INP-WealthPk

Sajid Irfan

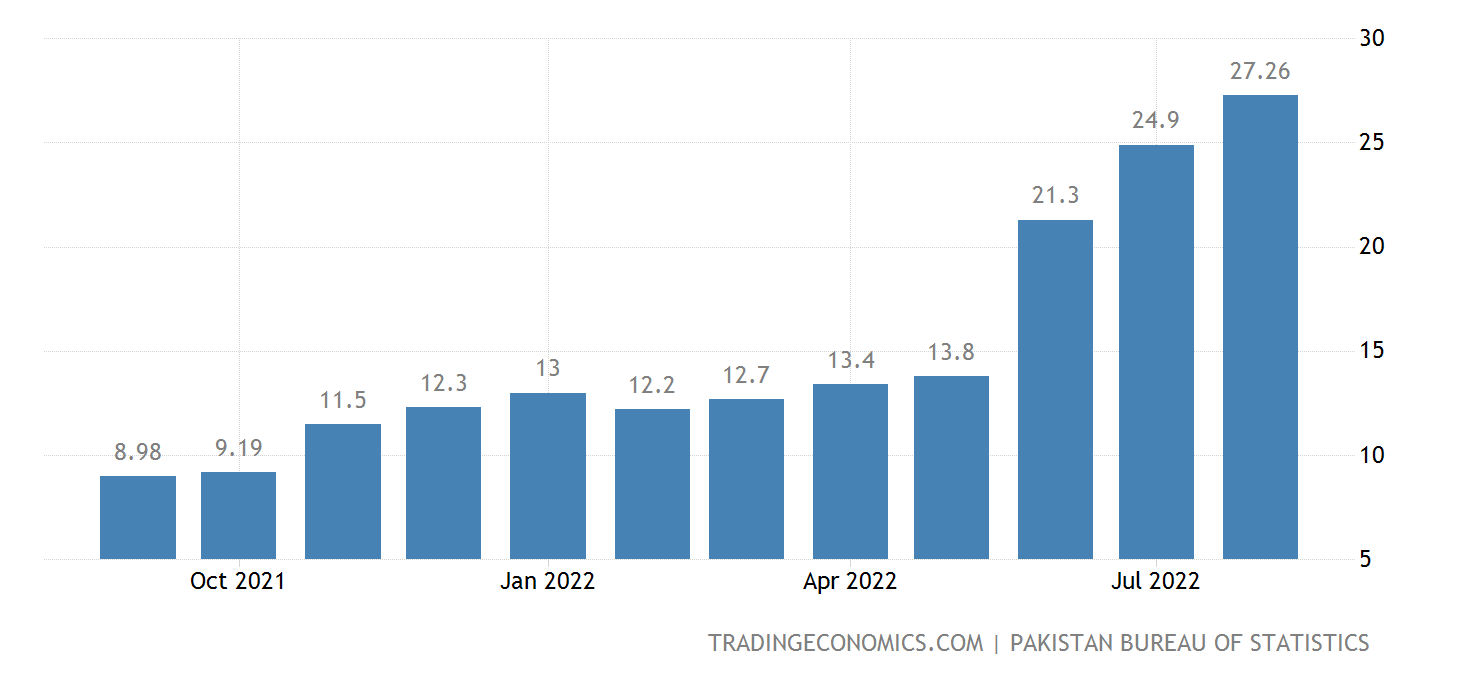

The current inflation rate in Pakistan is more than 27%, while in July it was 24.9%. Owing to hyperinflation, the prices of commodities are going out of reach of the low-level income group and daily wagers, reports WealthPK.

Talking to WealthPK, Dr Javed Iqbal of Quaid-i-Azam University said the current inflation rate of 27.3% was the highest after 1975. The inflation graph seems to be going out of control, he added.

“There are two basic reasons behind the spike in prices. One is depreciation in rupee against dollar and the second is the heavy floods. For the last one and a half years, the rupee has dipped to the historic low against dollar. The heavy floods have washed away crops, vegetables, fruits, livestock, etc., causing shortage of commodities and manifold increase in prices.’’

Dr Javed suggested currency reforms on an urgent basis to tackle inflation. He said the central bank independence and adapting a fixed exchange rate were significant currency reforms to tackle inflation. Provision of domestic and foreign credits for government-budgeted finance had no statistically significant effect on the success of currency reforms, he added.

“The rationale for independence of the central bank was reinforced by the need to prevent and limit panic in the financial markets. The central bank is a device to overcome the problem of time consistency – the concern that policy makers renege in future on a policy promise made today. Keeping inflation low and stable requires a credible policy commitment to price stability”, he added.

Dr Javed said if the role is single-minded focus on monetary policy or price stability, the central bank independence and monetary policy independence are the same. Then this step will be very helpful to reduce inflation. The situation becomes more difficult in the developing countries where the role of the central bank encompasses multiple objectives such as growth, employment, financial inclusion in addition to price stability and financial stability.

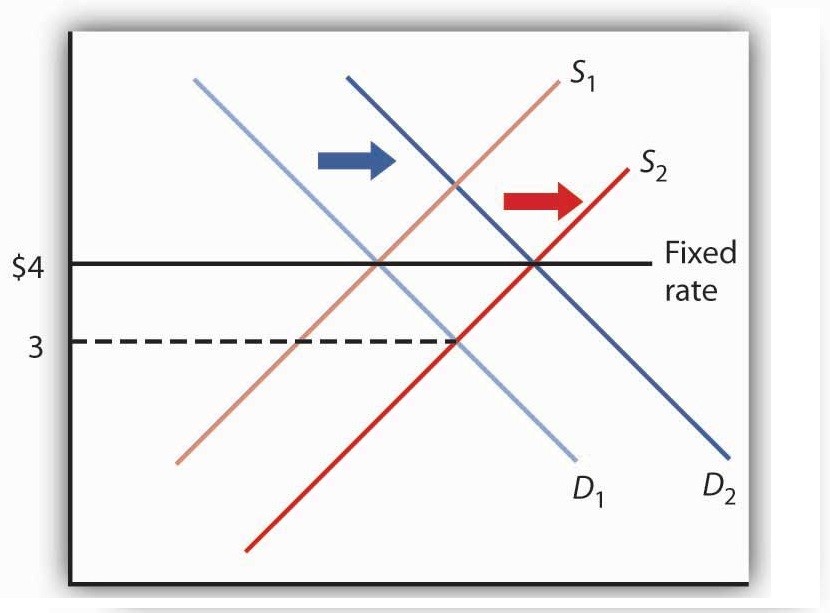

“Another effective way to reduce or eliminate this inflationary tendency is to fix the currency. A fixed exchange rate acts as a constraint that prevents the domestic money supply from rising too rapidly. In this case, the increase in the supply of domestic currency by the private investors will be purchased by the central bank to balance supply and demand at the fixed exchange rate”, he added.

Dr Javed said reducing inflation over a long period will require Pakistan to avoid devaluations. Devaluations occur because the central bank runs persistent balance of payment deficits and is about to run out of foreign exchange reserves. Once devaluation occurs, the country will be able to support a much higher level of money supply, which in turn will have a positive influence on the inflation rate.

Credit : Independent News Pakistan-WealthPk