INP-WealthPk

Hifsa Raja

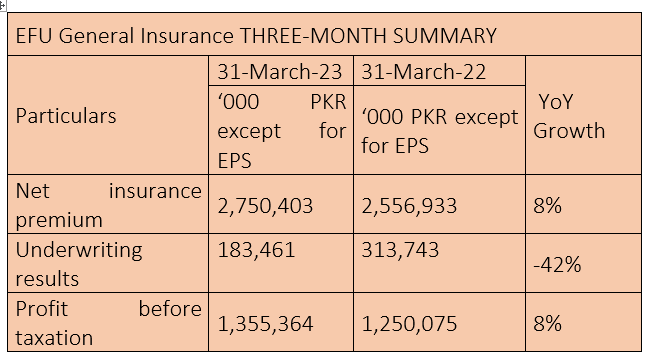

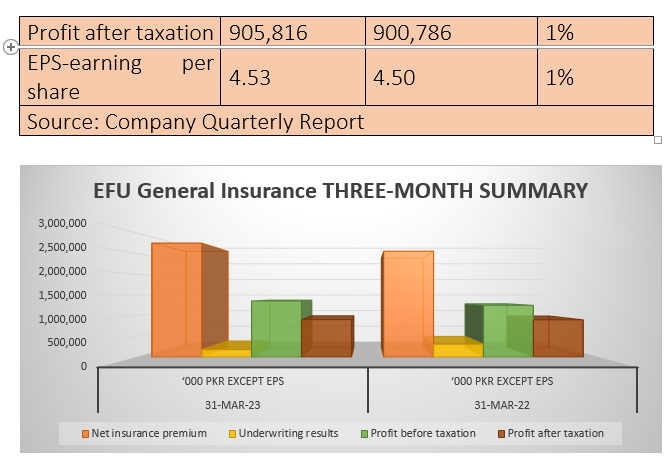

EFU General Insurance Limited netted an insurance premium of Rs2.75 billion in the first quarter of the ongoing calendar year 2023 (1QCY23) compared with Rs2.55 billion over the corresponding period of the previous year, registering an 8% yearly growth. The underwriting results during the three-month period of CY23 decreased to Rs183 million from Rs313 million over the corresponding period of CY22. Owing to a decrease in expenses, the profit-before-taxation increased by 8% in 1QCY23 to Rs1.35 billion from Rs1.25 billion over the corresponding period of CY22. The profit-after-tax increased by just 1% to Rs905 million in 1QCY23 from Rs900 million in 1QCY22.

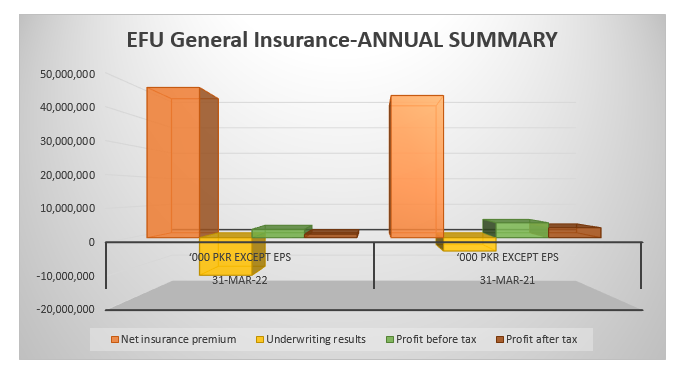

CY22 summary

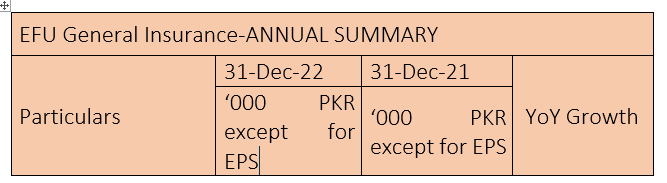

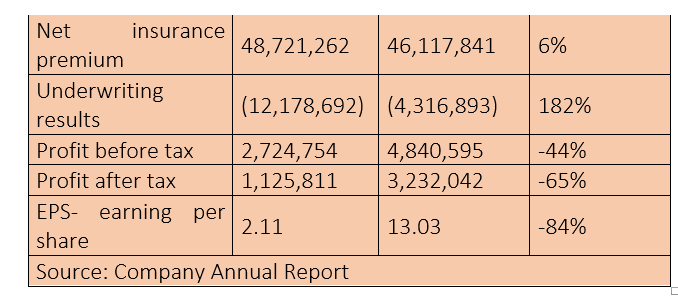

During CY22, the company’s net insurance premium was up 6% to Rs48 billion from Rs46 billion in CY21.

