INP-WealthPk

Fakiha Tariq

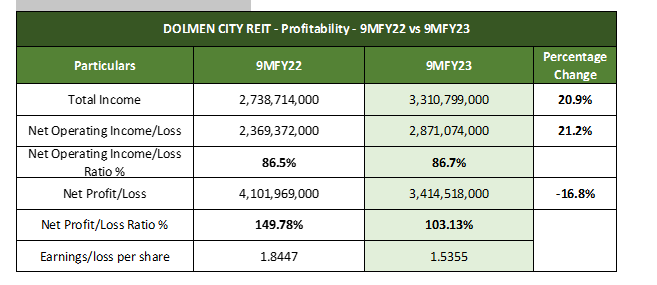

Dolmen City REIT (DCR) saw its revenues increase by 20.9% and gross profit by 21.2% in the first nine months (July-March) of the ongoing fiscal year 2022-23, but its net profit declined by 16.8% compared to the corresponding period of the previous fiscal, WealthPK reports. DCR made total income of Rs3.3 billion in 9MFY23, and a gross profit of Rs2.87 billion and net profit of Rs3.41 billion on it.

Therefore, DCR reported a gross profit ratio of 86.7% and net profit ratio of 103.13% in 9MFY23, respectively. DCR posted earnings per share (EPS) of Rs1.5355 in the nine-month period of FY23.

The real estate investment firm pocketed revenues of Rs2.7 billion, gross profit of Rs2.3 billion and net profit of Rs4.10 billion in 9MFY22. Though the company’s gross profit increased, its net profitability and EPS margins reduced. DCR, the second real estate investment trust registered on the Pakistan Stock Exchange (PSX), has a market capitalisation of Rs30.4 billion.

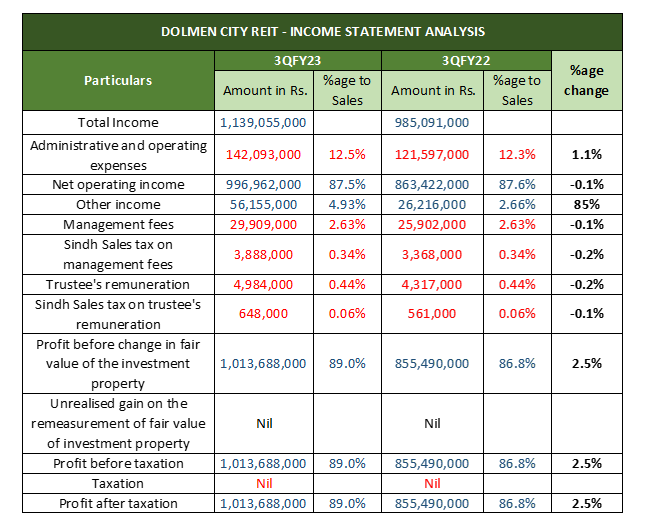

Income Statement Analysis – 3QFY23

In the third most recent quarter (January-March) of FY23, DCR’s financials showed slight changes in comparison to the same period of FY22. Income from other sources contributed the largest share of the net profit in this quarter. During this quarter, DCR made sales of Rs1.13 billion. The highest cost borne by the company in 3QFY23 was its administrative and operating expenses, which reduced the firm’s sales by 12.5%. The company bore Rs142 million as administration and operating expenses, meaning DCR posted operating profit of Rs996 million and operating profit ratio of 87.5% in this quarter.

Under the head of “other income”, the company added 4.93% to the sales worth Rs56 million. DCR paid the second-biggest expense as management fee, which chipped away at the sales by up to Rs29 million or 2.63% of the total income. Payment of the trustee’s remuneration reduced the sales by 0.44%, or Rs4.9 million. As regards Sindh government’s sales tax, DCR bore 0.34% and 0.06% on management fee and trustee’s remuneration, respectively.

