INP-WealthPk

Fakiha Tariq

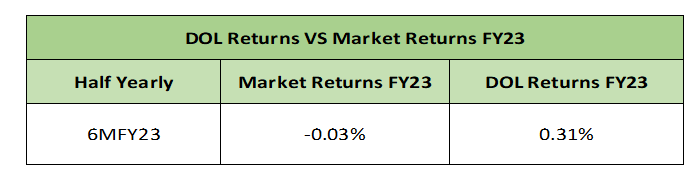

Descon Oxychem Limited (DOL) generated positive stock returns of 0.31% on average by the mid of (Jul to Dec) Fiscal Year 23, shows a study conducted by WealthPK.

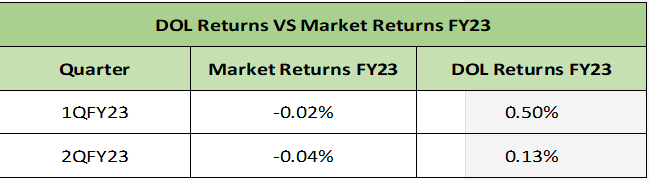

While the KSE All Share Index (ALLSHR) braced a loss of 0.03% by the end of 6MFY23, DOL shares brought profits of 0.31% to its shareholder’s portfolios. Breaking down into first two quarters (Jul to Sept and Oct to Dec) of the Fiscal Year 23, DOL brought about stock returns of 0.50% and 0.13% in 1QFY23 and 2QFY23, respectively.

Descon traded under the symbol of DOL and with the market capitalisation of Rs4.1 billion shares, ranking the 11th out of 25 companies listed in the chemical sector. DOL became a public limited company in 2008 and is a serving part of Pakistan’s leading engineering enterprise Descon in the chemical sector.

DOL is primarily engaged in the production and sale of hydrogen peroxide (H2O2) for commercial purposes.

Descon Oxychem Market Analysis – 6MFY23

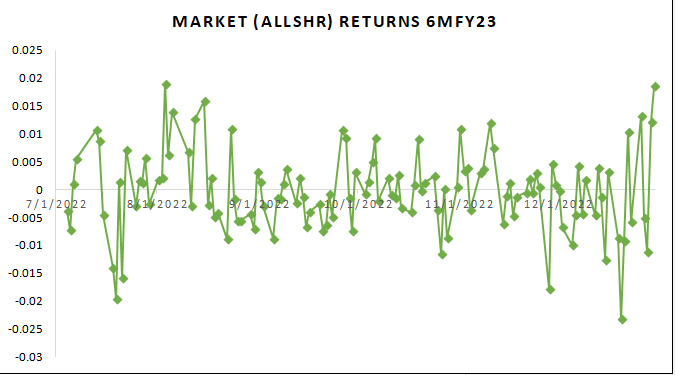

In the first six months (Jul to Dec) of the Fiscal Year 2023, on average, the stock market (PSX all share index) exhibited loss and generated negative returns of 0.03%.

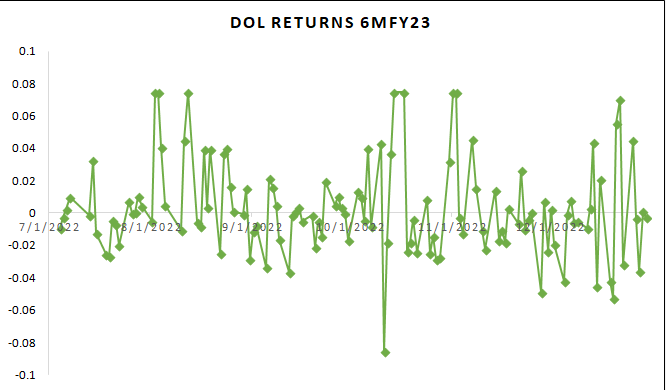

However, in comparison to the market returns, Descon Oxychem Limited brought average positive stock returns for its investors by 0.31% by the end of 6MFY23.

It can be clearly seen in the graphical representation of market returns and DOL stock return that the spikes for DOL stock returns remained higher throughout the first six months of fiscal year 23.

In 1QFY23, where market remained in loss of 0.02%, DOL stocks generated profits of 0.50% for its investors. Likewise, profits of 0.13% were generated for the DOL shareholders in 2QFY23, when the market experienced the increased percentage of loss of 0.04%.

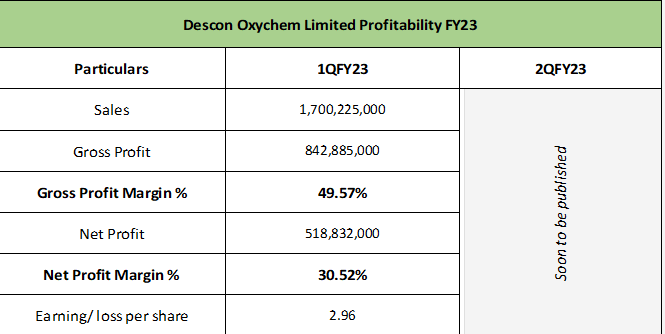

In the first quarter (Jul to Sept) of the Fiscal Year 23, Descon Oxychem Limited generated a massive gross profit of 49.57% and net profit of 30.52% from the total sales of 1.7 billion rupees. The gross profit in price was reported to be Rs842 million. The net profit of Rs518 million resulted in the earnings of Rs2.96 per share.

However, by securing a hefty gross profit of 36.48% and net profit of 20.95% in the second quarter of the last Fiscal Year 22 (2QFY22), Descon leaves mark for 2QFY23 to get registered as another profitable quarter of trade. The financial results for the second quarter (Oct to Dec) of Fiscal Year 23 are soon to be published.

Credit: Independent News Pakistan-WealthPk