INP-WealthPk

Ayesha Saba

The rupee's instability against dollar has discouraged foreign investors from investing in Pakistan, resulting in the country's deprivation of a source of liquidity to absorb financial shocks amid a struggling economy, said a renowned economist. “Foreign direct investment (FDI) plays a crucial role in driving economic growth, creating job opportunities, and transferring technology and knowledge. Currency fluctuations have significant impact on FDI in Pakistan. When a country's currency experiences significant fluctuations, it creates uncertainty and risks for foreign investors,” said Haroon Sharif, former chairman of Board of Investment (BoI), while talking to WealthPK.

He said fluctuations in the value of PKR affects the profitability and returns on investments made in Pakistan. “For instance, if a foreign investor invests in Pakistan when the PKR is strong and later experiences a sudden depreciation, their investment value will decrease when converted back into their home currency. This can erode investor confidence and discourage future investments,” he explained. Pakistan’s economy has long struggled with twin deficits, current account and fiscal deficit.

“They have now been overtaken by a third deficit, which is the trust deficit. There is a trust deficit from the rest of the world, particularly the investors,” he pointed out. Haroon said the country's economic difficulties, coupled with its political unrest, are deterring foreign investors from investing in the country. “If we really want a dignified revival of the economy, and stand among progressive nations, we need to increase the trust level and give signals right now. We need to demonstrate that we can do something,” he emphasised.

The economic expert pointed out that low investment was one of the core reasons why Pakistan’s growth in exports has been negative over several years. “We have just thought we keep living on borrowing. Now the time has come we cannot borrow much because repayment capabilities are shrinking,” he said. Haroon said the government needs to take proactive measures to stabilise the exchange rate. “One of the measures that can be taken is to ensure a stable macroeconomic environment by implementing sound economic policies such as incentives for investment, tax breaks, sector-specific subsidies, and business-friendly policies. The government can also work towards increasing exports to generate foreign exchange,” he suggested.

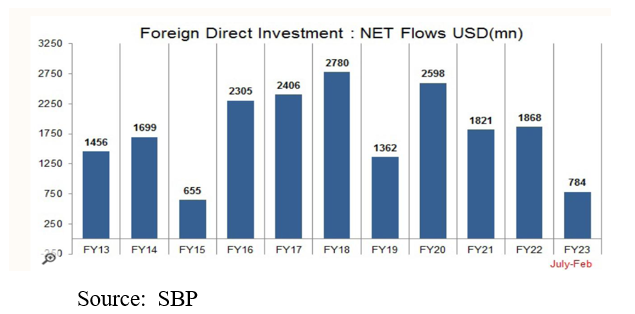

According to the data available from the State Bank of Pakistan (SBP), net FDI was not even $1 billion during the first eight months (July-February) of the current fiscal year (2022-23). During this period, the country attracted net FDI of $784 million, down by 40% on year-on-year (YoY) basis from $1.3 billion during 8MFY22. While outflows have been higher in some months and lower in others, the FDI inflows have been continuously falling.

Credit: Independent News Pakistan-WealthPk