INP-WealthPk

Qudsia Bano

The companies willing to maintain their competitiveness prefer absorbing the high production expenditures at the cost of reduced earnings to passing on the costs to consumers, said Muhammad Farhan, the compliance officer at Venus Securities (Pvt) Limited (VSPL). During an exclusive interview with WealthPK, he explained that when prices for products and services keep rising, customers will have less money to spend on non-essential purchases. And as input prices rise, increasing costs have an effect on enterprises' earnings.

WealthPK: How is your firm impacted by its increased vulnerability to changes in economic landscape and other factors, and how are you handling them?

Muhammad Farhan: The company plans to establish a national retail brokerage house and portfolio management operations using offices in various cities as well as online in order to provide our vast client relationship network with profound understanding of the capital market. Our objective to provide excellent trading services to our clients at fair prices and costs remains unaffected by political and economic developments in the country.

WealthPK: What distinguishing characteristic of certain businesses enables it to thrive when the market is low?

Muhammad Farhan: Giving clients something special makes firms stand out from their rivals. Many companies lose sight of those who matter the most: their consumers, as they become enmeshed in their own objectives. A strong customer focus and marketing professionals are two characteristics shared by successful firms. They develop a culture that prioritises their clients, and they structure their operations, goods, and services around their requirements. Their success is also aided by their ability to consistently provide high-quality goods and services, as this maintains their reputation among customers.

WealthPK: What factors affect the stock market?

Muhammad Farhan: The stock market does get impacted by the state of the economy as a whole. Economic expansion, economic stagnation, inflation, interest rates, and currency rates are a few of these variables. The stock market may be impacted by each of these. Investors can change their portfolios to minimise losses or increase profits if they are aware of these aspects. Companies may expand and boost earnings when the economy appears to be rising, which may lead to an increase in share values. When the economy is doing well, people spend more because they are more secure in their financial situation. Companies will find it tougher to grow and boost profits when the economy is weakening.

Performance in 2020-21

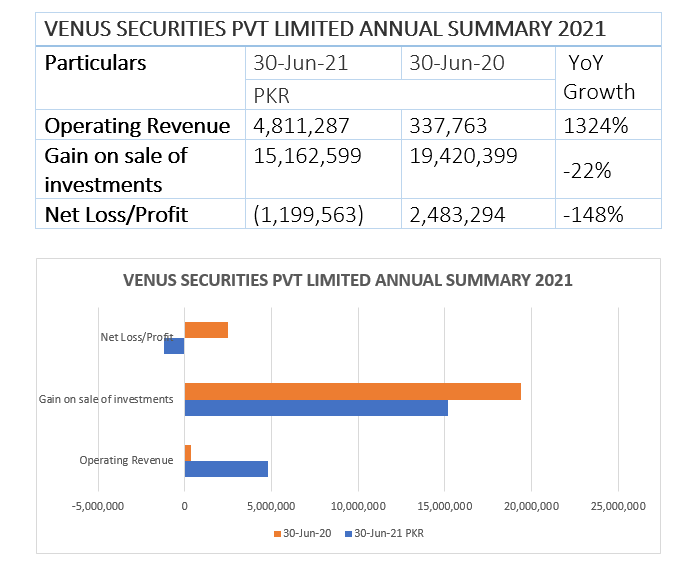

During the FY21, the company earned operating revenue of Rs4.8 million compared to just Rs337,763 in FY20, posting a phenomenal 1,324% increase year-on-year. However, the gain on sale of investments for FY21 stood at Rs15 million, down 22% from Rs19.4 million in FY20. The company sustained a loss-after-taxation of Rs1.2 million compared to a profit of Rs2.5 million in FY20, posting a massive 148% loss.

About the company

VSPL is a financial brokerage house that offers unmatched research-driven brokerage to its retail and institutional clients. The company was incorporated in Pakistan in June 2007 as Farooq Abdullah Securities Pvt Ltd, later changing its nomenclature into Venus Securities Pvt Ltd in 2014 under the Companies Ordinance, 1984. VSPL is a corporate member of the Pakistan Stock Exchange. It is also a registered broker with the Securities & Exchange Commission of Pakistan.

Credit : Independent News Pakistan-WealthPk