INP-WealthPk

Muneeb ur Rehman

The government is implementing specific measures to control inflation, but this trend is likely to persist due to the significant impact of imports on the overall price level. Talking to WealthPK, Khurram Shahzad, former director of the State Bank of Pakistan, said Pakistan’s consumption basket included items directly or indirectly connected to imports. As a result, the inflation rate was primarily influenced by imports, rather than the government's initiatives like raising the policy rate, implementing Sasta Bazaar package, or providing subsidies to the utility stores.

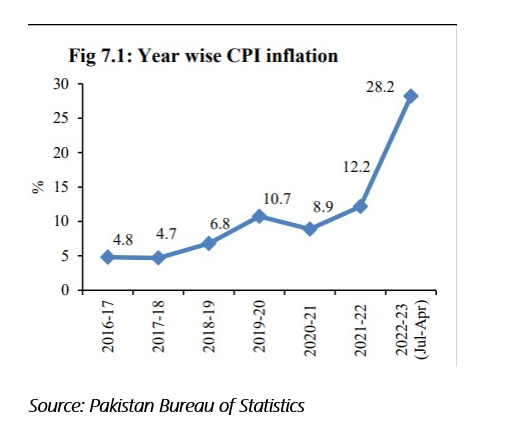

According to the Pakistan Bureau of Statistics (PBS), the Consumer Price Index (CPI) remained at 36.4% in April this year, which was higher than 35.4% in the previous month and 13.4% in April 2022. On average, the CPI for the July-April period in FY2023 was recorded at 28.2%, compared to 11.0% during the same period in the previous year.

Explaining the direct role of imports in the general price level, Khurram said, “Pakistan's dependence on imported commodities, including edible oil, tea, pulses, wheat, and other agricultural inputs, has grown due to insufficient domestic production. These imported goods often lead to an upward influence on food inflation, particularly when the value of the Pakistani rupee (PKR) depreciates”. According to the Pakistan Economic Survey (PES), food imports increased to USD8 billion, while exports remained at USD5.4 billion during the FY 2022-23.

The SBP ex-official added that the inflation rate was indirectly influenced by imports through the energy prices because a significant portion of energy production relied on the imported fossil fuels, and thus, the value of imports played a crucial role in determining the energy prices.“To address the rising challenge of inflation, the State Bank of Pakistan took the unprecedented step of raising the policy rate to 22% under the IMF direction. However, the intended purpose of increasing the savings and reducing the money supply could not be achieved due to the weak correlation between the savings and policy rate,” said Khurram. The increasing inflation is gradually limiting the purchasing power of the people. To mitigate this, reducing dependence on imports would assist the country in lowering the overall price level.

Credit: INP-WealthPk