The underwriting results jumped 182% to Rs12 billion in CY22 from Rs4.3 billion in CY21.

However, the profit-after-tax decreased by 65% to Rs1.12 billion in CY22 from Rs3.23 billion in CY21.

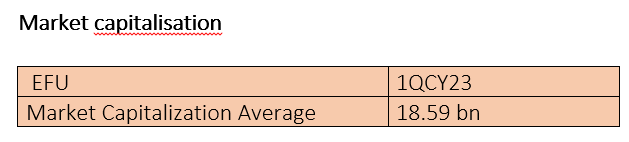

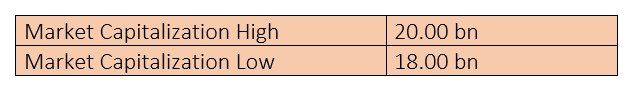

In the first quarter of CY23, EFU's market capitalisation experienced fluctuations. The average market cap stood at 18.59 billion. The highest market cap of Rs20 billion during this period suggested a peak in investor confidence and positive market sentiment towards the company.

The lowest market cap of Rs18 billion indicated a period of market uncertainty or reduced investor interest. These fluctuations in market capitalisation highlight the dynamic nature of the stock market and the impact of various factors on a company's perceived value.

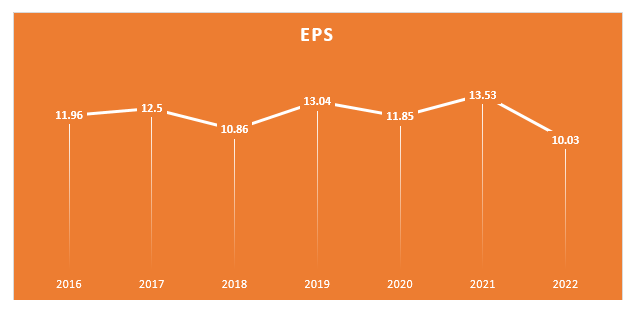

Earnings per share

The earnings per share of EFU stood at Rs11.96 in 2016, Rs12.5 in 2017, Rs10.86 in 2018, Rs13.04 in 2019, Rs11.85 in 2020, Rs13.53 in 2021 and Rs10.03 in 2022.

Industry comparison

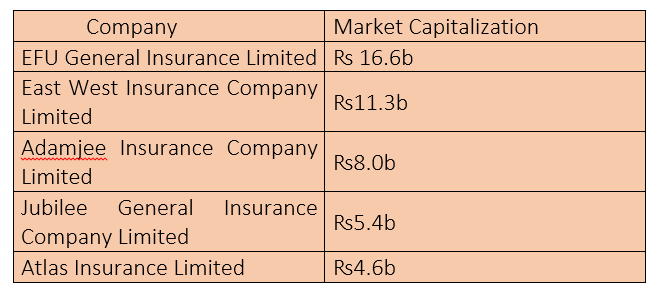

EFU General Insurance Limited’s competitors include East West Insurance Company Limited, Adamjee Insurance Company Limited, Jubilee General Insurance Company Limited and Atlas Insurance Limited.

EFU General Insurance Limited has a market cap of ₨16.6 billion, which is the highest among its competitors.

East West Insurance Company has the second highest market capitalisation of Rs11.3 billion.

Atlas Insurance has the lowest market cap of Rs4.6 billion.

About the company

EFU General Insurance Limited is engaged in the non-life insurance business. Its segments include fire and property damage, marine, motor and miscellaneous. It provides a range of insurance services to fulfil the needs of its customers, both commercial and individuals. Its fire and property damage portfolio ranges from residential property to industrial risks. The fire portfolio comprises operational risks. The engineering portfolio includes construction risks. Its marine, aviation and transport insurance covers goods in transit from all over the world to Pakistan and vice versa. Its motor insurance provides a range of products for all kinds of vehicles, being either private or commercial, and the coverage includes physical damage, including theft and liabilities. All other insurance products are covered under the miscellaneous segment.

Credit : Independent News Pakistan-WealthPk