INP-WealthPk

Qudsia Bano

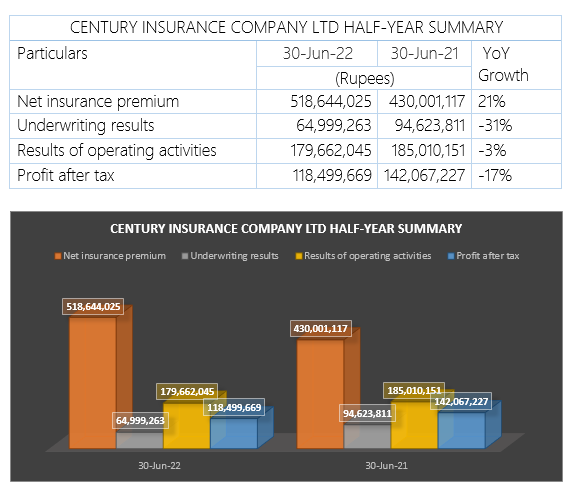

Century Insurance Company Ltd.’s net insurance premium increased 21% to PKR518.6 million in the first six months (Jan-June) of Calendar Year 2022 compared to PKR430 million in the corresponding period of the Calendar Year 2021, reports WealthPK.

The underwriting profit of the company decreased 31% during the six months of CY2022 ending June 30 and remained at PKR65 million compared to PKR94.6 million in the corresponding period of the previous year.

Profit from operating activities also decreased 3% during the six months and remained at PKR179.66 million, compared to 185 million in June 2021. Profit after tax fell 17% after accounting for the 4% Super Tax's impact on the FY2021 and HY2022 profit before tax.

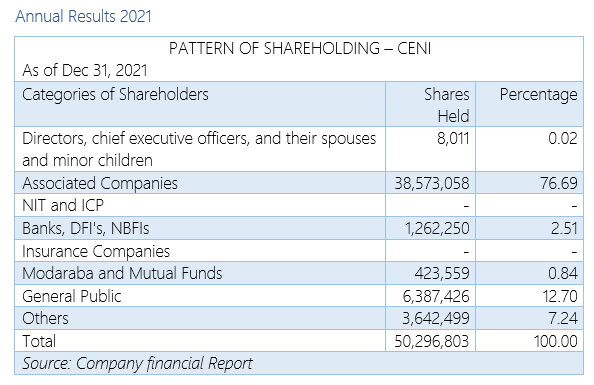

As of Dec 31, 2021, directors, chief executive officers and their spouses and minor children owned 0.02% of the shares, associated companies 76.69%, banks, development financial institutions, and non-banking financial institutions 2.51%, modarabas and mutual funds 0.84%, general public held 12.70%, while others held 7.24% of the shares of the company.

Financial performance

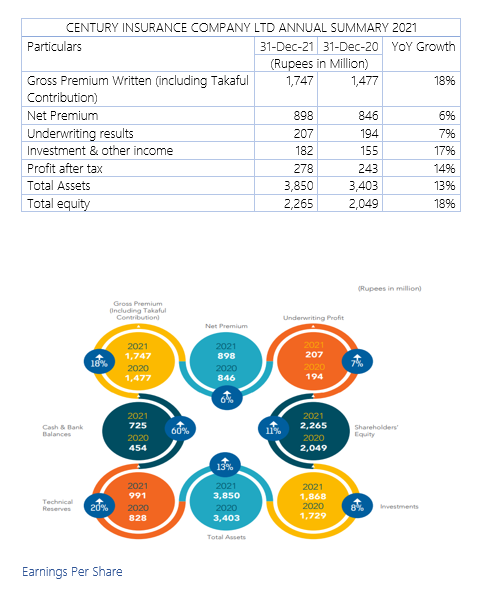

CY2021 was a successful year for the company. All insurance business classes registered growth, and underwriting income rose. During the CY2021, the company registered a gross premium written of PKR1.75 billion with an increase of 18% as against PKR1.47 billion in CY2020. The net premium revenue for the year 2021 was PKR898 million, 6% up from PKR846 million in the previous year. The profit after taxation was PKR278 million with an increase of 14% compared to a profit of PKR243 million in the corresponding period of the previous year.

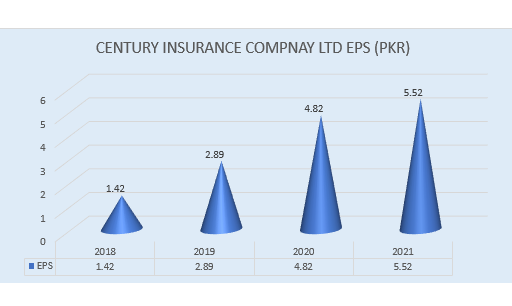

The earnings per share (EPS) of the company continually increased during the recent years showing a remarkable growth. In 2018, the EPS stood at PKR1.42 and increased to PKR2.89 in 2019 and to PKR4.82 in 2020, Similarly in 2021, the EPS again showed an exceptional growth and reached PKR5.52.

Century Insurance is a public limited company that was established in Pakistan on October 10, 1985 in accordance with the Companies Act of 2017. The company works in the general insurance industry.

On August 7, 2017, the Securities and Exchange Commission of Pakistan (SECP) authorized the company under Rule 6 of the Takaful Rules, 2012 to conduct window Takaful operations and general Takaful operations under the Takaful Rules, 2012.

Credit : Independent News Pakistan-WealthPk