INP-WealthPk

Hifsa Raja

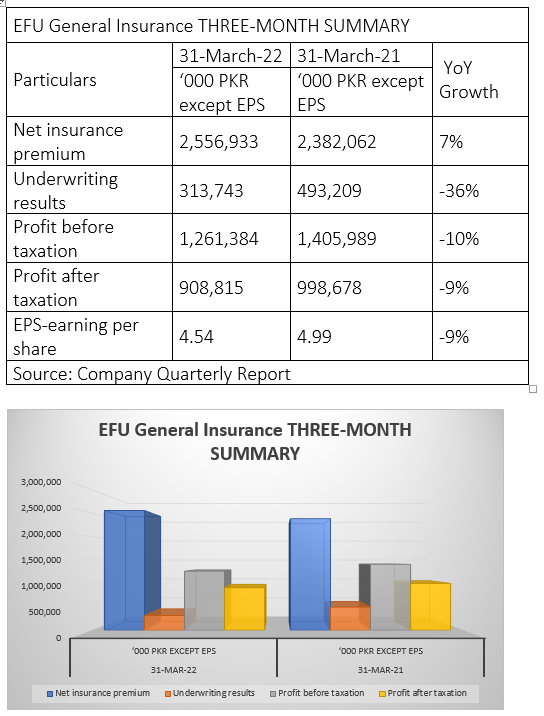

EFU General Insurance Limited netted Rs2.55 billion of insurance premium in the first quarter of calendar year (1QCY) 2022 compared with Rs2.38 billion in the corresponding period of the previous year.

The underwriting results during the three-month period of CY22 decreased to Rs313 million from Rs493 million in the corresponding period of CY21.

Due to increase in expenses, the profit-before-tax decreased by 10% in the 1QCY22 to Rs1.2 billion from Rs1.4 billion over the corresponding period of CY21.

Profit-after-tax declined by 10% to Rs908 million in the 1QCY22 from Rs998 million in the 1QCY21, reports WealthPK.

Annual Results 2021-22

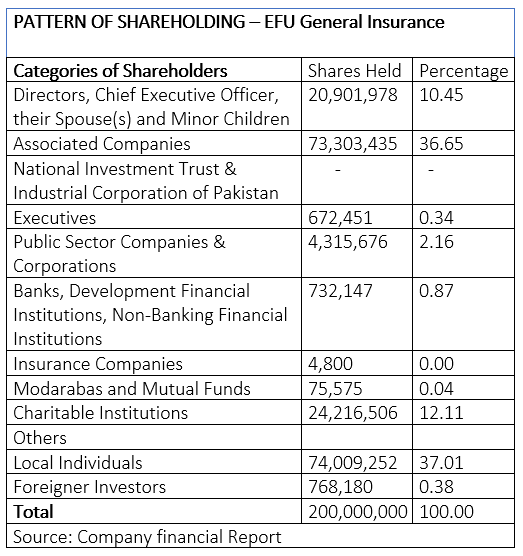

As of March 31, 2022, directors, the chief executive officer, their spouse(s) and minor children owned 10.45% and associated companies 36.65% of the company’s shares. Executives had 0.34% of the shares, public sector companies and corporations 2.16%, banks, development financial institutions and non-banking financial institutions 0.87%, insurance companies, modarabas and mutual funds 0.04%, charitable institutes 12.11%, local individuals 37.01%, and foreigners 0.38%.