DCR declared Rs1.013 billion as profit before the change in the fair value of the investment property (FVIP). Thus, the profit before FVIP ratio came out to be 89% of the total income. As the firm did not post any amount under the head of unrealised gain, it reported the same amount of Rs1.013 billion as profit-before-tax. As DCR is a trust and is, therefore, exempt from corporate tax payment, it posted net profit of Rs1.013 billion and net profit ratio of 89% in the third quarter of FY23.

Income Statement Analysis – 3QFY23 vs 3QFY22

Compared to the third quarter of FY22, DCR collected incremented revenues by 18.5%, which positively affected the overall profitability. The company’s administration and operating expenses increased, thus burdening the total income by 1.1% more in 3QFY23 than 3QFY22. DCR’s net operating profit reduced by 0.1%.

The addition to the income from the “other income” head saw a huge increase of 85%. In 3QFY23, expense of management fees and trustee’s remuneration burdened the sales by 0.1 and 0.2 percentage points less, respectively. Under the head of Sindh government’s sales tax, the company reduced its outflow by 0.2% and 0.1% on management fees and trustee’s remuneration, respectively.

The reduced expenses and high cash inflow from “other income” head helped DCR post 2.5% increase in profit-before-FVIP in 3QFY23 compared to 3QFY22. DCR posted incremented net profit by 2.5% in 3QFY23.

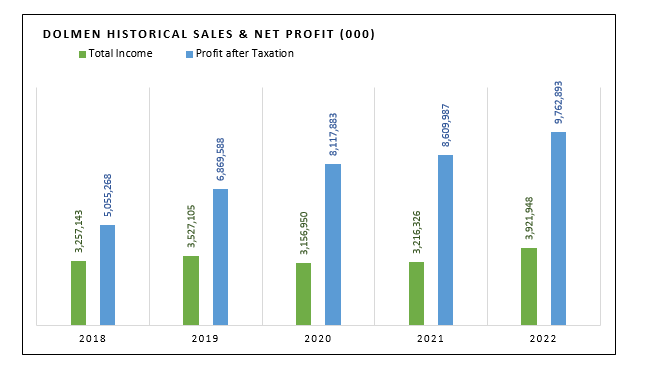

Historical Analysis – FY18-FY22

Historical analysis shows DCR has been raising its total income and net profit since 2018. During the last five years (2018-2022), DCR posted the highest income of Rs3.92 billion in 2022 and the lowest Rs3.1 billion in 2020.

From 2018 to 2022, the company declared the highest net profit values of Rs9.7 billion in 2022 and the lowest Rs5.05 billion in 2018.

DCR raised its sales from Rs3.2 billion in 2018 to Rs3.5 billion in 2019 followed by a slight dip in 2020 to Rs3.1 billion. The firm’s income increased in 2021 to Rs3.2 billion. From there, DCR posted the highest last five-year sales in 2022.

In the last five years, DCR’s net profit showed an upward trend. The firm raised its net profit from Rs5.05 billion in 2018 to Rs6.86 billion in 2019 followed by a jump in net profit in 2020 to Rs8.11 billion. The firm’s net profit kept on increasing in 2021 to Rs8.6 billion and Rs9.7 billion in 2022.

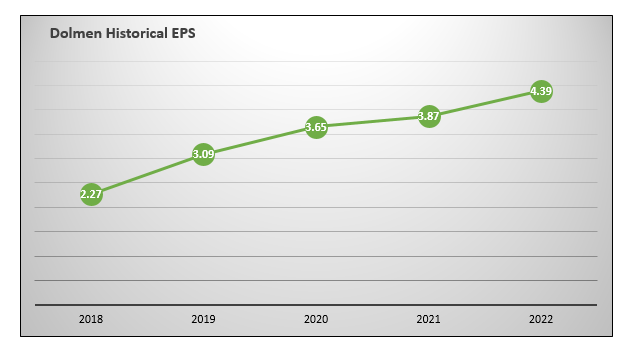

During the last five years, the company posted the highest EPS of Rs4.39 in 2022. DCR’s EPS also showed a continuous upward trend since 2018. The real estate firm posted the lowest five-year EPS of Rs2.27 in 2018.

Credit : Independent News Pakistan-WealthPk