INP-WealthPk

Irfan Ahmed

Trading in the Pakistan Stock Exchange (PSX) largely remained bearish during the week ending on Sept 9 (Friday) due to runaway inflation and devastating floods, which have inflicted unprecedented losses on the economy.

The market commenced on a negative note during the week as the government predicted slowdown in the GDP growth, estimating the flood-related losses to be between $15 billion and $20 billion.

Despite the disbursement of the International Monetary Fund’s loan of $1.17bn, which took the State Bank of Pakistan’s reserves to $8.8bn, the rupee continued to weaken against the greenback and settled at Rs228.18 (down by Rs9.2 or 4% week-on-week).

Moreover, the cement sector dispatches in August witnessed a decline of 24% year-on-year, further damping the investor sentiment. Furthermore, urea and DAP fertiliser sales witnessed a massive fall of 16% and 87% year-on-year, respectively. As a result, the market remained lackluster.

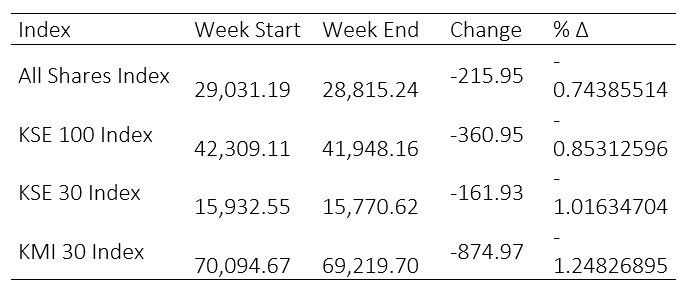

According to WealthPK analysis, the market lost 360.95 points throughout the week, closing at 41,948.16 points (down by 0.85%). The All-Share Index also decreased by 215.95 points; the KSE-30 index slipped by 161.93 points, and the KMI-30 index decreased by 874.97 points on a weekly basis.

Source: PSX/ WealthPK Research

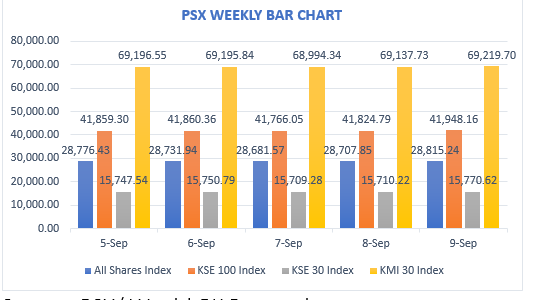

The PSX remained in red on Monday (Sept 5) due to concerns over inflation and prevailing flood crisis. At the end of the day, the KSE-100 index fell 449.81 points or 1.06% to close at 41,859.3 points.

The floods triggered investor sentiments to shift in favour of an inflationary outlook and volatility in the equity market on Tuesday (Sept 6). As a result, the KSE-100 index finished with a marginal gain of 1.06 points to close at 41,860.36.

The PSX remained in red on Wednesday (Sept 7). By the end of the session, the benchmark KSE-100 index settled at 41,766.05 points with a decrease of 94.31 points or 0.23%.

PSX prices rose on Thursday (Sept 8) as investors cheered receipt of the long-delayed $1.2 billion IMF tranche. Owing to the positivity, the KSE-100 closed with a gain of 58.74 points or 0.14% at 41,824.79.

The 100-index witnessed a bullish trend on Friday (Sept 9). As a result, the index gained 123.37 points or 0.29% to close at 41,948.16 points.

Source: PSX/ WealthPK Research

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $2.82 million. Mutual Funds made the most money during the week under review, selling their shares for $6.12 million, followed by overseas Pakistanis with $1.73 million and foreign corporates with $1.10 million. Companies purchased up to $3.23 million in shares, followed by banks/DFIs, which purchased $2.60 million in stock. Other organisations purchased up to $2.18 million worth of stocks.

According to Muhammad Ahmed, a financial analyst with Arif Habib Limited, they expected the market to remain range-bound in the upcoming week amid concerns over rupee’s depreciation and inflation. That said, valuations across the board, particularly in blue chips, have reached attractive levels.

Ahmed further stated that investors were advised to invest in blue-chip scrips.

Credit : Independent News Pakistan-WealthPk