7.4 million in FY22 from Rs6 million in FY21. The earnings per share (EPS) also increased by 23% year-on-year.

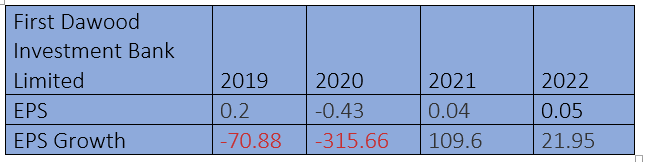

EPS over the years

The EPS remained positive in 2019, 2021, and 2022, except 2020 when the earnings remained negative, suggesting the company was in loss that year. The business had a significant EPS growth in 2021. The company's profits per share significantly decreased in 2019 and 2020, as seen by the negative EPS growth. Positive EPS growth in 2022 suggests a turnaround in fortunes.

In 2019, the company’s net profit margin was 171%, but it declined to -653% in 2020. Nevertheless, it improved to 57.34% in 2021 before falling to 9.59% in 2022, but stayed positive.

It is worth noting that the bank should continue to closely monitor and address any factors that may impact its EPS growth, such as regulatory changes, market fluctuations, or credit quality. By maintaining a vigilant approach and adopting proactive measures, the bank can navigate through challenges and work towards achieving consistent and sustainable earnings growth in the future.

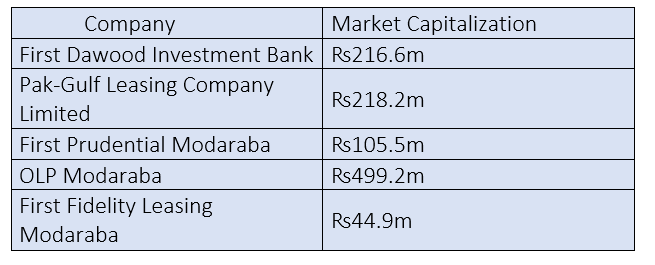

Industry comparison

First Dawood Investment Bank’s competitors include Pak-Gulf Leasing Company Limited, First Prudential Modaraba, OLP Modaraba and First Fidelity Leasing Modaraba.

First Dawood Investment Bank has a market capitalisation of ₨216 million. OLP Modaraba has a largest market capitalisation of ₨499 million and First Fidelity Leasing Modaraba has the lowest market value of Rs44.9 million.

Future prospects

The company made a recovery of Rs150 million against non-performing lease and advances portfolio in FY22. As the bank expects further recovery, it will provide cash flow cushion in next two-three years. The management is confident it will continue writing back provisions as a result of expected recoveries, which will result in better cash flows. Administrative expenses have been curtailed and departments have been rationalised.

The proposed reduction in financing cost through settlements with the lenders will assist in further reducing the losses and improving the equity. This will make the bank attractive for equity merger along with an opportunity for the existing shareholders to inject additional equity. The main sponsors are committed to subscribing their portion of right issue.

Company profile

First Dawood Investment Bank Limited was incorporated on June 22, 1994 under the Companies Ordinance, 1984. The company has obtained licences for leasing business and investment and finance services under Non-Banking Finance Companies (Establishment and Regulation) Rules, 2003, and Non-Banking Finance Companies and Notified Entities Regulations, 2008, from the Securities and Exchange Commission of Pakistan.

Credit: INP-WealthPk