INP-WealthPk

Hifsa Raja

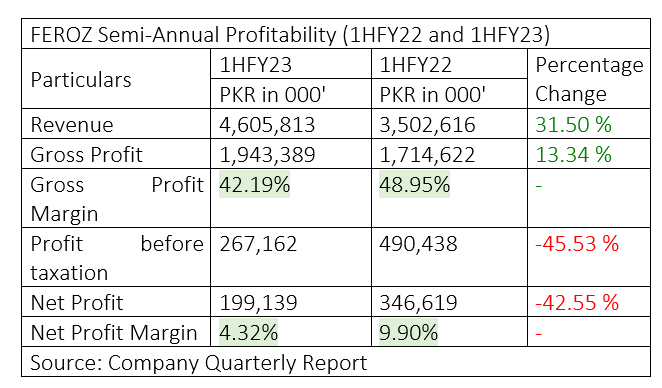

Ferozsons Laboratories Limited (FEROZ) posted an increase of 31.5% and 13.3% in its revenue and gross profit in the first half (July-December) of the fiscal year 2022-23 compared to the same period of FY22, WealthPK reports. The company’s revenue increased to Rs4.6 billion in 1HFY23 from Rs3.5 billion over the corresponding period of FY22.

The gross profit increased to Rs1.9 billion in 1HFY23 from Rs1.7 billion in 1HFY22. The profit-before-taxation, however, dropped to Rs267 million 1HFY23 from Rs490 million in 1HFY22, registering a negative growth of 45%. Similarly, the profit-after-taxation fell 42% to Rs199 million in 1HFY23 from Rs346 million 1HFY22. The company’s gross profit and net profit ratios were calculated at 42.19% and 4.32%, respectively. Ferozsons Laboratories Limited is listed on the Pakistan Stock Exchange under the symbol of FEROZ in the pharmaceutical sector.

Quarterly analysis shows that FEROZ earned more net profits in the first quarter (July-September) of FY23 than in the second quarter (October-December).

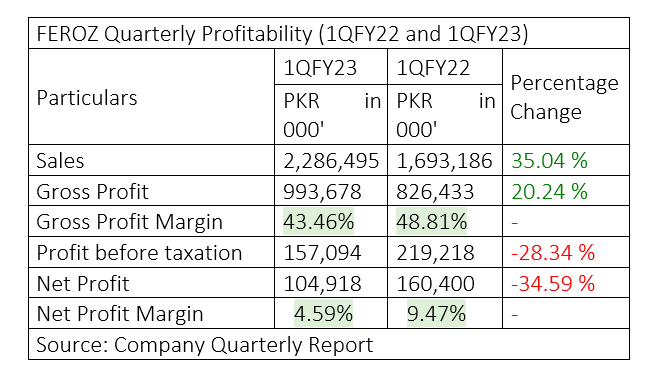

FEROZ – 1QFY23 (July-Sept)

In the first quarter of FY23, FEROZ’s sales increased by 35.04% and gross profit by 20.24% compared to the same period of FY22. During this quarter, FEROZ posted sales of Rs2.2 billion, gross profit of Rs993 million and gross profit ratio of 43.46%.

The company posted a net profit of Rs104 million and a net profit ratio of 4.59% in 1QFY23.

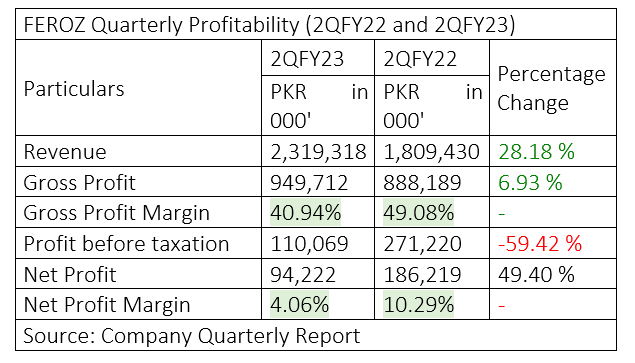

FEROZ – 2QFY23 (Oct-Dec)

In the second quarter (October-December) of FY23, FEROZ’s revenue increased by 28.18% and gross profit by 6.93% compared to the same period of FY22. The company posted revenue of Rs2.3 billion, gross profit of Rs949 million and gross profit ratio of 40.94% in 2QFY23.

