INP-WealthPk

Hifsa Raja

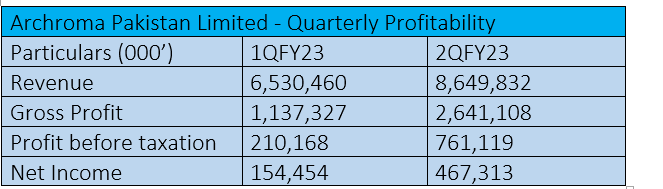

Chemical manufacturer Archroma Pakistan Limited (ARPL) experienced an upward trend in profitability in the first two quarters of its own financial year, which runs from October to September.

The net income also witnessed a significant rise quarter-on-quarter.

In the first quarter (Oct-Dec) of FY23, the company posted gross revenues of Rs6.5 billion and a gross profit of Rs1.1 billion. The company posted a net profit of Rs154 million in 1QFY23.

In the second quarter (January-March), ARPL posted a gross revenue of Rs8.6 billion and a gross profit of Rs2.6 billion. The company posted a net profit of Rs467 million, demonstrating a noteworthy surge from the first quarter, reflecting effective cost management and operational efficiency.

Performance in FY22

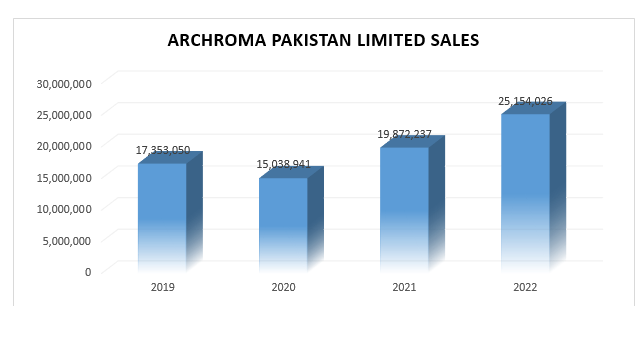

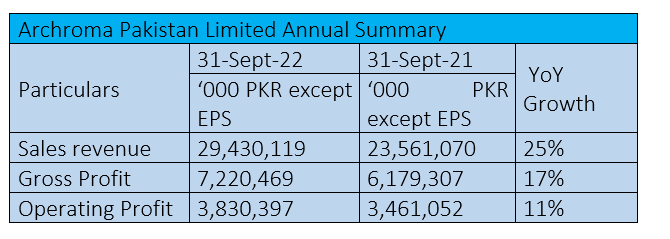

In the fiscal year 2021-22, the company’s sales revenue leapt to Rs29 billion from Rs23 billion in FY21, posting a growth of 25%. Similarly, the gross profit surged to Rs7.2 billion, up 17% from the previous year's Rs6.1 billion.

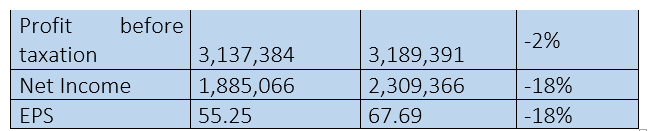

The company managed to achieve an 11% growth in operating profit, which increased to Rs3.8 billion in FY22 from the previous year's Rs3.4 billion. However, the company recorded a 2% dip in profit-before-tax, which inched down to Rs3.13 billion in FY22 from Rs3.18 billion in FY21 The profit-after-tax for FY22 also fell by 18% to Rs1.88 billion from Rs2.30 billion in FY21.

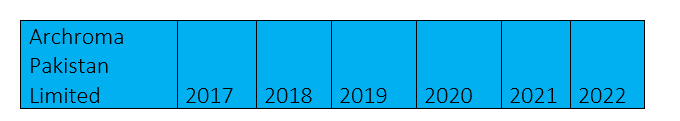

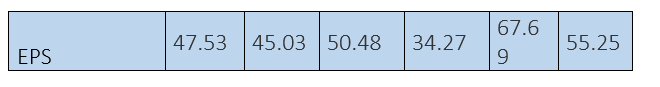

Earnings Per Share

Over the past few years, the earnings per share (EPS) of the company have shown a mixed trend since 2017. In 2017, the EPS showed a value of Rs47.53, which dipped to Rs45.03 in 2018. However, EPS jumped to Rs50.48 in 2019, before falling to Rs34.27 in 2020 due to effects of the Covid-19-induced lockdowns on the economy. In 2021, the company rebounded and gave an all-time high EPS of Rs67.69, before falling to still robust Rs55.25 in 2022.

