INP-WealthPk

Hifsa Raja

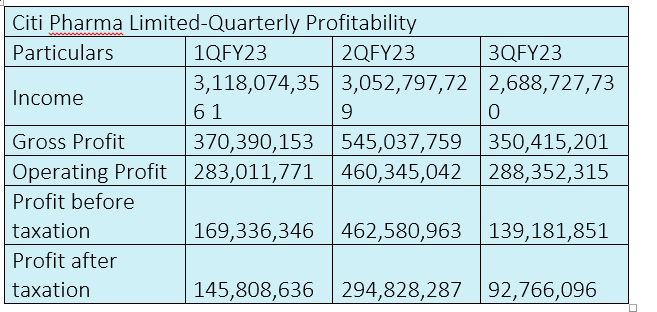

Citi Pharma Limited showcased ‘impressive’ performance during the first two quarters of the outgoing fiscal year 2022-23, but the revenues (income) and profitability dwindled during the third quarter.

In the first quarter (July-Sept) of FY23, Citi Pharma posted income of Rs3.1 billion, gross profit of Rs370 million and net profit of Rs145 million.

The company posted income of Rs3.05 billion, gross profit of Rs545 million and net profit of Rs294 million in the second quarter (Oct-Dec).

In the third quarter (Jan-March), the company posted income of Rs2.68 billion, gross profit of Rs350 million and net profit of Rs92 million.

Performance in FY22

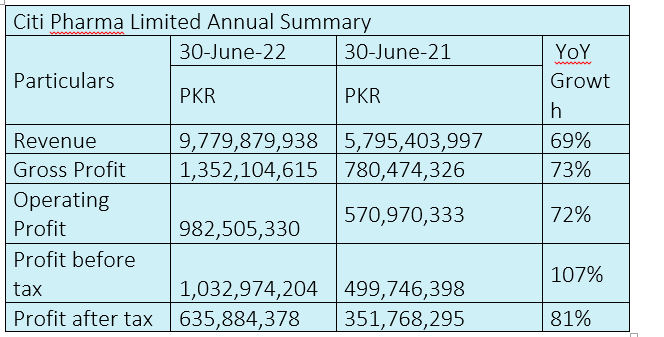

In the fiscal year 2021-22, the company’s sales increased 69% to Rs9.7 billion from Rs5.7 billion the previous year.

The gross profit also experienced increase, standing at Rs1.35 billion, up 73% from the previous year's Rs780 million.

The operating profit also increased to Rs982 million, up 72% from the previous year's Rs570 million.

The company’s profit-before-tax jumped 107% to Rs1.03 billion in FY22 from the previous year's Rs499 million.

The company’s profit-after-tax also jumped to Rs635 million in FY22 from the previous year's Rs351 million.

Earnings per share (EPS)

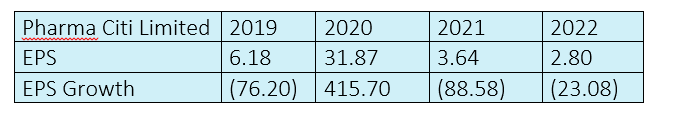

In 2019, the company recorded an EPS of Rs6.18, which leapt to Rs31.87 in 2020, demonstrating an outstanding growth of 415%, but the EPS plunged to Rs3.64 in 2021 with the EPS growth turning negative (88.58%).

The EPS further dropped to Rs2.80 in 2022, again demonstrating a negative growth of 23% compared to the previous year.

These fluctuations in its EPS demonstrate the challenges and uncertainties faced by Citi Pharma during this period. Factors such as market dynamics, regulatory changes, and global economic conditions can significantly impact a company's financial performance.

It remains to be seen as to how Citi Pharma Limited will strategise and navigate through these challenges in the coming years. The company's ability to adapt, innovate and capitalise on emerging opportunities will be crucial in regaining growth and profitability.

