INP-WealthPk

Fakiha Tariq

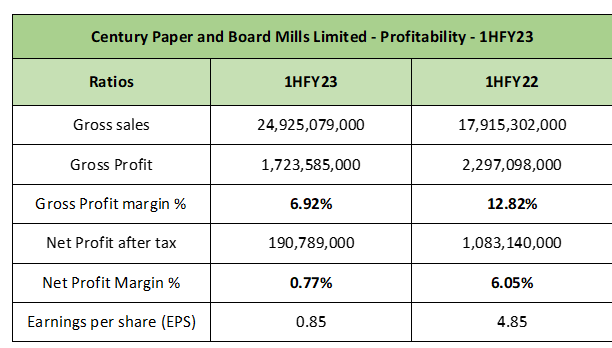

Century Paper and Board Mills Limited’s gross revenues soared by 39% to Rs24 billion in the first half (Jul to Dec) of Fiscal Year 23 compared to the gross sales of Rs17 billion in the corresponding period of the previous Fiscal Year 2022, reports WealthPK.

The company uses the symbol of CEPB on the Pakistan Stock exchange and is listed in the paper and board sector. With a market capitalisation of Rs8.9 billion, CEPB is the second-largest firm in the paper and board sector. It was incorporated as a public limited company in 1984 and is primarily engaged in the manufacture and sale of paper.

In the first six months of the Fiscal Year 23, the company posted a gross profit of Rs1.7 billion against the sales of Rs24 billion. The net profit declared by CEPB was Rs190 million. The gross profit ratio and net profit ratio came out to be 6.92% and 0.77% respectively in 1HFY23. CEPB posted an EPS value of Rs0.85 in 1HFY23.

However, the company’s profits declined in the first half of the ongoing FY23 compared to the corresponding period of the FY22. In 1HFY22, the company posted gross profit and net profit of Rs2.2 billion and Rs1.08 billion against sales of Rs17 billion. Thus, the gross profit ratio and net profit calculated to be 12.82% and 6.05% for CEPB in 1HFY22. The EPS value was reported as 4.85 in 1HFY22.

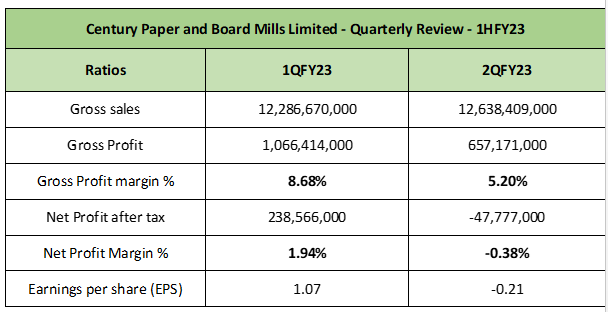

Quarterly Review – 1HFY23

A quarterly review of profitability reveals that the company’s financial performance remained high in the first quarter (Jul to Sept) compared to the second quarter (Oct to Dec) in Fiscal Year 23.In the first quarter of Fiscal Year 23, the company posted gross profit and net profit of Rs1.06 billion and Rs238 million against sales of Rs12.2 billion. The EPS value remained Rs1.07 in 1QFY23.

In comparison to 1QFY23, the company suffered a net loss of Rs47 million in the second quarter of FY23. However, the company earned a gross profit of 5.2% against the sales of Rs12.6 billion in 2QFY23. The company also bore loss per share of -0.21 in 2QFY23.

Market Value Review – 1HFY23

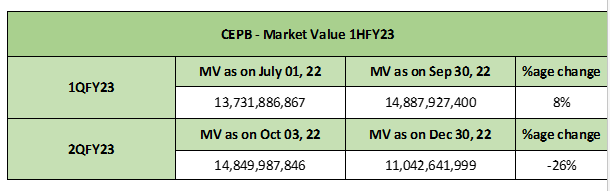

The company lost around 20% of its market value in the first six months (Jul to Dec) of the Fiscal Year 2023 on the Pakistan Stock Exchange.

Although the company gained up to 8% of its market value in 1QFY23, the market value drenched by 26% in 2QFY23.

Credit: Independent News Pakistan-WealthPk