INP-WealthPk

Muhammad Asad Tahir Bhawana

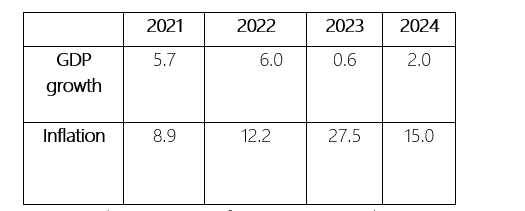

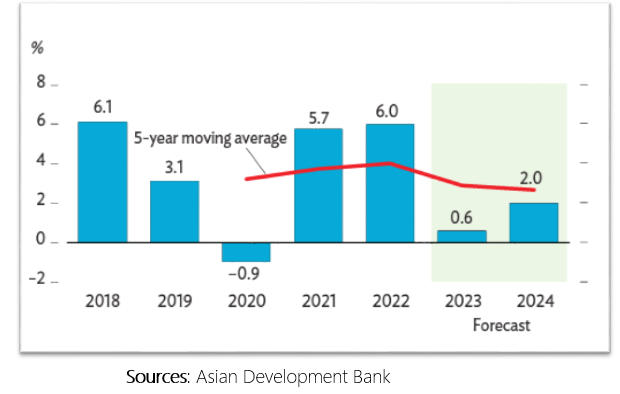

Pakistan’s economy is projected to grow by 0.6 percent in FY2023 as per the Asian Development Bank. A challenging external environment, ongoing foreign exchange crisis, economic losses and devastation from flooding, and a difficult political situation all weigh on economic activities, reports WealthPK.

As a result of high inflation, the domestic demand will be restrained due to reduction in the purchasing power. In the first half of the fiscal year, some of the damage and disruption to economic activities is expected to be offset by increased government spending for relief, recovery, and rehabilitation. According to the ADB report, growth in FY2024 will increase to 2.0%, assuming sustained macroeconomic policies, reforms, recovery from flooding-related supply shocks, and improved external conditions.

Source: Pakistan Bureau of Statistics, National Accounts Tables Base 2015-16, Table 5: Gross Domestic Product of Pakistan (at constant basic prices of 2015-16); State Bank of Pakistan, Economic Data, Asian Development Bank estimate

In addition to flood related losses to cotton, wheat, and rice crops, livestock were also drowned. Approximately 4,410 million acres of agricultural land came under water, affecting 40% of cotton crop. Rise in agricultural productivity and increase in crop production in the winter season are likely to offset losses to summer crops as a result of improving input availability from the Kissan Package 2022 for farmers.

The foreign exchange crisis is driving up prices for imported cotton to replace domestic supply. This will lead to a decline in textile production, which normally accounts for 25% of industrial output and 60% of exports.

There are additional pressures on the industry as inflation rises and fiscal and monetary policies are expected to tighten. The depletion of foreign exchange reserves is further disrupting supply chains and preventing industries from importing essential raw materials and intermediate goods.

As a result, many factories are either temporarily closed or are operating at less than full capacity. Over the July to November 2022 period, output from large manufacturers dropped by 3.6%. There was a 5.5% decline in output from large manufacturers in November compared to a year earlier. The industry is therefore expected to contract in FY2023 but expand in FY2024 after demand and supply shocks subside.

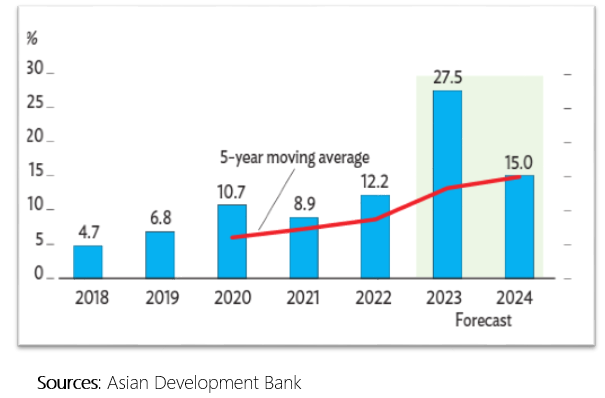

In the first seven months of this fiscal year, headline consumer inflation surged to 25.4% due to higher energy prices, weaker currency, flood-related supply disruptions, and import restraints caused by the ongoing balance of payments crisis. Rural core inflation increased to 17.7% year-on-year in the first 7 months of FY2023 from 9.0% a year earlier, while urban core inflation rose to 14.3% from 8.1%.

However, it is also expected that headline inflation will decrease to 15% in FY2024 as global energy prices decline and flood-induced supply constraints are resolved. The State Bank tightened the monetary policy further owing to the rising inflation and external imbalances, raising the policy rate by 200 basis points in January, 300 basis points in March, and 100 basis points in April to 21% to tackle inflation.

It is expected that the overall economy will be on track in FY2024 with political stability and strict economic measures taken by the government.

Credit: Independent News Pakistan-WealthPk