INP-WealthPk

By Hifsa Raja

The financial services sector has recently seen tremendous growth in the use of artificial intelligence (AI) and machine learning (ML).

Financial institutions can now apply AI and ML-based solutions for a range of purposes, including customer segmentation for better marketing, cross and up-selling, campaign management, client-facing chatbots, creditworthiness assessment, and credit score prediction.

This was highlighted by NetSol Technologies Limited’s Finance Manager Amir Iqbal during an exclusive interview with WealthPK.

NETSOL Technologies is an IT service management company.

Q: What types of cutting-edge technologies have you been developing at the NetSol Innovation Lab?

A: NetSol Innovation Lab continues to experiment with and work on different technologies in order to generate new revenue streams and to ensure that by running a future-proof business, its clients maintain their competitive advantage in today’s highly competitive marketplace. These technologies include but are not limited to AI/ML, Big Data, and Blockchain.

Q: To which industries does your company offer technology/solutions?

A: The company continues promoting its highly adaptive solution for banks, automotive and equipment finance, and leasing companies worldwide. By offering its premier products on the Cloud, NetSol enables finance and leasing companies to gain access to the same next-generation platform used by blue-chip organisations and Fortune 500 companies without having to pay any upfront licence fees.

Q: How has the IT sector's rapid growth affected your company’s cost structure?

A: Due to massive growth in the IT industry both locally and globally, and the resultant increase in demand for IT resources, the resources retention cost is increasing significantly for the company. Additionally, cost of revenue increased due to increase in salaries and benefits costs. The company has also hired a net of 55 additional resources recently.

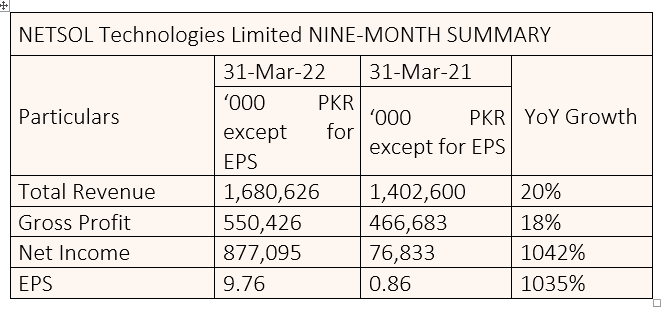

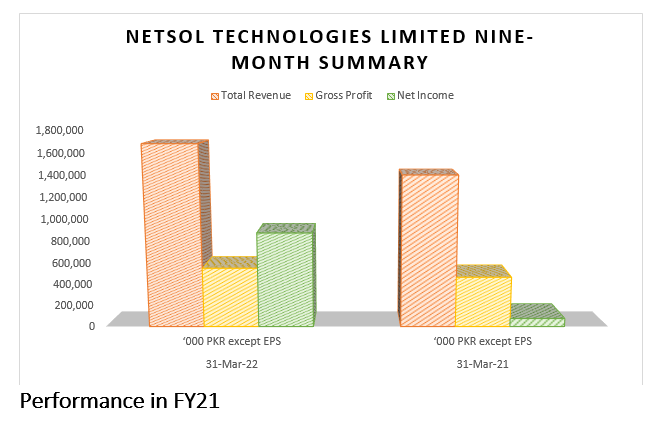

Performance in 9MFY22

NetSol Technologies Limited’s revenue climbed 20% to Rs1.68 billion in the first nine months of the previous fiscal year 2021-22 (9MFY22) compared with Rs1.40 billion over the same period of fiscal 2020-21.

The company’s gross profit registered a growth of 18% year-on-year to reach Rs550 million in 9MFY22 from Rs466 million in 9MFY21.

The company’s net income jumped to Rs877 million in 9MFY22, up by 1042% from just Rs76,833 in 9MFY21.

The EPS jumped to Rs9.76 in 9MFY22 from Rs0.86 in 9MY21, reports WealthPK.

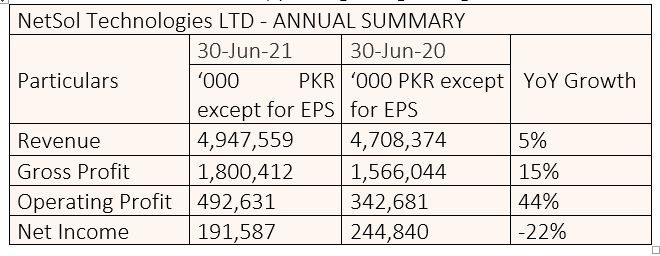

During the fiscal year 2020-21, the company’s net revenue increased by 5% to Rs4.94 billion from Rs4.70 billion in 2019-20.

The gross profit for FY21 stood at Rs1.8 billion, up 15% from Rs1.5 billion in FY20.

The operating profit for FY21 increased to Rs492 million from Rs342 million in FY20, posting an increase of 44%.

The net income in FY21, however, decreased to Rs191 million from Rs244 million in FY20, posting a negative growth of 22%.

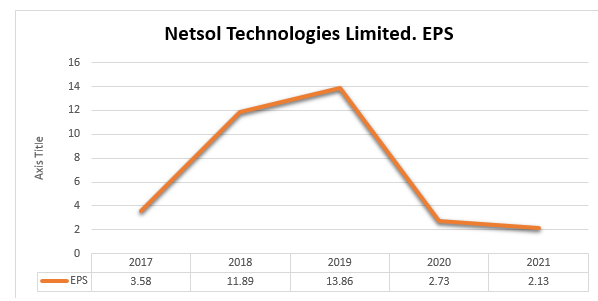

Earnings Per Share in FY21

The earnings per share (EPS) ballooned from a low of Rs3.58 in 2017 to a high of Rs13.86 in 2019. However, the EPS plunged to Rs2.73 in 2020 and stayed slightly lower at Rs2.13 in 2021.

NetSol Technologies Limited was incorporated in Pakistan on August 22, 1996 under the now repealed Companies Ordinance, 1984, amended to Companies Act, 2017 as a private company limited by shares. However, it was later converted to a public limited company.

The main business of the company is development and sale of computer software and allied services in Pakistan and abroad.

Credit : Independent News Pakistan-WealthPk