INP-WealthPk

Amir Khan

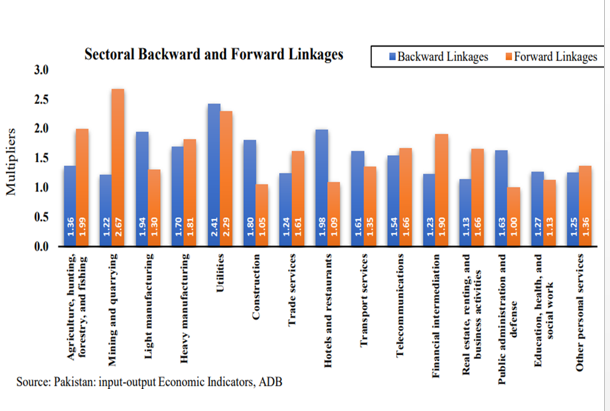

Transmission of both supply and demand-side shocks to various sectors is characterized by cyclical backward and forward linkages, influenced by the 2022 flood and global economic conditions. Backward linkages denote intersectoral flows between a specific sector and the sectors that supply its required inputs, said Dr. Shahid, economist at the Planning Commission of Pakistan.

Talking to WealthPK, he said, “Sectors with high backward linkages heavily rely on inputs from other sectors, making them vulnerable to supply chain disruptions. However, these linkages can also foster innovation and efficiency by leveraging diverse resources and expertise.”

According to Shahid, “When the energy prices go up, it affects how much it costs to make things and how much things cost to buy. This is because energy is an important part of producing goods and services. The countries that depend a lot on energy resources like oil can face even more pressure on prices when the oil prices go up’’. “Forward linkages represent relationships between a particular sector and the sectors that purchase its output” he said. “Strong forward linkages indicate dependence on a sector's products or services, potentially granting it market power and a crucial role in the economy.

While strong forward linkages can stimulate investments and growth, downturns in purchasing sectors can adversely affect the sector's performance,” he added. He pointed out, “The agricultural sector serves as a prime example of the impact of backward and forward linkages on Pakistan's economy. Despite its importance for economic growth, food security, employment generation, and poverty alleviation, the agricultural sector experienced a loss in GDP due to the flash floods in FY2023.” “With strong linkages to the industrial and services sectors, this loss in the agricultural sector's GDP transmitted its effects, reducing overall GDP through intersectoral flows,’’ he said.

The key factor in this process is the multiplier effect which further exacerbates the impact of economic shocks on sectors and the economy as a whole, Shahid explained.When input prices increase, the prices of outputs surpass the initial shock. For instance, Pakistan's heavy reliance on oil exposes it to global oil shocks. As oil prices rise, it affects not only the industrial sector but also numerous other sectors, significantly deteriorating the economy as shown in the below graph.

According to Dr Shahid, “The multiplier effect can be illustrated using the agricultural sector as an example. Owing to its connections with other sectors like industry and services, the decline in GDP caused by the flood has had a broader impact on the country's economic growth. Specifically, if we analyze the interconnections between agriculture and other sectors, a 1-million-rupee loss in agricultural GDP would lead to a 1.9-million-rupee reduction in the overall GDP of the country.’’

“The interconnectivity of sectors through backward and forward linkages highlights the need for a comprehensive understanding of the economy's resilience to shocks. The policymakers must consider the potential ripple effects and implement strategies to mitigate vulnerabilities and foster economic stability in the face of global challenges,’’ he said.

Credit : Independent News Pakistan-WealthPk