INP-WealthPk

Qudsia Bano

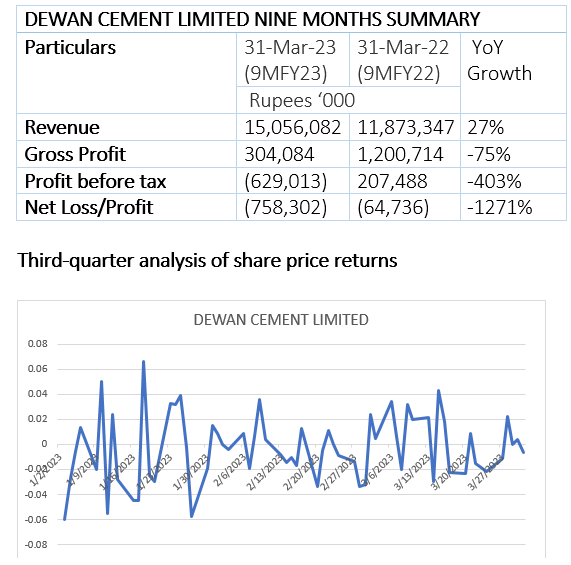

Dewan Cement Limited’s revenue went up to Rs15.06 billion in the first nine months of the ongoing fiscal year 2022-23 from Rs11.87 billion recorded over the corresponding period of the previous fiscal, registering a significant growth of 27% year-on-year, reflecting the company's ability to generate higher sales. However, the company’s gross profit plunged to Rs304 million in 9MFY23 from Rs1.20 billion over the same period of last year. This marks a substantial decrease of 75% in gross profit, indicating the challenges or inefficiencies in the company's cost structure or pricing strategies.

The company also reported a loss-before-tax of Rs629 million as against a profit of Rs207 million in 9MFY22, posting a whopping 403% negative growth, and indicating a challenging business environment or internal factors affecting the company's profitability. Furthermore, Dewan Cement Limited’s net loss soared to Rs758 million from Rs64.7 million in 9MFY22. This represents a substantial increase of 1271% in net loss, highlighting the financial difficulties faced by the company during the nine months under review, reports WealthPK.

The share prices of Dewan Cement in third quarter (January-March) of FY23 reflect fluctuations in investor sentiment and market conditions. In January, the share price started at 5.53 and gradually declined, reaching a low of 4.51. There was some volatility during the month with minor ups and downs. In February, the share price remained relatively stable around the range of 4.55 to 4.91, with no significant fluctuations. In March, the share price experienced a moderate increase during the first half of the month, reaching a high of 4.9. However, it started declining afterward, ending the month at 4.59. It is important to note that share prices are influenced by various factors, including market conditions, investor sentiment, company performance and industry dynamics.

Recent events

Dewan Cement Limited has made significant changes to its management structure with the appointment of new chief executive officer and chairman Board of Directors. In a recent notice, the company announced that Ghazanfar Babar Siddiqi has been appointed as the new CEO, while Mr Ishtiaq as the Chairman of Board of Directors. These appointments reflect the company's commitment to strengthening its leadership role to achieve the targeted growth. The company also held a board meeting where seven new directors were appointed. This move was aimed at ensuring the company had the necessary expertise and diversity on its board to guide its strategic direction and decision-making.

Credit: Independent News Pakistan-WealthPk