INP-WealthPk

Amir Khan

The overall decline in foreign direct investment (FDI) and remittances poses a serious risk to Pakistan's economic stability and ability to meet its external obligations, said Dr Muhammad Afzal, an economist at the Planning Commission, while taking to WealthPK.

''The decline in investment is not limited to the FDI alone. Pakistan's investment-to-GDP ratio has hit a record low of 13.5%, highlighting concerns about sovereign default, uncertain taxation policies, restrictions on repatriation of profits, and continuing political tensions. The decline in profits and dividends on foreign investments has further discouraged the foreign investors,’’ he said.

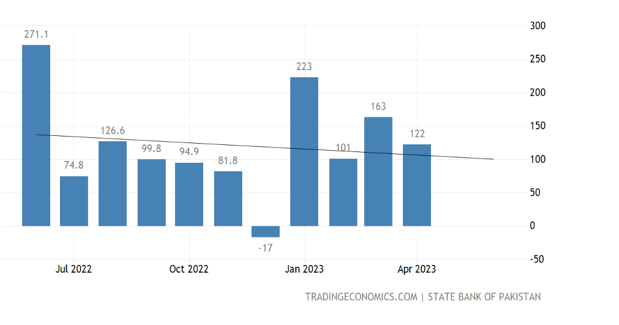

The above graph shows the decreasing trend of FDI in FY 2023

“The FDI plays a crucial role in the economic development of developing countries like Pakistan. It provides capital for positive externalities such as employment generation, technology transfer, managerial skills, productivity gains, research and development, and new production methods,” he added.

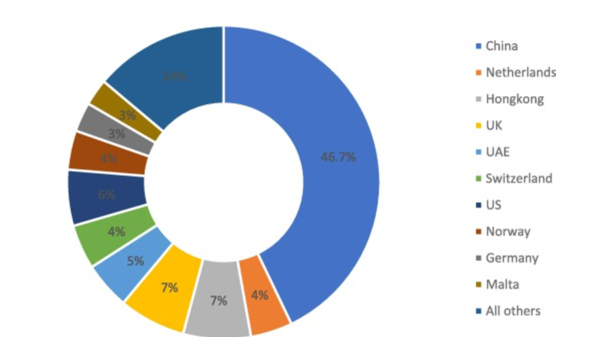

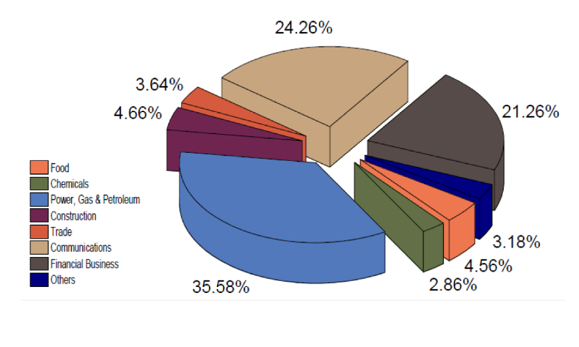

Pakistan has attracted foreign direct investment from various countries, including China, the United States, Japan, Norway, the United Kingdom, Saudi Arabia, and Switzerland. These investments have been made in power and energy, finance, trade, construction, transport, textiles, and many more sectors as shown in the graph below.

China plays a pivotal role in Pakistan's foreign direct investment (FDI) landscape, thanks to its substantial contributions to the energy and infrastructure sectors.

According to Dr Muhammad Afzal, Pakistan's economy greatly benefits from these investments, particularly through the establishment of special economic zones and improved road connectivity. The Chinese investment of over 350 billion in FY 2023 significantly impacts Pakistan's economic growth and development.

“Energy and power are vital inputs for economic productivity and a measure of a country's socioeconomic development. Pakistan's energy demand and consumption have consistently increased due to the population growth. However, the country is currently facing a severe energy crisis due to heavy reliance on oil and gas, de-rated capacity, circular debt, energy security threats, and governance issues,” he pointed out.

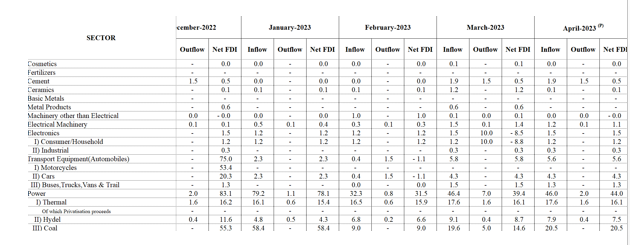

The energy sector receives the largest share of the FDI, as it holds significant importance for the Pakistani economy. However, the country is currently grappling with a severe energy crisis due to a decline in FDI specifically targeted at this sector in FY2023.

In terms of electricity capacity, Pakistan's total installed capacity stands at 41,000MW. However, the current power demand has surged to 21,500MW, while the supply is only 17,500MW, resulting in a shortfall of approximately 4,000MW.

Showing his concern, Dr Muhammad Afzal said, ’’The decline in foreign direct investment in the power sector serves as an indicator of the potential energy crisis that lies ahead. This situation has a significant multiplier effect, disrupting not only the economy as a whole but also the domestic markets and various sectors within the economy.’’

To address this situation, the government should focus on enhancing the investment climate, diversifying the economy, promoting innovation and technology transfer, improving infrastructure and connectivity, and strengthening international cooperation, he suggested.

Credit : Independent News Pakistan-INP wealth pak