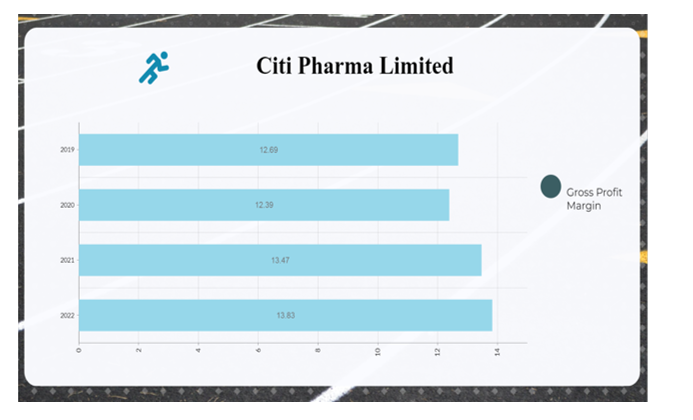

Ratio analysis

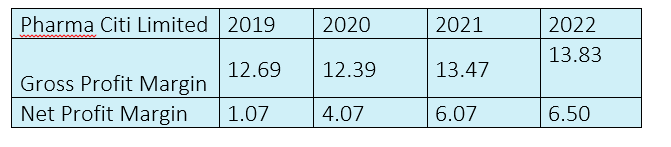

In 2019, the company’s gross profit margin was 12.69%, but slightly declined in 2020 to 12.39%. However, the gross profit margin continued to improve to 13.47% in 2021 and 13.83% in 2022. The net profit margin stood at 1.07% in 2019, and increased to 4.07% in 2020, 6.07% in 2021 and 6.50% in 2022.

This remarkable growth in 2022 indicates a significant increase in profitability, which can be attributed to successful strategic decisions, effective cost management, and increased revenue generation.

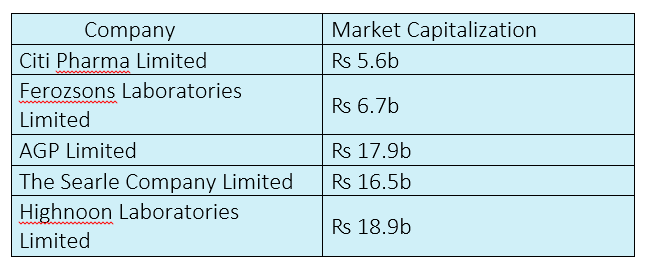

Industry comparison

Citi Pharma Limited’s competitors include Ferozsons Laboratories Limited, AGP Limited, The Searle Company Limited, and Highnoon Laboratories Limited.

Citi Pharma Limited has the lowest market capitalisation of ₨5.6 billion, while Highnoon Laboratories Limited has the highest market value of Rs18.9 billion.

Future prospects

The company has expanded its existing capacity of producing 3,600 tonnes of Paracetamol per annum to 5,400 tonnes, and intends to increase it to 6,000 tonnes per annum. Further, the company has added active pharmaceutical ingredients (APIs) to its existing product line, i.e. Ascorbic Acid, Chloroquine Phosphate and Hydroxychloroquine Sulfate. These will also add formulation products of the same to the company’s portfolio.

In the formulation segment, the company is building three manufacturing facilities, which will increase its total capacity to 200,000 vials/injectable per day, dry powder/suspension 60,000 bottles per day, capsules 4,200,000 per day, and tablets 4,500,000 per day. These include dedicated lines for Penicillin 36, Cephalosporin, and Psychotropic & Narcotics drugs 37.

As per guidelines of DRAP, in API manufacturing, a separate dedicated line is required to eliminate any chances of cross contamination. Citi Pharma’s in-house engineering team shall be responsible for civil, electrical and mechanical work for both API and formulation. Further, they will also be responsible for procurement and installation of machinery for both the API and formulation.

Company profile

Citi Pharma was incorporated as a private limited company in Pakistan under the now repealed Companies Ordinance, 1984 on October 08, 2012. The principal activity of the company is manufacturing and sale of pharmaceuticals, medical chemicals and botanical products.

Credit: INP-WealthPk