In the latest financial update for the company’s own fiscal year 2022-23, its EPS showcased a mixed performance in the first two quarters. During the first quarter, the company reported an EPS of Rs4.53, indicating a less than promising start to the year. However, the second quarter witnessed a surge in EPS as it increased to Rs13.69. As the financial year progresses, the company's EPS is expected to be relatively stable.

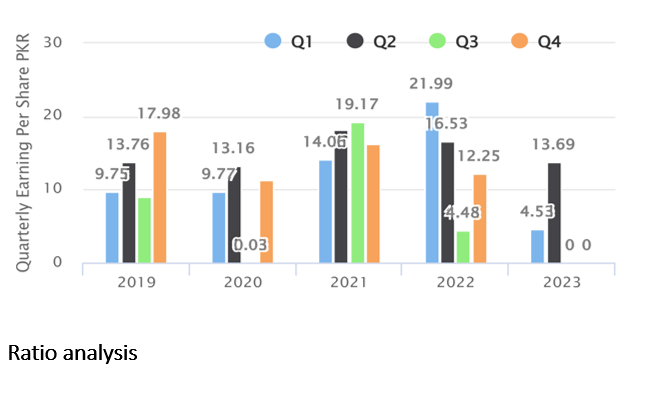

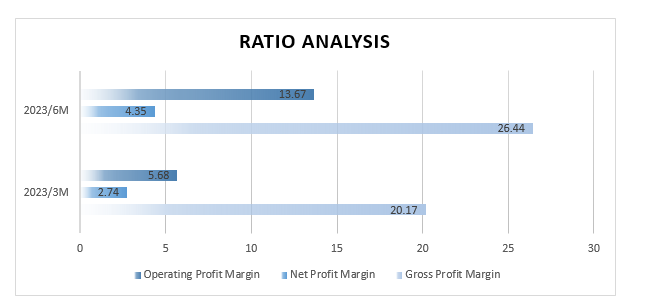

In the first quarter of FY23, the gross profit margin stood at 20.17%, proving the company effectively managed its production costs and generated a substantial profit from its operations. The net profit margin stood at 2.74% after accounting for all other taxes during the first quarter. This indicates the company is successfully controlling its expenses and generating a reasonable profit after accounting for taxes and other costs. The operating profit margin was 5.68% for 1QFY23, suggesting the efficient management of operational expenses and a positive return on investments. Overall, these figures indicate a good financial performance for the company in this quarter.

In the second quarter, operating, net, and gross profit margin numbers all increased significantly. The gross profit margin jumped to 26.44%, net profit margin to 4.35% and operating profit margin to 13.67%, respectively. These figures highlight a positive financial performance for the company in the first quarter of FY23.

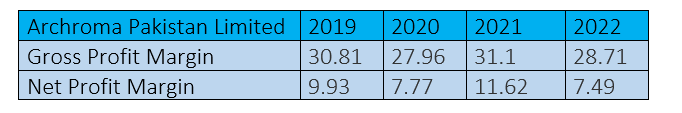

The firm's financial performance remained strong in 2019, as seen by the large gross profit and net profit margins of 30.81% and 9.93%, respectively. However, net profit margin decreased to 7.77% and gross profit margin to 27.96% in 2020, indicating the expenses other than the cost of goods sold. Between 2021 and 2022, the profitability also dipped significantly.

Overall, the trends in the gross profit margin and net profit margin show a mixed performance over the years. While there were periods of improvement and recovery in profitability, there were also instances of decline. It is essential for the company to closely monitor and address the factors contributing to the decline in profitability to ensure sustainable financial performance in the future.

Company profile

Archroma Pakistan is a limited liability company and is primarily engaged in manufacture, import and sale of chemicals, dyestuffs and coating, adhesives and sealants. It also acts as an indenting agent. The company is a subsidiary of Archorma Textiles Gmbh, registered and headquartered in Reinach, Switzerland.

Credit : Independent News Pakistan-WealthPk