Financial Performance

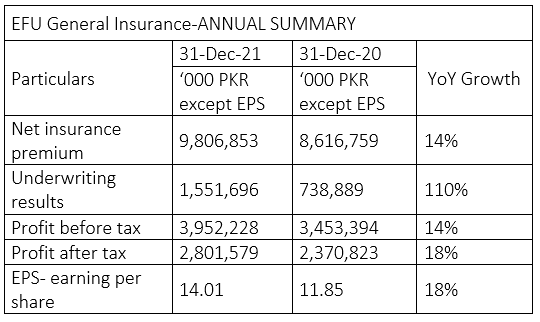

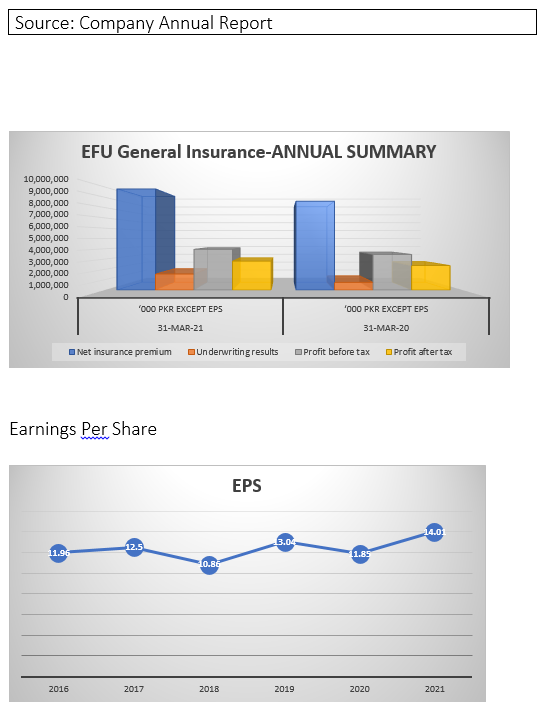

During the CY21, the company’s net insurance premium was up 14% to Rs9.8 billion from Rs8.6 billion in CY20. The underwriting results increased by 110% to Rs1.55 billion in CY21 from Rs738 million in CY21. The profit-after-tax in CY21 increased by 18% to Rs2.80 billion from Rs2.37 billion in CY20.

The earnings per share of EFU stood at Rs11.96 in 2016, Rs12.5 in 2017, Rs10.86 in 2018, Rs13.04 in 2019, Rs11.85 in 2020 and Rs14.01 in 2021.

Income and CF Analysis:

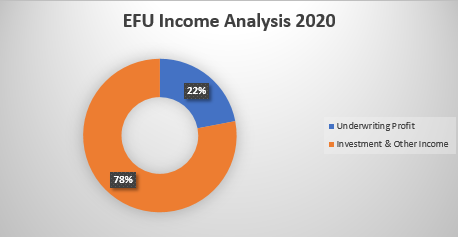

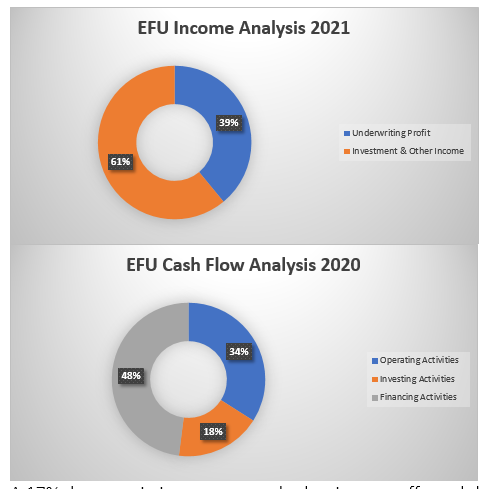

The share of underwriting profit was 22% in CY20 and increased to 39% in CY21. On the other hand, the share of investment and other income decreased from 78% in CY20 to 61% in CY21.

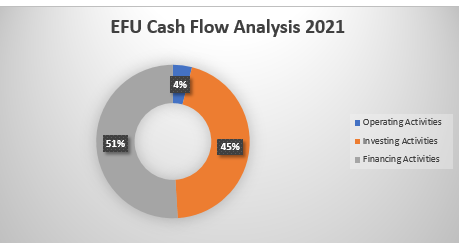

A 17% decrease in investment and other income affected the operating activities. The share of investing activities increased from 18% in CY20 to 45% in CY21. The share of financing activities increased from 48% in CY20 to 51% in CY21.