INP-WealthPk

Fakiha Tariq

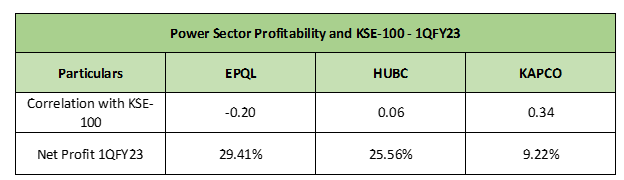

Engro Powergen Qadirpur Limited (EPQL) led the electricity generation sector by earning a net profit margin of 29.41% in the first quarter (July-Sept) of the ongoing fiscal year 2022-23, a study conducted by WealthPK shows. EPQL returns also found a negative correlation with the KSE- 100 index during the 1QFY23. To know about the correlation between financial assets helps investors design weighted portfolios and save their investments.

The WealthPK study also observed that companies with more market sensitivity posted lower profitability in the period under review. For 1QFY23, KSE-100 ended in quarterly loss of 501.68 points, but the power sector remained a potential investment opportunity for diversification. Market sensitivity has been calculated via taking correlation between the daily stock returns and KSE-100 index value during the 1QFY23.

In 1QFY23, the top three most profitable members of power generation and distribution sector were EPQL, the Hub Power Company Limited (HUBCO) and Kot Addu Power Company Limited (KAPCO). On the basis of market capitalisation, HUBCO led the power sector with market cap of Rs77.3 billion. Whereas, KAPCO and EPQL with the market caps of Rs23.4 billion and Rs7.8 billion, respectively, stood third and fifth.

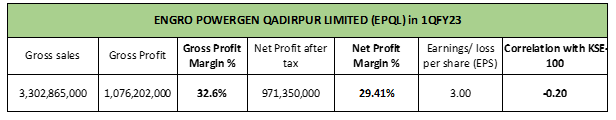

EPQL profits in 1QFY23

During the first quarter of FY23, EPQL earned the highest net profit of Rs971 million from the sales of Rs1.07 billion. The gross profit and net profit margins of EPQL reported to be 32.6% and 29.41%, respectively. EPQL derived the earnings per share of Rs3.00 in 1QFY23 for its shareholders.

EPQL stock returns were negatively correlated with the market, meaning it managed to bring returns when the market is bearish. Thus, EPQL investors earned on the market decline during the first quarter of FY23.

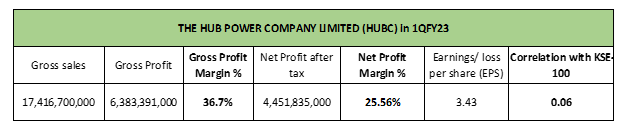

HUBCO profits in 1QFY23

HUBC with the net profit ratio of 25.56% grabbed the second highest position. It generated the EPS value of Rs3.43 for its investors in 1QFY23.

HUBCO showed weakly positive correlation with the market, thus getting impacted by the bearish market trend, and showing less profits than EPQL during 1QFY23.

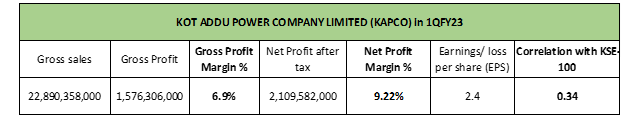

KAPCO profits in 1QFY23

Though KAPCO made the highest sales of Rs22 billion among the top three firms of the power sector, it could only generate a gross profit ratio of 6.9% in 1QFY23. KAPCO earned the net profit percentage of 9.22% and EPS value of Rs2.40 apiece in the first quarter of FY23.

Out of the top three power sector firms, KAPCO returns showed the highest correlation with KSE-100 and posted the third largest net profit margin of 9.22% in 1QFY23.

Credit : Independent News Pakistan-WealthPk