The company posted a net profit of Rs94 million and a net profit ratio of 4.06% in 2QFY23.

Earnings growth analysis

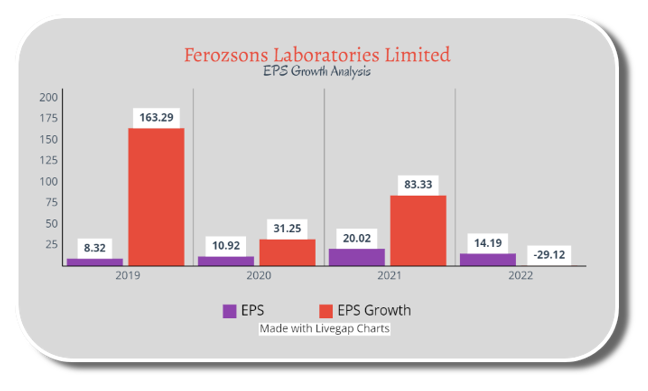

In 2019, the earnings per share (EPS) of the company stood at Rs8.32, which increased to Rs10.92 in 2020, jumping further to Rs20.02 in 2021. However, the EPS declined to Rs14.19 in 2022. These figures suggest that the company has gone through some fluctuations in its EPS. The company’s EPS growth has been quite volatile over the past four years. In 2019, this growth stood at 163.29%, but in 2020, it plunged to 31.25%. However, in 2021, the EPS growth posted a significant increase of 83.33%. In 2022, the EPS growth decreased to 29.12%.

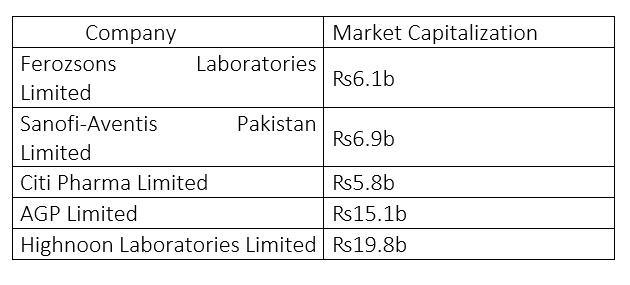

Industry comparison

The competitors of Ferozsons Laboratories include Sanofi-Aventis Pakistan Limited, Citi Pharma Limited, AGP Limited and Highnoon Laboratories Limited.

Highnoon Laboratories Limited has the largest market capitalisation of ₨19.8 billion followed by AGP Limited ₨15.1 billion, Sanofi-Aventis ₨6.9 billion, FEROZ Rs6.1 billion and Citi Pharma ₨5.8 billion.

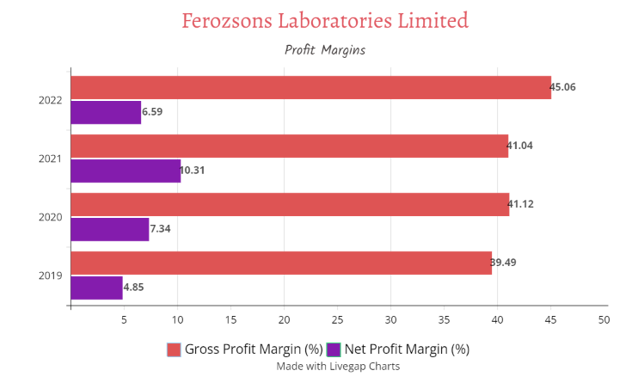

Profit or loss over the years

The gross profit margin increased from 39.49% in 2019 to 45.06% in 2022, indicating the company has been able to control its cost of sales and increase its pricing power. Similarly, the net profit margin increased from 4.85% in 2019 to 6.59% in 2022, indicating the company’s operating costs were under control and earnings from operations increased. Overall, the company's financial performance is sound as suggested by the rising trend in both gross and net profit margins.

Company profile

FEROZ was incorporated as a private limited company on January 28, 1954 and was converted into a public limited company on September 08, 1960. The company is primarily engaged in import, manufacture and sale of pharmaceutical products and medical devices.

Credit: Independent News Pakistan-WealthPk